Reporting on institutional asset management is a quick cure for hobbyist investors. Peek inside the Citadel machine, and the amateurishness of after-work stock Googling becomes all too clear. Investing, I’ve learned, is best left to professionals.

But sometimes these decisions are forced on you. Moving to Institutional Investor this fall meant moving to its defined contribution plan too. So I called on the pros to pick investments and contribution amounts for me.

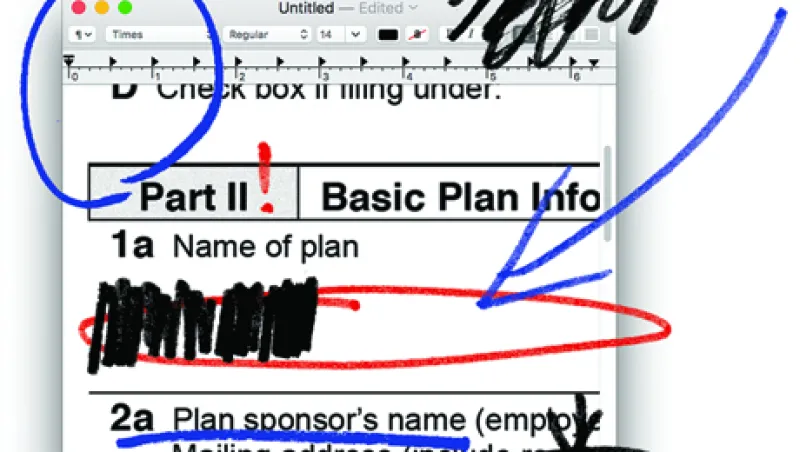

The brains: Carnegie Mellon University treasurer Jay Calhoun; Jeanmarie Grisi, CIO of pension investments at Nokia; CenturyLink Investment Management Co. president and CIO Kathleen Lutito; and Mark Thompson, CIO of BP America. The challenge: providing guidance to a 28-year-old single journalist who would one day like to retire and who has been contributing 10 percent of her salary to a 401(k) since 2012. The plan: 32 menu options, including the standard array of active and passive equities, fixed income, and Fidelity Investments target date funds. II matches 50 percent of contributions, up to 6 percent of an employee’s paycheck.

I vowed to implement the professionals’ suggestions. Little did I know how much this free advice would end up costing me.

“My number one suggestion for you is to contribute more now while you are single,” Grisi wrote in answer to my query on II’s allocator network, IIN. “Early contributions will help defray the burden of higher contribution when you have more competition for your dollars (children, education, house, etc.). My suggestion is at least 15% or more if you can afford it. I think studies show that between 15% and 20% of salary is needed for a secure retirement.”

Corporate America’s investment chiefs apparently share reading materials, because BP’s Thompson likewise trotted out soul-crushing saving requirements. “I just read a study that said Millennials need to save 22 percent or so of their salaries to retire comfortably,” he said. “The common wisdom is 15 percent [or] 16 percent is what people need to put away to retire comfortably. You’re young enough to start doing that and make a difference.”

So, double my contributions. Ouch. Subtracting 20 percent for the golden years from a journalist’s salary, along with Manhattan rent and subway fare, doesn’t leave much for shoes. Thompson doesn’t ask such sacrifices of plan participants. “We match 401(k) contributions dollar for dollar and have an open defined benefit plan,” he pointed out. “But the energy industry is rare in that regard.” II’s 50 percent match is “standard,” he said, imploring me to not leave that money on the table. Deal. I’ll take free money anywhere I can find it.

To make the most of those extraordinary contributions, Grisi, Thompson, and Lutito recommended II’s target date funds, Fidelity Freedom 2055 or 2060. “It has 90% equities, 10% bonds, and given that you will be dollar-cost averaging over time, I think it is appropriate,” Lutito said via e-mail. “Your potential tail risk” — raising children — “and your high profile/demanding career” — she flatters me — “may mean that you might not have time to think about rebalancing your portfolio.” Thompson concurred and noted again how much better BP’s plan members have it, with their ultralow-cost custom target date program.

Fidelity Freedom’s 0.67 percent expense ratio could be avoided with a little DIY, Carnegie Mellon’s Calhoun suggested. “I would strongly recommend a passive core of equity complemented by some developing (emerging) market exposure,” he wrote on IIN. “And at your age you should have no more than 15 percent of your portfolio in fixed income, preferably high quality, intermediate maturity. Rebalance once a year and you will have an easy-to-manage portfolio that will very likely deliver top quartile performance.”

Top quartile! I could peddle my investing services with that track record. “The low-cost passive core is the key,” Calhoun concluded, “since 75% of active managers underperform their passive indices.”

The pros effectively delivered a consensus on asset allocation (target date fund–like) and funding level (as much as I can stomach). I have six weeks to elect my investment choice — and a lot of shoes to buy before I start paying into it.

Leanna Orr is Global Content Director of the Investors Intelligence Network (IIN), Institutional Investor’s private community for asset owners.