The first quarter proved to be an uncertain and volatile period for markets. Fears ranged from a slowdown in China’s growth and attendant troubles in commodity-exporting emerging markets to concern over the U.S.’s own growth prospects and questions over the future path of Federal Reserve monetary policy. Yet by the end of the quarter, much of this market fear had abated, and financial conditions appeared stable. The rapid shift toward negative market sentiment was remarkable considering that, in December, the Fed felt economic conditions warranted a rate hike, ending a historic seven years of policy rates at the zero bound.

In many respects, inflation markets were not immune to that turbulence. Indeed, January market action appeared somewhat reminiscent of 2008 to us at BlackRock — at least on the surface. In fact, inflation breakevens reached a new postcrisis low by the middle of February but have since rebounded nearly 45 basis points from those levels.

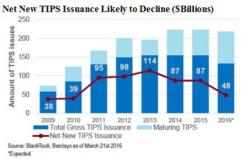

The first step toward stabilizing inflation markets was the announcement on February 3 from the U.S. Treasury that it would reduce the supply of Treasury Inflation-Protected Securities (TIPS) by $6 billion in the first quarter of 2016. If that degree of reduced issuance were to be maintained through the rest of the year — as we anticipate it will be — it would amount to a 15 percent supply cut for the year. The Treasury move provided relief to an oversupplied asset class that struggled to match supply with demand as some institutional buyers pulled back from exposures to dollar-based assets. Overall, we expect to see net new issuance of TIPS decline this year, providing a supportive technical backdrop to the asset class (see chart 1). Of note, we believe the influence of supply cuts will not be felt evenly across the TIPS curve on a risk-adjusted basis, as it’s likely to hold greater significance for 30-year TIPS than for shorter-dated maturities, potentially providing a favorable boost to the long end of the inflation curve.

Over the past year, slowing global growth, a precipitous decline in commodities prices and historically low inflation rates in developed markets all combined to foster fears of deflation. Recent data suggest these fears are unwarranted, however, at least in the U.S. More specifically, both the headline consumer price index and the core CPI measure, which excludes food and energy, have been on upward trajectories since the start of 2016. Part of the reason for this trend is that energy price declines in late 2014 are contributing to positive base effects today as they roll off from year-over-year data measures. Core inflation’s strength is also noteworthy. Core CPI increased at a 0.3 percent month-over-month rate in both January and February, bringing the year-over-year rate of growth to 2.3 percent, a level not seen since early 2012.

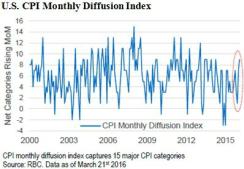

Even though Federal Reserve chair Janet Yellen appeared to dismiss this firming in the inflation rate as “transitory” during the press conference following the Fed’s March 16 policy meeting, we see reasons for inflation to keep solidifying. In Yellen’s words, some components of inflation data “tend to be quite volatile without very much significance for inflation over time.” It is true that recent price increases in historically volatile categories, such as apparel and hotel accommodations, are unlikely to persist. Nevertheless, we find the broad-based character of the acceleration in inflation encouraging. If we look at the CPI monthly diffusion index (see chart 2), we can discern multiple sources of strength within the components of the overall inflation market basket. Moreover, categories such as consumer goods, shelter, medical care and recreation are historically quite stable and likely to demonstrate persistent strength. Finally, tighter labor markets may begin to feed through to price inflation, a trend that we believe will strengthen in 2016.

The recent stabilization in risk assets and oil prices is also factoring into our expectations for higher inflation. That fact, combined with the realized uptick in CPI data and the higher levels of year-over-year core CPI, convinces us that TIPS should continue to garner renewed interest.

Another key driver of inflation valuations in recent weeks has been the increasingly dovish language from the Fed and hints that the central bank might be willing to let inflation run hot for a bit. Of course, the European Central Bank’s recent expansion of accommodative policy has been a factor in inflation valuations as well.

The question is, Where, then, do all these market crosscurrents leave TIPS market valuations today, particularly given the recent strength seen in inflation market performance? In our view, favorable supply technicals, a higher run rate in the CPI and a Fed that seems fine with overshooting its 2 percent target for a bit mean that TIPS have more room to run.

Despite the fact that five-year spot break-even inflation levels have widened by about 45 basis points since mid-February, we think breakevens across the curve could move another 30 basis points just to reach our estimates of fair value. What’s more, valuations appear particularly compelling at the longer end of the inflation curve and in the forward markets. Despite the strong rebound seen in TIPS markets recently, the macro and policy environment implies there’s more value to be had in the asset class.

Martin Hegarty is the lead portfolio manager, and Gargi Chaudhuri is a senior portfolio manager, of the Inflation-Linked Bond Portfolios within BlackRock’s global fixed-income group in New York.

Get more on fixed income.