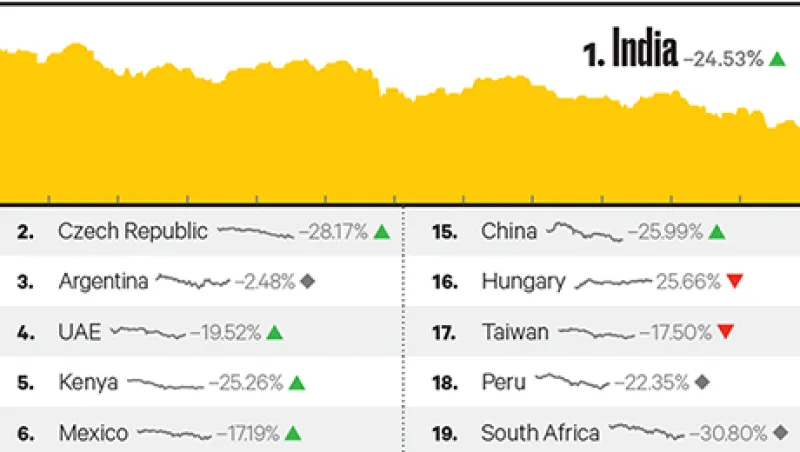

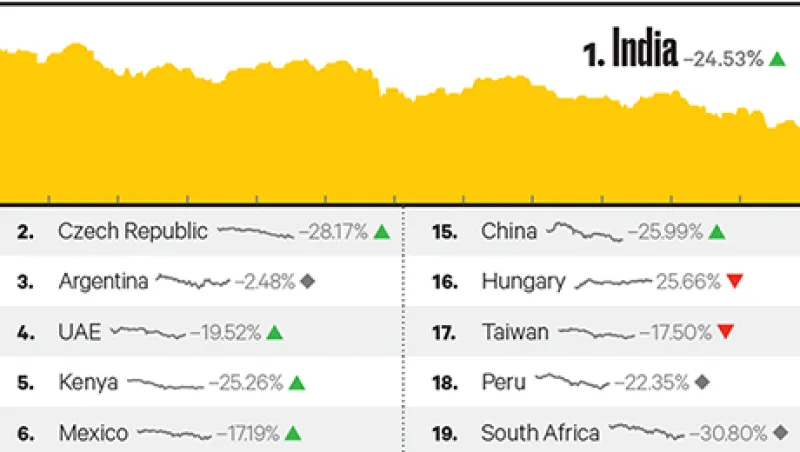

Stall in India’s Reform Drive Disappoints Investors

Opponents are blocking Modi’s proposed tax reform and other measures, but the economy’s 7 percent-plus growth rate remains attractive.

Georgina Hurst

March 17, 2016