Mayor Michael Bloomberg’s proposed ban on the sale of sugary drinks larger than 16 ounces in New York City’s public eateries caused an uproar this spring. It got me thinking about the value of published nutritional information. Implementing an optimal diet that reflects your personal situation is considerably easier now that such wisdom is readily available. New gadgets and phone apps enable you to search databases for nutritional facts on thousands of foods and track the calories you consume and burn on a daily basis.

Making an investment choice is not that different from deciding what to eat. The ease with which one can follow an optimal diet has not yet been realized in the investment arena, but that may be one of the most important developments we witness over the next decade.

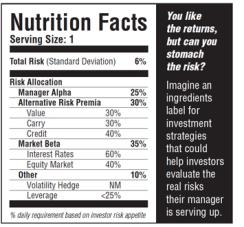

The development of investment products that meet specified risk goals in measurable terms would be a vast improvement over the confusing array of fund categories and simplistic style boxes that exists today. Shifting the focus from a fund’s particular investment strategy to the return profile the manager is trying to achieve would make it easier for investors to choose funds that would help them meet their financial goals. In addition to assessing standard deviation, which measures risk by the volatility of total returns — as opposed to historical volatility, which is driven purely by market conditions — investors should be able to view other risks their managers are taking with their money. How much of the risk budget is allocated to manager alpha and market beta? What about leverage? A strategy’s information ratio, one of the best measures for evaluating a manager’s risk-adjusted performance, should be as easy to decipher as the sugar content in a Starbucks caffè mocha — which this author discovered, much to his chagrin, is 45 grams, busting his optimal allocation budget of 40 grams of sugar a day in a single drink.

The value of nutritional information, combined with the recommended daily intake, makes the identification of what we consume easier than the alternative of using basic ingredients as inputs to an optimization. The ubiquitous nature of nutritional information has changed the process from one in which we optimize the choices available in the supermarket to one in which we select from a menu. Designing and describing investment products in an analogous fashion has the potential to both revolutionize and simplify the way we implement our choices.

The wizardry of investing — whether it be the use of new asset classes; tail-risk hedging solutions; novel portfolio construction techniques like risk parity, minimum volatility and maximum diversification; or even the use of leverage and short positions — should be left to the equivalent of the chef, namely the portfolio manager. Naturally, the portfolio design would incorporate correlations among the asset classes in the portfolio and the manager’s view on the optimal mix, which would change over time. The main goal of the manager would be to obtain the highest return possible for the targeted risk level. Meanwhile, funds would be evaluated based on the degree to which the portfolio managers achieved their risk goals and not solely on their risk-adjusted returns.

Clear disclosure of the risk level to which the portfolio is managed, expressed in easy-to-understand terms, would help investors choose investment products that are consistent with their goals. Only then will we be able to follow Benjamin Graham’s dictum that “the essence of investment management is the management of risks, not the management of returns.” For those of us who are older investors with shorter horizons, high-risk solutions will clearly be off the table — along with the 24-ounce bone-in rib eye.

Harindra de Silva is president and portfolio manager of Los Angeles–based asset management firm Analytic Investors.