Emily Balsamo and Arthur Yu, CME Group

At a Glance:

- Ethanol production has plateaued over the past 15 years, but still comprises a large share of U.S. corn use

- Corn and ethanol futures markets are correlated, but prices can move independently due to several factors

A surge in ethanol production occurred at the turn of the 21st century, as the U.S. political climate supported policy to reduce dependence on foreign oil. While ethanol production has plateaued over the past 15 years, it still comprises a very meaningful share of total domestic disappearance of corn, second only to use for feed. Corn and Ethanol futures have differing listing cycles and distinct seasonality. Additionally, the respective underlying commodities respond to unique supply and demand dynamics contributing to independent price movements.

Ethanol is an alcohol derived primarily from corn in the United States. Ethanol is blended with gasoline at a ratio averaging 10% ethanol, 90% petroleum-based gasoline. Corn is the primary input to ethanol production in the U.S., while ethanol production accounts for about 35% of domestic disappearance of corn. Animal feed, exports and processed food ingredients also put demand-side pressure on corn, while weather, planting sentiment and yield push corn supply. Ethanol demand, conversely, is driven by policy, notably in the form of the EPA Renewable Fuel Standard, and supply is dependent on production capacity.

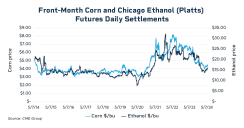

The following figure shows the front-month futures settlement prices for Corn futures and Chicago Ethanol (Platts) futures, with the latter converted from its conventional price quotation of U.S. dollars per gallon to dollars per bushel at a conversion rate of 9.30917797 gallons per bushel. Corn futures pricing has been converted from U.S. cents per bushel to dollars per bushel.

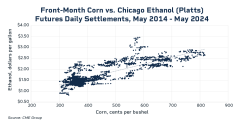

Front-month daily settlement pricing of the two products shows a highly statistically significant correlation, demonstrating a correlation coefficient of 0.83,* indicating that Corn derivatives may serve as an approximate hedge for Ethanol derivative pricing, and vice versa. The following figure plots front-month Corn futures against front-month Chicago Ethanol (Platts) futures prices, with each point representing a unique trade date since May 2014.

*Cointegration was established between Corn and Ethanol pricing using an Engle-Granger test, therefore correlation analysis was conducted on levels, rather than differences.

Nothing is Perfect

Several factors contribute to corn and ethanol markets exhibiting less-than-perfect correlation. One reason why Corn and Ethanol futures do not move in tandem is a difference in listing cycles between the two derivative products. Corn futures, a physically delivered product, are listed to expire in March, May, July, September and December, with the latter month denoting the new crop instrument. Ethanol, conversely, is financially settled and listed monthly. With a highly storable downstream underlying product, Ethanol futures demonstrate seasonality distinct from Corn futures.

While the strong positive correlation between Corn and Ethanol futures prices offers valuable insights for hedging, it is essential to recognize the nuances of each market and the factors that contribute to independent price movements. A comprehensive understanding of these dynamics is crucial for developing effective risk management strategies in the Corn and Ethanol futures markets.