Scott Bauer, for CME Group

AT A GLANCE

- Bitcoin, gold and the S&P 500 have all experienced record highs in 2024

- Geopolitical uncertainty may have investors turning to safe haven assets like gold and the U.S. dollar

In the first two and a half months of 2024, the S&P 500 experienced 17 trading days that closed at new highs. Following suit, bitcoin and gold also surged to new highs in the early months of 2024. Bitcoin is up close to 50% this year, and gold has also continued to thrive to record highs off the October lows. Despite remaining strong, the U.S. dollar has only appreciated about 2% year-to-date, and has actually depreciated around 2% in the last 6 months since the market and other asset classes began this strong rally.

Comparing Bitcoin Rallies

The last time bitcoin rallied like it has recently was during the first year of the COVID-19 pandemic, when a cryptocurrency craze drove retail investors to purchase bitcoin, meme stocks and NFTs. Retail investors began looking at cryptocurrency as a phenomenon and popular investment opportunity. Over the course of the next two years, the narrative around cryptocurrencies changed as many companies were exposed as fraudulent, driving the price down.Bitcoin’s current rally, however, appears to be different. On January 10, the U.S. Securities and Exchange Commission (SEC) approved 13 spot bitcoin ETFs to go live, legitimizing the asset class and allowing institutions to drive the price of bitcoin by purchasing registered securities. Since that landmark decision, spot bitcoin prices set an all time high near $74,000.

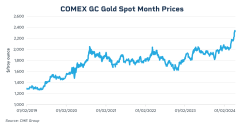

Gold Prices Continue to Rise

Spot gold prices have also experienced a strong rally up to all-time highs of over $2,400 per ounce during trading on April 12. Gold presents a prudent opportunity for investors to flock to in times of uncertainty as well as when low interest rates persist. The futures market is showing near-record levels of interest in gold. April 12 represented the third highest volume day on record across the CME Group precious metals complex, and the second highest volume day on record for Micro Gold futures.

What’s Next for the U.S. Dollar?

The U.S. dollar’s strength this year will be heavily dependent on how the Fed views inflationary numbers on a monthly basis and their resulting policy decisions. Should the Fed feel comfortable with where inflation is at and start to cut rates, the dollar may retreat again. However, concerns over the stability of other economies and geopolitical situations around the world may keep the dollar strong as investors look for the most stable safe haven assets to manage their risk.While bitcoin, other cryptocurrencies and gold offer high volatility and potential gains, the U.S. dollar is typically a safeguard against volatility in uncertain times.