Investors have been bingeing on richly valued high-dividend-yielding stocks and other bond-proxy equities for the past year. We at AB think it’s time for an intervention.

The craving for stability and yield is understandable, given current macro anxieties and subpar interest rates — and the likely persistence of both. But following the surge in flows into passive investing vehicles this year, what has been apparently a safety trade is showing signs of excess. If sentiment or conditions change, investors who have overindulged in safe-haven stocks could be in for a nasty case of heartburn.

We see a better way to get equity upside potential with far fewer side effects: by actively targeting companies with high, sustainable profitability and staying sensitive to valuations. This flexible approach offers more room to maneuver, to seize opportunities — sometimes in unexpected places — and to avoid expensive, vulnerable corners of the market.

The passion for safety is largely being satisfied passively. Half of the ten top-selling equity exchange-traded funds so far this year have been high-dividend and low-volatility funds. Excluding those top ten, ETFs have seen outflows.

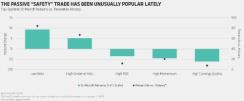

Flows, in turn, have fed into returns: The least-volatile quintile of U.S. stocks is up nearly 10 percent for the 12 months ended June 2016, and the highest-dividend-yielding stocks have risen 5 percent (see chart 1). Both categories have rarely performed better, whereas many other traditional return drivers have rarely performed as badly.

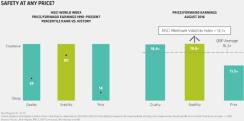

This binge eating has also fattened valuations. Low-beta stocks are now trading at some of their highest valuations of the past 25 years, while the multiples of high-quality and low-valuation stocks remain reasonable versus their history (see the left-hand graph in chart 2).

The MSCI minimum volatility index, the most commonly used proxy for low-beta stocks, currently sells near its all-time high based on current earnings (see the right-hand graph in chart 2). The index is also heavily clustered in sectors of the market beloved for their bondlike behavior — such as utilities, telecoms and REITs — which adds unintended interest rate sensitivity. These stocks are highly correlated to shifts in bond yields.

These lofty valuations are a consequence of ultralow interest rates and increased risk aversion. But what if the environment changes? Indeed, amid talk of an impending U.S. Federal Reserve rate hike, the safety trade appears to have lost some appeal. Some could say that as a proxy for safety at any price, the index is all shield and no sword.

As we see it, by ignoring valuations and excessive sector concentrations, investors are limiting their future upside potential or exposing themselves to greater downside risk when rates rise.

Recall what happened in the summer of 2013: As concerns mounted that the U.S. Federal Reserve would begin to ease its bond purchases, bond-proxy stocks took a beating in the meltdown widely known as the taper tantrum.

These are important considerations in an era in which broad market performance is likely to be more subdued than it has been historically.

These issues underscore the advantages of a nimble, active approach that seeks to gain more in market upturns than it loses in downturns. Our guiding principle: Target companies enjoying well-defended competitive advantages that enable them to maintain high and predictable profitability.

Being able to identify high-quality, shock-resistant companies isn’t enough, though. To tilt the odds even further to the upside, you also need to determine whether the market is properly valuing these characteristics.

In our view, the secret to delivering on the outperformance potential of low-risk equities lies in focusing on the ingredients of what you’re buying: quality, stability and attractive valuation. As with any balanced diet, being selective about what you consume is the best way to produce healthy results that get attention.

Kent Hargis is portfolio manager of strategic core equities, Chris Marx is portfolio manager of equities, and Sammy Suzuki is portfolio manager of strategic core equities; all at AB in New York.

See AB’s disclaimer.

Get more on equities.