Erik Norland, CME Group

At a Glance:

- The growing need for copper in EV charging stations and AI data centers are boosting demand

- As the demand for copper rises, its production growth continues to be slower than most other metals

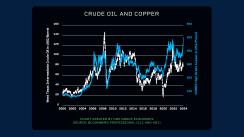

For most of the past twenty years, copper prices have closely followed on the heels of Chinese growth, hitting their peaks and valleys anywhere from two to 12 months after the Chinese economy. However, while Chinese growth has slumped to its slowest since early 2020, copper prices have broken $5 per pound for the first time ever.

Increased Demand for Copper

Finally, copper typically trades more or less in tandem with crude oil, reflecting the energy-intensive mining and refining process for the metal. Since October 2022, however, copper prices have been diverging from oil, rallying even as oil sags.

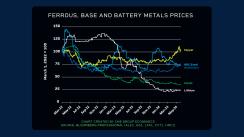

This new demand for copper has collided with extremely slow growth in mining output, which has trailed that of just about every other ferrous and base metal. When demand rises and supplies do not, the usual result is higher prices.