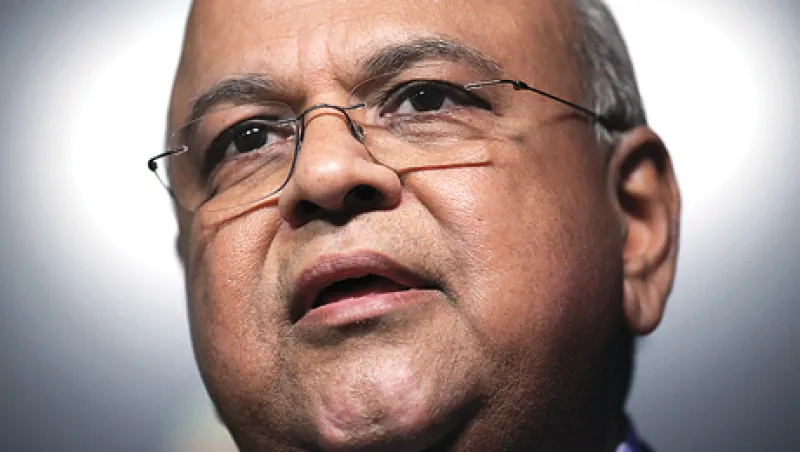

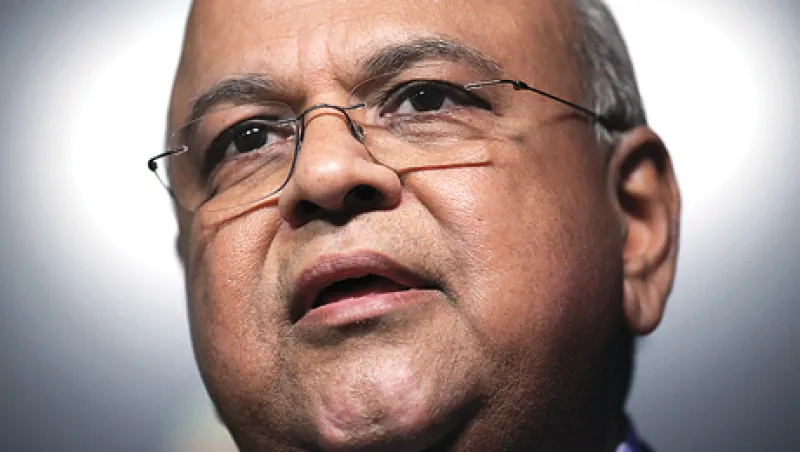

South African Finance Minister Gordhan Seeks Growth and Inclusiveness

As its economy slows, South Africa must keep a national infrastructure program alive without racking up big deficits. Finance Minister Pravin Gordhan wants the newest member of the BRICS group to pursue an economic expansion that creates opportunity for all.

Tom Buerkle

May 1, 2013