Erik Norland, CME Group

AT A GLANCE:

- After the Bank of Japan cut rates below zero in January 2016, the yen gained 10% against the U.S. dollar

- The recent hike in interest rates may end up further stimulating, instead of slowing, economic growth

Typically, the reaction to a rate hike would be the opposite: the currency strengthens and the equity market sells off. However, there is something different about negative rates. Rather than stimulating growth, they instead act as a tax on the banking system. The idea of negative deposit rates is to discourage excess savings and therefore to spur spending and investment. Markets seem to think that they have the opposite effect.

Yen Strengthens in Response to Negative Rates

Looking back to January 29, 2016, the day that the BoJ first cut rates below zero, the yen strengthened versus the U.S. dollar – the opposite of what usually happens after a rate cut. Moreover, the yen continued to rise versus the U.S. dollar during the months afterwards with a total gain of about 10%.

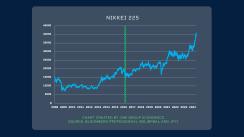

Nikkei 225 Rallies After Rates Rise

The Nikkei 225 slumped in January and February 2016 when the BoJ initially set rates negative and then rallied once negative rates ended.

Eventually, higher rates could have the impact of slowing growth, as they do elsewhere, but that would likely require rates much higher than the currently zero to 10 basis point range.