Productivity never really goes out of style. In a world of scarce earnings growth, companies that are purveyors of productivity can be especially important in helping investors blaze new trails to profitable pockets of the equity markets.

For the most part, companies want to improve their productivity. Reducing costs or sharpening performance typically requires investment, though the willingness and ability to pay for productivity gains fluctuate over time, depending on the health of a company or industry. The energy sector has been under acute pressure to improve productivity over the past year, because low oil prices have compressed profits drastically. Yet falling profits make it harder to fund efficiency moves.

Productivity can be enhanced in various ways. Frequently, these involve substituting physical capital for labor to improve performance. By automating processes or upgrading machinery, a manufacturer might increase production in the same facility from 100 units per day to 120 units per day at a negligible increase in cost.

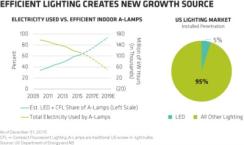

Light-emitting diode–based lighting is a current example. As the costs of LED chips have fallen, the adoption of LED bulbs and fixtures has accelerated, though it still remains quite low. Although these products may initially cost more than traditional lighting, the total cost over time is much lower, and since they consume less energy, they are an environmentally friendly product.

The impact of such development on companies is complex, however. Some hardware suppliers may benefit from the new demand, whereas utilities could face lower electricity sales (see chart 1). At the same time, the ongoing shift to digital lighting opens up new potential applications. Generally, whereas innovation in an industry often occurs across multiple dimensions, those areas that are more differentiated tend to be more durable — and more interesting for investors — in our view at AllianceBernstein. We believe that finding the structural winners from this sort of innovation can lead investors to sources of superior returns.

The proliferation of sensors is another case in point. Sensors are increasingly being incorporated into products to capture information for detailed analysis. Efforts to meet increasingly stringent fuel economy and safety regulations are prompting carmakers to add sensors to vehicles, as well as other new components, such as electric motors, cameras, radar and incremental microprocessing capability. These will reduce average fuel consumption per mile (see chart 2) and support features such as automatic emergency braking, which can reduce accidents — and the associated costs — and should ultimately enable full autonomous vehicle operation.

Smartphone proliferation is enabling shared mobility, in which people without cars can hail a ride from just about anywhere. As travel cost per mile improves, this could potentially redefine car ownership over time, as more people outsource capital-intensive ownership to others.

Mobility and wireless connectivity are powerful agents for productivity gains. They can also help squeeze out unnecessary costs and generate incremental market opportunities to innovators. Diners are increasingly ordering meals in advance online from wherever they are, helping restaurants understand each customer better and reducing waiting times.

New service models are sprouting up to cost-effectively help people with an array of everyday tasks, from meal preparation to bill paying. Retailers and transportation companies are using sensors, wireless connectivity and asset management software to extract higher utilization rates from their networks while also improving safety and customer service. We believe that we are still in the early innings of combining data capture, analysis and mobility to drive efficiency and improve customer experience.

In a world of sluggish economies, it’s easy for investors to lose faith in growth. Among corporations, however, change is always unfolding beneath the surface. By driving down costs or increasing service offerings, productivity gains help consumers, producers or both. Investors who can pinpoint companies with the potential to improve productivity can find attractive investment opportunities — even in difficult market conditions.

Frank Caruso, based in New York, is chief investment officer, and Chris Kotowicz, based in Chicago, is a senior research analyst; both at AB’s U.S. growth equities.

See AB’s disclaimer.

Get more on equities.