When Walter Burke took over as chairman of Denison University’s investment committee in January 2009, the financial markets were in free fall. Even before his first board meeting, Burke huddled with committee members to make sense of the devastation suffered by the school’s endowment, which had dropped in value from $693 million at the end of 2007 to $536 million just 12 months later. “We decided the plan was to hunker down and focus on shoring up liquidity,” Burke says.

Unlike most university endowment committee chairmen — typically, alumni with financial or business backgrounds — Burke is a clinical psychologist and has spent most of his career as a professor in the division of psychiatry at Northwestern University’s Feinberg School of Medicine in Chicago. Given the market devastation in January 2009, “I thought that it might make sense to have a psychologist in the chair position,” jokes Burke, a member of the Denison class of 1971 and a trustee since 1997.

It was no joke when Denison’s return came in at a dismal –19.6 percent for the academic fiscal year ended June 30, 2009. Yet the small, Granville, Ohio–based liberal arts school — with just 2,185 undergraduates — emerged from the market meltdown in better shape than Harvard University, whose once-$36.9 billion endowment lost 27.3 percent, or Yale University, which saw its $22.9 billion fund fall by 24.6 percent. Even more unexpected: Tiny Denison continued to outperform Harvard, Yale and many of the U.S.’s largest educational endowments over the next four years.

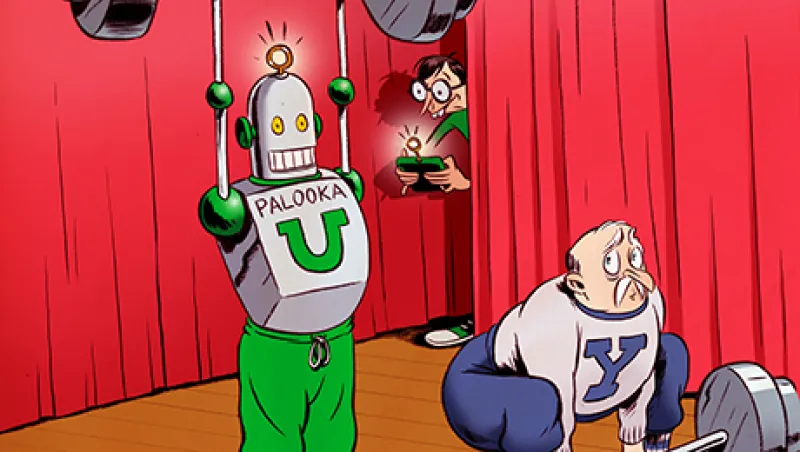

Denison is not alone. A select group of 20 midsize endowments with $500 million to $1 billion in assets schooled their larger peers from June 2007 through June 2012. Annualized returns for the high performers ranged from 1.86 percent to 5.36 percent, besting both Harvard (up 1.24 percent a year) and Yale (up 1.83 percent). The midsize stars outshone the 1.7 percent median return for endowments with more than $1 billion in assets, according to the Washington-based National Association of College and University Business Officers (Nacubo).

At first glance, it is easy to dismiss the outperformance of midsize endowments during the fateful 2008–’09 fiscal year as the result of being in the right place — that is, the right asset classes — at the right time. Entering the financial crisis, endowments with $500 million to $1 billion in assets had, on average, more money in fixed income and less in private equity, hedge funds and other illiquid alternatives than their larger brethren did, according to Nacubo. For big endowments“2008–2009 was a disaster,” says André Perold, co-founder and CIO of Boston-based HighVista Strategies, which manages $3.6 billion in endowment assets. Perold, an emeritus professor of finance and banking at Harvard Business School, points out that big endowments take a lot more risk to get high returns and that “there are periods when there’s a cost to that.”

Charles Skorina, founder and president of an eponymous San Francisco–based executive search firm specializing in financial services and asset management, says the successes of the smaller schools are usually overlooked because their returns are generally not reported in any prominent way. His view is supported by an October 2012 report by Vanguard Group that found that from 2009 through 2011 an investor was nearly ten times more likely to see a story about one of the ten largest endowments than to read one about any of the others. In the first half of 2013, Skorina dug into the 2012 Nacubo-Commonfund Study of Endowments (NCSE) to identify the top midsize performers — and he shared his data with Institutional Investor. “Why are so many smaller endowments, with their more modest resources, punching above their weight, and why hasn’t anybody noticed?” he asks.

The five years that followed the financial crisis have been challenging for all U.S. college and university endowments, which managed to eke out only low-single-digit returns. Still, Stephen Nesbitt, CEO of alternative-investment consulting firm Cliffwater, based in Marina del Rey, California, believes that more midsize schools have been positioning themselves to outperform the largest schools since the crisis. “Midsize endowments had been a little sleepy,” and 2008 was a wake-up call, explains Nesbitt, who consults with a dozen endowments averaging $750 million in assets. As a result, schools are allocating more resources to their endowments: establishing professional investment offices, changing compensation to attract and retain investment staff, upgrading investment committees and hiring top-notch consulting advice.

It turns out that great contacts and investment committees are not exclusive to the Ivy League. “How you structure your committee, who you recruit — that’s a very important, often forgotten element,” says John Griswold, executive director of Wilton, Connecticut–based Commonfund Institute, the educational arm of Commonfund, which manages $25 billion for 1,400 nonprofit organizations. “If you don’t get the governance process right, it’s going to be very difficult.”

The benefits of being smaller often go unnoticed. Having fewer assets can work in an endowment’s favor, as Paula Volent has observed in her 13 years as senior vice president of investments at Bowdoin College in Brunswick, Maine. “Small endowments are often by necessity entrepreneurial,” explains Volent, who worked in the Yale Investments Office under its longtime CIO, David Swensen, first as an MBA student in 1996, then as a full-time staffer from 1997 through 2000 before moving to Bowdoin. Small staffs need to be generalists, and that gives them a lot of market knowledge and close relationships with asset managers, she says. In addition, when a top asset manager offers a $5 million allocation in its fund to an investor, for example, a smaller school can make good use of an investment that would be too little to put a dent in the portfolio of a multibillion-dollar institution.

Volent says she learned everything she knows about endowment management from Swensen. But for the five years following the financial crisis, the pupil bested the teacher: Bowdoin’s endowment had an annualized return of 3.10 percent. As schools like Bowdoin apply the lessons learned from the Yale model and their own individual circumstances, the results have been impressive. “There’s been a view that [midsize endowments] have to be more aggressive,” observes Cliffwater’s Nesbitt, who began consulting with Denison after being introduced to the school in 2005 by Jack Meyer, former head of Harvard Management Co. “If there was a skill gap between the largest and midsize endowments, it has closed significantly.”

Colleges and universities in the U.S. have long depended on endowment funds to help cover the steep annual costs of running institutions of higher education. The largest schools have the largest endowments and aim to keep them that way by hiring the smartest investment professionals they can find. One of the very smartest is Yale’s Swensen, who has headed the investment office at the New Haven, Connecticut, university since 1985.

Swensen developed an investment style whose hallmark is seeking out the newest untried investments, then adding these emerging alternative asset classes to Yale’s increasingly diversified portfolio. His 2000 book, Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, was a runaway bestseller among endowments, foundations, pensions and asset managers of every stripe. Swensen’s success — decades of consistently high returns — became the model for other schools to copy. It also became the bogey to beat.

Following the Yale model, schools large and small began to heap alternative investments into their endowment portfolios. For the fiscal year ended June 30, 2002, institutions with more than $1 billion allocated about a quarter of their portfolios to domestic equity, compared with 40 percent at midsize schools, according to NCSE. By the end of 2012, the biggest schools had halved that allocation, to 12 percent, while the midsize schools cut it even more, down to 18 percent. At the same time, allocations to alternatives, already high at 44 percent at the largest schools, increased to 61 percent; midsize schools brought their alternatives allocation from 23 percent in 2001–’02 to 48 percent in 2011–’12.

It all came crashing down when the financial crisis slammed schools in the 2009 fiscal year. The largest schools, whose allocations to illiquid private partnerships averaged 40 percent of their portfolios, were hit the hardest, caught without enough liquid assets to meet their obligations to the schools’ operating budgets, scholarships and other necessities. Smaller schools, which had about a quarter of their assets tied up, had more room to maneuver. In the five years since then, the Yale investment model has been turned on its head.

Though much has changed in the 28 years since Swensen took up the CIO reins at Yale, one thing in particular has provided an opportunity for smaller schools to add alpha to their portfolios: the increasing importance of manager selection to portfolio performance. In 1986, Gary Brinson, L. Randolph Hood and Gilbert Beebower’s seminal paper “Determinants of Portfolio Performance” established the long-held theory that asset allocation was responsible for 90 percent of fund returns. Last year Swensen, writing in Yale’s annual endowment report, officially acknowledged the end of that theory. As more investors have crowded into the newest asset classes, observes the report, opportunities for returns have diminished. Yale’s research shows that in the 20 years ended June 30, 2012, only 20 percent of Yale’s outperformance (relative to the average endowments monitored by investment consulting firm Cambridge Associates) was attributable to portfolio asset allocation, whereas nearly 80 percent resulted from the value added by active managers.

If hiring top asset managers has become the key to endowment success, securing a talented CIO to head the endowment office is also critical. In October 2008, three months before psychology professor Burke took over the leadership of the investment committee at Denison, the school recruited its first CIO, aiming to professionalize its endowment management. Adele Gorrilla, a graduate of the Wharton School of the University of Pennsylvania and a Goldman Sachs Group alum, was hired away from her post as director of investments at the University of Minnesota just as the financial system was crashing. “The assets had grown to a point where the committee could only do so much, and we needed to get a full-time, talented staff,” Burke explains.

Denison’s need for a healthy endowment is particularly acute given that a full 96 percent of its undergraduates receive some kind of scholarship or financial aid funded by the school. “The crisis led to some great opportunities,” says Gorrilla, who got down to work with the committee and a team of two investment professionals and one analyst.

The Denison CIO has a different take on using the Swensen model. Whereas most endowment watchers point to it as an asset allocation recipe that includes a boatload of alternative investments with a lower than average level of liquidity, Gorrilla views Swensen chiefly as a role model for endowment leadership: “If it means you are being a leader and first in all ways in endowment investing, then it will never be dead.” In early 2009, Denison hired new managers and continued to put money into real estate and energy, coinvesting in private investments with existing managers. “We saw that Adele and her team could dive in and hunt down good managers,” reports Burke. “She does the whole thing now,” he adds. Today the committee’s major responsibility to the board is to oversee the asset allocation, with help from Nesbitt’s Cliffwater.

“They have a very good team approach,” says Nesbitt, describing how the staff, investment committee and outside advisers work together. “Part of their solution was organizational, delegating greater authority to staff, staff pulling the trigger and flexible decision making.”

Gorrilla is modest about having posted a five-year 4.1 percent return, the second highest among midsize endowments for the 2007–’12 period. “It’s still a function of the trust of the committee and relationship they have with the internal team and the market environment,” she says. “It’s not something you just turn on like a switch.”

As endowments grow into the midsize range, it is not unusual for trustees to hand the reins of fund management to CIOs like Gorrilla and Carleton College’s Jason Matz. Despite this trend, however, there are still successful endowments run by investment committees with help from consultants or an investment director without discretion. Four such schools appear on the list of top midsize endowments: No. 1-ranked Cooper Union for the Advancement of Science and Art, in New York; Colorado College (No. 5) in Colorado Springs; Vassar College (No. 9) in Poughkeepsie, New York; and Mount Holyoke College (No. 11) in South Hadley, Massachusetts. Their success is a function of superior teamwork and access to top managers.

Mount Holyoke’s committee chairman, Betsy Palmer, agrees with Bowdoin’s Volent that being small has its advantages. “One of the advantages we have is that we don’t have to identify quite as many good managers as Harvard and Yale,” notes Palmer, speaking of the now-$623 million Holyoke endowment.

A 1976 graduate of one of the last bastions of all-women education, Palmer, who is also a Mount Holyoke trustee, stresses the importance of a highly functional committee that includes at least two trustees. Unlike most, however, this committee is made up of nine women and one man, the parent of a current student. “This is a group that works extremely well together,” says Palmer, a Columbia Business School graduate and head of North American marketing and client services at London-based investment manager Lindsell Train. “With a committee dominated by women, it’s a different culture.” As chairman, Palmer sees her role as making sure every view is heard and all board members participate and generate broad opinions.

The other element in Mount Holyoke’s success is its relationship with longtime consultant Cambridge Associates and a team that includes a Holyoke alumnus. The committee is currently trying to streamline the manager-hiring process, handing more discretion to its consultant. “I think the key driver for us has been manager selection,” Palmer says, referring to the endowment’s 2.6 percent annualized return over five years. With help from committee contacts, the school was early into funds at Kensico Capital Management Corp. in Greenwich, Connecticut; London-based Cedar Rock Capital; and Jack Meyer’s Convexity Capital Management in Boston.

Vassar, meanwhile, banged out a 2.7 percent annualized return over five years. Henry Johnson, class of 1988, became chairman in 2009 when Jeffrey Goldstein left both Vassar’s board and private equity firm Hellman & Friedman (which he has since rejoined) to work for then–Treasury secretary Timothy Geithner. “We don’t have a CIO but a very active and engaged committee,” says Johnson, who is president and CEO of Fiduciary Trust Co. International in New York. A self-described “financial aid kid,” Johnson points to the importance of delivering returns to pay for scholarships. “One of the things that gets lost in the investment story is how colleges are grappling with meeting their mission when the need and cost for that has never been greater,” he says.

Johnson credits much of Vassar’s success to an investment committee that includes Christianna Wood, former senior investment officer at the California Public Employees’ Retirement System; Steven Tananbaum, managing partner and CIO of GoldenTree Asset Management; Robert Tanenbaum, a partner in Maryland real estate firm Lerner Enterprises and an owner of the Washington Nationals baseball team; and John Arnhold, chairman and CIO of New York–based First Eagle Investment Management.

Johnson is very clear about the source of Vassar’s returns. “I think one of the great things that Dave Swensen says and is often forgotten is, the Yale model is built for Yale,” he notes. “It doesn’t work for everybody.” Without hospitals or a major sports program to generate revenue and only $800 million in assets, Vassar can’t take the same risks as bigger schools. With help from Anne Casscells of Menlo Park, California– and New York–based Aetos Capital on marketable alternatives, which make up close to a quarter of the total portfolio, and Commonfund’s Susan Carter on the private portfolio, targeted at 10 percent, Vassar has taken a more conservative view on sources of return.

Despite having a team of consultants that includes Russell Investments for long-only asset allocation, Johnson believes that endowment portfolios are largely in the hands of economic fate. “In a period of robust growth and stability in the global economy, schools like Harvard and Yale will thrive,” he says. “In periods of uncertainty schools that are more defensive will do well.”

Wallace Weitz was a value investor, even before he opened the doors of Weitz Investment Management in Omaha, Nebraska, in 1983. Today, Weitz oversees $5.3 billion in mutual funds just five miles down the road from Warren Buffett’s Berkshire Hathaway, whose shares he has held for 35 years. According to Chicago-based data provider Morningstar, the $913 million Weitz Partners III Opportunity Fund delivered an annualized return of 15.87 percent for the five years ended August 31, 2013, putting it in the No. 1 position in its midcap fund universe.

Weitz also oversees a $650 million pool of assets unrelated to his firm. As chairman of the Carleton College investment committee since July 2003, the 1970 graduate — who met his wife at the Northfield, Minnesota, school and sent their three children there — has had a hand in his alma mater’s top performance. Carleton’s 2.6 percent annualized return for the five years ended June 2012 placed it above the 1.2 percent median for schools the same size.

Back in 2000, when Weitz took a seat on the investment committee, the small liberal arts college was heavily invested in technology stocks. As with many endowments that had tech-laden portfolios, Carleton put up outsize returns, peaking at 24.7 percent in 2000, compared with a 12 percent median return for the Nacubo universe that year. Then the tech bubble burst in March 2000, and Carleton’s endowment dropped from $681 million in fiscal year 2000 to a low of $452 million three years later. “We held the stocks too long and were at the bottom of the rankings for a few years, then had average returns for five years,” recalls Weitz. “It was traumatic after being at the top of the charts.”

The lesson wasn’t lost on Weitz. After looking at options like outsourcing the endowment, and speaking with D. Ellen Shuman, then CIO at Carnegie Corp. and a Yale endowment alumna, in 2004 the school hired its first CIO, Jason Matz. Carleton also hired consulting firm Hammond Associates (acquired by Mercer in 2009), whose mandate spanned the two-year transition to an investment office. To make the new model work, the investment culture had to change from being committee-led to handing discretion for manager selection and portfolio rebalancing to Matz and Andy Christensen, head of private markets. Committee members “who wanted to touch and feel the managers got off the board,” explains Matz.

“We can help Jason have the courage to lean against the wind and the courage to do things that don’t look popular,” Weitz says. “That includes giving him cover to rebalance away from strategies that are working and adding more to those that are unpopular or scary.”

With the freedom to reallocate the portfolio, Matz brought it more in line with larger schools but stopped well short of an oversize chunk in private, illiquid partnerships. He cut public equity from 61 percent in March 2004 to 35 percent in June 2013. Private equity was increased from 12 percent to 18 percent, fixed income dropped from 20 percent to 7 percent, and marketable alternatives were raised from 8 percent to 29 percent (now spread among nine hedge funds). A real-asset portfolio was launched that is 10 percent of the total.

There must be a balance between the race for returns and the need to do what is best for each school, warns Weitz. Most of the 20 midsize schools depend on their endowments for 30 percent of their annual operating budgets. “If you’re competing in the wrong race, you might get to the wrong place,” he says. But Weitz acknowledges that it’s difficult to avoid focusing on competition among schools given the pressure from rankings like U.S. News & World Report’s annual “best colleges,” in which one of the criteria is “endowment per student.”

There are finer points of the Swensen model that work for smaller schools. Weitz points out that asset classes have streaks and Swensen is good at rebalancing. “It’s all about rebalancing to take advantage of the bargains,” he says. “It’s not just if you have a Noah’s ark of asset classes that you win.”

For his part, Matz believes that Carleton’s success — its ability to bounce back from a steep 19.2 percent loss in 2002 to the top of the charts by June 2012 — rests on manager selection. “If you’re not able to source superior managers who put the intent of the client ahead of themselves, if you’re not in the network, you’re probably going to get into trouble,” says Matz, pointing to the fact that only one of Carleton’s then-14 hedge funds gated the school’s assets that it had in that fund in 2008.

Manager selection is also key at Bowdoin, where CIO Volent has carved out a special place in the portfolio for what she calls a farm team. In a formalized, now-ten-year-old program, she has invested with small, emerging managers, mostly hedge funds that spin out of larger firms. “A big university may not be able to do that,” Volent notes. “It’s a rounding error for them.” Whereas many large hedge funds have become institutionalized, smaller managers are hungrier. “That’s driven a lot of our returns,” she adds.

Volent was the first investment professional when she was hired in 2000. As the Bowdoin portfolio has grown, the school has added staff, most recently opening a satellite office in New York to cover real estate, hedge funds and private equity; Volent can be found there two days a week. “If you are Harvard or Yale, investment managers are coming to see you all the time,” she explains. “If you are in Brunswick, Maine, you’re not going to see the flow.” Like most of the top midsize endowments, Bowdoin is responsible for providing 30 percent of the school’s annual operating budget, making liquidity a top concern. “Our focus is on capital preservation and accessing really good managers,” says Volent.

Unlike schools with CIOs or committee-led investment programs, some midsize institutions have chosen to outsource portfolio management. Although outsourcing has been gaining popularity, only two of the top 20 midsize endowments outsource their investment offices: Middlebury College (No. 4) and the University of Colorado Foundation (No. 20).

Outsourcing sends a strong signal that schools want to follow the traditional Yale model, which requires greater resources than a midsize endowment can muster. The number of outsourced CIOs, or OCIOs, has grown with the demand. What started as a trickle in 2003, when Alice Handy left her CIO position at the University of Virginia to found Investure, has almost a decade later reached a flood, with some 50 firms identifying themselves as OCIOs, according to Darien, Connecticut–based consulting firm Casey, Quirk & Associates. Among the latest OCIOs are Matthew Wright, who vacated Vanderbilt University’s CIO spot earlier this year to set up Disciplina Group in Nashville, and Shuman, who with Nina Scherago, former deputy CIO at the Investment Fund for Foundations, is currently in the process of building out Edgehill Endowment Partners in New Haven.

The OCIO business has become very competitive, and services vary widely. Whereas the early firms followed Handy’s original model of individualized attention to a small group of schools and foundations, today’s OCIOs will accept all or just a portion of endowment portfolios and include the largest money managers, such as J.P. Morgan Asset Management, where $40 billion in endowment and foundation assets are overseen by practice head Monica Issar. According to research conducted by Commonfund, by June 30, 2012, 38 percent of colleges and universities were outsourcing some or all of their endowment portfolios, for fees that ranged from 0.3 percent to 1.0 percent of their assets under management.

The University of Colorado Foundation officially became outsourced in 2009, when its CIO, Christopher Bittman, was hired by New York–based Perella Weinberg Partners to start an OCIO practice. Colorado’s 1.86 percent five-year return on what are now $770 million in assets just squeaked ahead of Yale’s 1.83 percent return but is solidly above the 1.7 percent median return for the largest endowments. Bittman, who has remained in his Denver office, recently picked up a new client, the ASU Foundation for a New American University, which oversees the $553 million Arizona State University endowment. According to Virginia Foltz, treasurer and CFO of the ASU Foundation, the seven-member ASU investment committee felt its time might be better spent discussing the higher-level concepts of asset allocation, spending and investment policy and global market impacts rather than the day-to-day management of the fund. Foltz’s own time is constrained by multiple roles that include responsibility for the organization’s financial operations, including reporting, treasury, debt management, risk management, planning and budgeting, payroll and benefits, gift reporting, building operations and oversight of six subsidiary organizations. She also points to the increasing need for nimble investment decision making.

Vermont’s Middlebury, with a 3.5 percent annualized return over the five-year period, was an early adopter of the outsourcing model when it selected Handy to be its OCIO. Churchill Franklin, an emeritus Middlebury board and investment committee member who now holds a nonvoting seat on the committee, continues to be pleased with the decision. “You can only make this kind of change at certain points,” says Franklin, CEO of Acadian Asset Management in Boston. That point was reached at Middlebury when the head of the investment committee moved on to become chairman of the board of trustees.

Outsourcing is still a very difficult decision for schools to make, according to a Greenwich Associates report published in early 2013. The study of 30 endowments and foundations uncovered scads of fears about the outsourcing model, starting with the surrender of day-to-day control of the investment process. Other concerns included uncertainty about costs, worries about oversight and monitoring, a possible lack of transparency about fees, fear of violating fiduciary responsibility, geographic distance between the fund and the OCIO, and potential conflicts of interest.

Regardless of whether smaller schools go the OCIO, investment office or committee route, Carleton’s Weitz is sanguine about their chances to outperform, as long as their investment teams avoid getting carried away with the latest hot idea and stick with quality investments, even if they are not working at the time. “I don’t despair of keeping up investmentwise with the Harvards,” he says. “There’s more to endowments than investment size.”

Perhaps the most vocal believer in the ability of midsize schools to be successful with their own version of the Yale model is Cliffwater’s Nesbitt. “You’ve got a lot of good talent at the midlevel now,” he explains. “It wouldn’t surprise me if the group of 20 does better than the Ivies in the next five years.” • •

Read more about U.S. college and university endowments in a companion piece, “Does Size Matter for Successful Endowment Investing?”

Read more on endowments and foundations.