Lack of aggressive monetary policy support has helped separate emerging equity markets performance from its developed-markets counterpart this year.

While central banks in developed markets continue to push hard, emerging-markets monetary policymakers have mostly stood pat in recent months. Although growth in emerging markets remains significantly below trend, inflation has stabilized in the past nine months. With generally low unemployment rates signaling limited slack, emerging-markets central bankers have felt much less free to add stimulus than have the Fed and the Bank of Japan, among others. Our forecast does not suggest much change during the remainder of 2013, with the aggregate emerging-markets policy interest rate likely to drop less than 10 basis points. While risks are probably tilted in the direction of greater easing, the monetary policy cycle looks unlikely to provide a significant tailwind to emerging-markets equities in coming months.

The list of major emerging-markets countries either currently cutting rates or very likely to do so in the near term consists of just five: Hungary, Poland, Turkey, Korea, and India. The first two of these are suffering the consequences of the extended euro area recession. On top of that effect, the National Bank of Hungary is carrying out a “structural” easing associated with a regime change at the central bank, with doves now holding a majority on the board. Turkey is also feeling the euro area chill, though to a lesser extent. Its easing additionally reflects the upgrading of the role played by real exchange rate management in determining the overall policy stance. Gradual currency appreciation (in real, trade-weighted terms) is triggering compensatory interest rate reductions. In Korea’s case, global cyclical weakness is combining with the yen’s depreciation — a negative competitiveness shock to Korea — to bolster the case for additional cuts, on top of the 50 basis points in easing during 2012. Finally, India has been cutting gradually since last year but has brought the policy rate down a modest 75 basis points during that period. The statement following the most recent move suggested that the cycle is drawing to a close or perhaps has already done so. Our forecast assumes only one additional 25 basis point move.

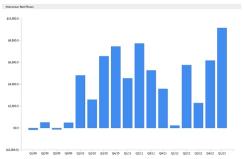

Chart 1: Aggregate emerging market policy interest rate (%, GDP-weighted)

Chart 1

Source: JPMSI, JPMAM; data and forecasts as of May 2013 |

What other central banks may ease? At least two may consider doing so. The Russian central bank has also gone through a leadership change, with a close advisor of Vladimir Putin now leading the institution. The central bank has come under significant pressure from the government to cut. Its signals in the early days of its new administration, though, have not sounded particularly dovish, and the inflation pickup during April makes a near-term move unlikely. In any case, real rates are not running at especially high levels, making large-scale easing unlikely. Mexico, meanwhile, did not appear on the list of “currently easing” central banks, because it explicitly characterized the 50 basis point March cut as a one-off. Still, the surprisingly effective reform process now underway carries the potential to boost productivity growth significantly over time and is leading to currency appreciation. The central bank recently signaled the possibility of another “one-time” move later this year, though it later backtracked slightly from that statement. Nonetheless, these two countries represent the most likely candidates to join the easing group. Other outside possibilities — Chile, South Africa, the Philippines, and Taiwan — could come into play if global growth surprises significantly to the downside in the next quarter or two.

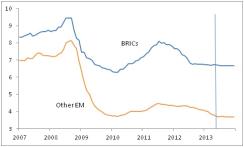

Chart 2: Aggregate policy interest rate (%, GDP-weighted)

Chart 2

Source: JPMSI, JPMAM; data and forecasts as of May 2013 |

Michael Hood is a market strategist for J.P. Morgan Asset Management.