At the top of every equity market cycle, some prognosticator invariably claims “this time it’s different,” helping foster pro-risk behavior and a false sense of security at precisely the wrong time. Throughout history, investors have suffered for being lulled into complacency, particularly those on the cusp of retirement in 1987, 2000, and 2008. Only with the benefit of hindsight will we know when this market cycle will end. Regardless, with unusual political developments at home and abroad, with many assets trading near all-time highs, and with prospective returns likely to be exceptionally low, it seems that—for certain investors—the risk of capital losses could be far more harmful than the risk of missing out on future gains. A measure of caution may be in order for many market participants.

Explore one of the industry’s most conservative target-date fund glide paths.

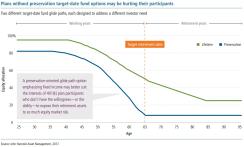

This is especially the case for baby boomers in the retirement readiness zone—those recently retired or expecting to retire within the next few years. With $1 trillion in assets today,1 target-date funds have become one of the most popular ways for working Americans of all ages to save for retirement. But most of these target-date assets sit in funds that hold relatively heavy allocations to stocks, even as the investor’s retirement draws closer. A more preservation-oriented glide path option emphasizing bonds may better suit 401(k) plan participants who don’t have the willingness—or the ability—to expose their retirement assets to so much stock market risk.

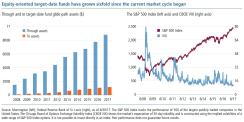

Riskier target-date fund assets dwarf those in more conservative offerings

Retirement target-date funds follow a glide path that trims stock exposure over time. Asset growth has been impressive in recent years, buoyed by the Pension Protection Act of 2006, which made target-date funds a qualified default investment alternative, or QDIA, for defined contribution plans. Depending on the type of target-date fund, the dynamic derisking process can either continue through the retirement years or continue to the start of retirement, when the most conservative allocation is permanently reached.“… bull markets don’t die of old age. More concerning are the valuations.”

Target-date funds following through retirement glide paths are typically more heavily allocated to equity at the target retirement date and are what dominate the marketplace today, with over $880 billion, from less than $150 billion at the end of 2008.1 This growth is not surprising in light of the market appreciation we’ve seen over that period, as funds demonstrating stronger performance tend to be rewarded with higher inflows. A few of these target-date fund managers even use leverage, carrying the assumption of greater risk for greater return potential to its logical extreme.Target-date funds following to retirement glide paths that have relatively high allocations to fixed income at retirement have also demonstrated asset growth, but their assets under management stand at less than $120 billion today.1 The tempered enthusiasm for these less risky offerings is understandable given that they tend to underperform stocks in extended bull markets. But this tamer type of target-date fund may represent a solution that better suits late-career investors, especially given the mature stage of the current equity market cycle.

The market’s multiple expansion has left stocks with less room to run

The current market cycle began in March 2009, and it’s been an exceptionally generous run so far, but bull markets don’t die of old age. More concerning are the valuations. Price-to- earnings, or P/E, multiples, for example, can give us clues as to whether markets are overvalued—a key question for U.S. equity investors right now.

While short-term results are driven by a variety of factors, the trend is clear: Long-term returns have declined as starting valuations have risen. In fact, over the past 60 years, when stock market valuations reached today’s lofty levels, the median price return over the next decade was a nominal 5%, an even smaller return when taking inflation into account.

It’s possible that multiples could continue to expand from here given today’s low rates of interest and inflation. However, at some level, valuations will matter, and it seems the risk is on the downside given where we are in the current market cycle.

“… at some level, valuations will matter, and it seems the risk is on the downside given where we are in the current market cycle.”

Your target-date fund may have too much risk right now if you plan to retire soonAll things considered, is now the right time to be putting retirement assets at risk? For millennials, Generation Xers, and other investors in their prime accumulation years, the answer is probably yes. Despite today’s high valuations, stocks still have the best long-term wealth-building potential of all the major asset classes.

However, the answer may be different for baby boomers, or anyone else who will soon require an income-producing investment portfolio—instead of a paycheck—to cover basic living expenses. One of the greatest challenges for investors and their advisors resides in trying to assess the potential rewards relative to the risks at any given point in time. The relationship between risk and reward isn’t static, and it isn’t necessarily symmetrical either. As we’ve shown, the potential rewards in

U.S. stocks look low right now, but these low prospective returns don’t mean that market volatility is likely to be low. On July 26, 2017, the CBOE VIX slipped to 8.84,2 the lowest level ever in intraday trading, capping off an extended period of subdued readings. However, market volatility only stays low until it doesn’t: Historically, some of the largest VIX spikes have immediately followed calm periods.

How and when will the story of this current bull market cycle end? No one knows. But that shouldn’t stop retirement savers from being prepared.

Explore one of the industry’s most conservative target-date fund glide paths.

1 Morningstar, 6/30/17.

2 “Wall Street’s ‘fear index,’ the VIX, falls to record low as traders maneuver after Fed statement,” cnbc.com, 7/26/17.

This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise. John Hancock Investments and its representatives and affiliates may receive compensation derived from the sale of and/or from any investment made in its products and services.

This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index. The information contained herein is based on sources believed to be reliable, but it is neither all inclusive nor guaranteed by John Hancock Investments.

This material does not constitute tax, legal, or accounting advice, and neither John Hancock nor any of its agents, employees, or registered representatives are in the business of offering such advice. It was not intended or written for use, and cannot be used, by any taxpayer for the purpose of avoiding any IRS penalty. It was written to support the marketing of the transactions or topics it addresses. Anyone interested in these transactions or topics should seek advice from independent professional advisors based on his or her particular circumstances.

Price to earnings (P/E) is a valuation measure comparing the ratio of a stock’s price with its earnings per share.

Diversification does not guarantee a profit or eliminate the risk of a loss.

The portfolio’s performance depends on the advisor’s skill in determining asset class allocations, the mix of underlying funds, and the performance of those underlying funds. The portfolio is subject to the same risks as the underlying funds and exchange-traded funds in which it invests: Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; the securities of small companies are subject to higher volatility than those of larger, more established companies; and high-yield bonds are subject to additional risks, such as increased risk of default. Each portfolio’s name refers to the approximate retirement year of the investors for whom the portfolio’s asset allocation strategy is designed. The portfolios with dates further off initially allocate more aggressively to stock funds. As a portfolio approaches and passes its target date, the allocation will gradually migrate to more conservative, fixed-income funds. The principal value of each portfolio is not guaranteed, and you could lose money at any time, including at, or after, the target date. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Hedging and other strategic transactions may increase volatility and result in losses if not successful.

Request a prospectus or summary prospectus from your financial advisor, by visiting jhinvestments.com, or by calling us at 800-225-5291. The prospectus includes investment objectives, risks, fees, expenses, and other information that you should consider carefully before investing.