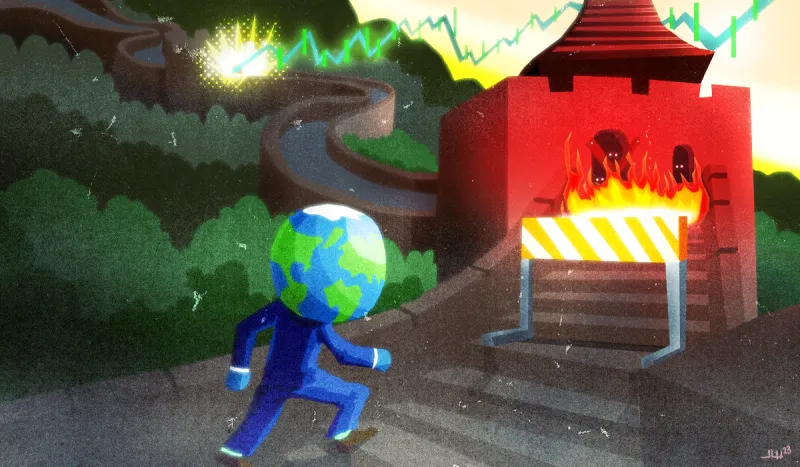

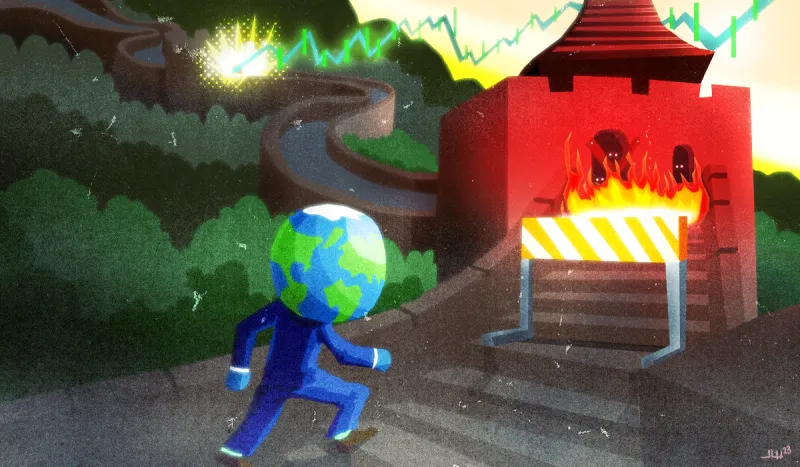

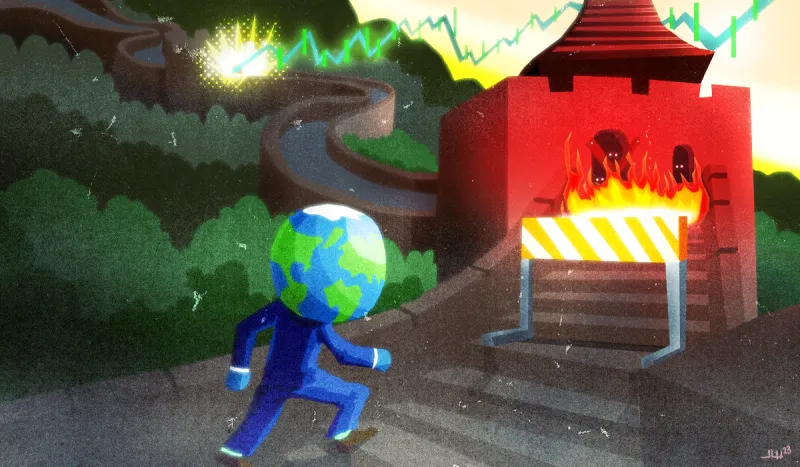

The Real Reason So Many Asset Managers Are Struggling in China

Illustration by II

The world’s second-biggest economy has its own rules of engagement. “You’re not going to change them. You have to accept what they are and find ways to adapt your business.”

Alexander

Hong Kong

China

HSBC

BlackRock