Jim Iuorio, for CME Group

At a Glance:

- A weaker yen boosted Japanese exports, contributing to a 55% surge in the Nikkei 225 from January 2021 to July 2024.

- As rates begin to rise in Japan, market participants can more precisely manage equity risks with CME Group Micro Nikkei futures.

In the early months of 2020, Japan‘s Nikkei 225 index collapsed, losing 33% of its value in less than a month, bottoming out in mid-March. Of course, this equity weakness wasn‘t specific to Japan, as most of the world‘s stock markets were in free fall in the wake of the COVID-19 pandemic. But everything appeared to change in those weeks as central banks stepped up in unison and announced massive stimulus measures to head off the potential deflationary spiral related to the shutdowns.

Japan, however, was in a different situation than much of the developed world, having dealt with deflation for the previous 30 years, and Japanese short-term rates were already held in negative territory prior to the pandemic. Japan‘s plan involved keeping rates negative while injecting a stunning 300 trillion yen (or 2 trillion dollars) into its struggling economy in three installments throughout the year.

Yen Weakens and Nikkei Soars

By mid-2021, most of the world‘s central banks began to breathe easy in their fight against deflation, but, as is often the case, these loose policies ushered in global spikes in inflation. The world‘s central banks scrambled to raise rates quickly to quell the inflation – by August of 2023, the U.S. Federal Reserve had raised rates by 500 basis points as most of the world‘s central banks took similar actions. However, one didn‘t: the Bank of Japan (BOJ).

Analysts‘ consensus on the BOJ‘s inaction in the face of rising inflation was pretty uniform. The belief was that the long-term, persistent worry in Japan was the deflation that had plagued it for decades – not the upstart inflation. The market reaction was decisive. The yen kept losing value against its peers as rate differentials began to expand. The "carry trade" is the basic mechanism that fuels this disparate movement as global money borrows yen at the low rate, buys dollars (or another high-rate currency), and then invests it in higher-yielding bonds. This pushes the low-rate currency lower and the high-rate currency higher. From the beginning of 2021 to mid-2024, the yen lost a staggering 35% of its value against the dollar.

Although the BOJ‘s policies were likely trying to address deflation, there was an interesting secondary derivative: the Nikkei soared. Japan is the fourth-largest exporter nation on the planet, exporting over 700 billion dollars of autos, machinery and integrated circuits throughout the world. A weaker yen makes Japanese exports cheaper to the rest of the world, and Japanese companies benefited. From January 1, 2021 through July of 2024, the Nikkei rallied over 55%, fueled in part by the declining yen.

A Changing Narrative?

In March, the BOJ abandoned its negative rate policy, and in July, it hiked rates to 0.25%. The question that the currency trading world is asking is: are the factors that fueled these multi-year trends now reversing?

With uncertainty ahead in Japanese equities, there is rising interest in Nikkei 225 futures – average daily volume year-to-date is up 8% from 2023, reaching 41k contracts.

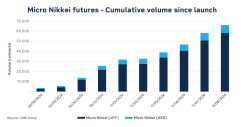

The October launch of Micro Nikkei futures also complements the existing suite of micro-sized contracts in domestic equities, offering more precise trading and risk management in an increasingly important international space – since their debut, Micro Nikkei futures have already traded a combined 65,996 contracts.

If a trader believes that the Nikkei will head higher from here, they could express that by buying Micro Nikkei futures. Alternatively, if a trader believes that the Nikkei‘s highs could be coming to an end, they could sell Micro Nikkei futures.

On the surface, it looks like the trends are reversing – the Fed has begun what could be an extended easing cycle, and the BOJ has begun a hiking cycle, albeit a very casual one, as evidenced by their pause at the September meeting and again at the October one. However, that answer could also be an oversimplification. In the week that followed the Fed‘s initial 50 basis point ease, we began to see economic data suggesting an accelerating economy. Gross domestic product (GDP), employment data, and retail sales came in better than expected, and some analysts began to question whether rates were lowered too far.

Perhaps both central banks are solely focused on inflation, as Japan‘s September read of year-over-year Consumer Price Index (CPI) is 2.5% and the U.S. CPI is 2.4%. The difference, however, is that the U.S. CPI has continued a steady deceleration from its highs and sits at the lowest level in almost 3.5 years, while Japan‘s CPI has ticked up from a low of 2.2% earlier this year. However, a radical reacceleration of inflation in Japan could push the BOJ to hike more aggressively, potentially boosting the yen at the expense of the Nikkei.

Watch a discussion on Japan’s economic resurgence in the video above.