Since the beginning of 2013 financial markets have generally taken an optimistic view of Mexico, although there have been periods of concern. Mexican equities, while down for the year, have outperformed those of Brazil, Chile, Colombia and Peru, the other four Latin American members of the MSCI emerging-markets index. The prospects for Mexico have looked promising.

If historical data are any indication, robust U.S. growth would directly help its southern neighbor, which would receive additional benefits from the Mexican government’s aggressive reform agenda in such areas as energy, the labor market and government finance. Testament to the inextricable economic links between the bordering nations, the Mexican peso appreciated strongly during the first quarter of 2013 until spring, when the U.S. Federal Reserve Board’s rhetoric turned hawkish and the peso fell.

But in economic reality, Mexican growth has stumbled badly. Gross domestic product grew a mere 0.1 percent in the first quarter of 2013 (seasonally adjusted, quarter-over-quarter rate), dropping a startling 2.9 percent in the second quarter. This weakness raises the question of whether the relationship between Mexico and the U.S. has changed and, by extension, whether Mexico might fail to benefit from expected economic acceleration by its northern neighbor.

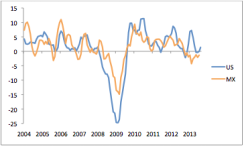

With regards to simple GDP growth, Mexico has indeed underperformed this year (see Chart 1). Its average growth rate of –1.4 percent during the first half of 2013 badly lagged the 1.8 percent growth in the U.S.

If anything has changed in the Mexican economy, however, it has happened this year. Mexico’s 3.6 percent average growth rate during 2011 and 2012, while nothing to shout about, comfortably exceeded the 2 percent pace in the U.S. This gap parallels that seen during the past few expansion cycles.

Chart 1: U.S. and Mexico real GDP (percent quarter-over-quarter, seasonally adjusted annual rate)

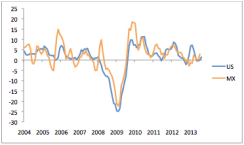

GDP figures are prone to waffle from quarter to quarter. But industrial production, the activity that binds the U.S. and Mexico, tells a story similar to the countries’ economies as a whole. U.S. industry has expanded in 2013, albeit in a volatile fashion, while Mexican industrial output has contracted (see Chart 2). The two series, which normally show strong correlation, have shown unusual divergence this year.

Chart 2: U.S. and Mexico industrial production (percent three months over three months, seasonally adjusted annual rate)

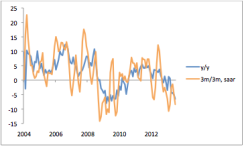

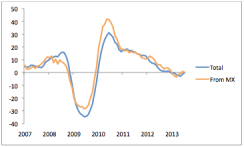

A look at the details of industrial activity, however, reveals a slightly different story. Mexican manufacturing has underperformed its U.S. counterpart by somewhat less than the headline series, and to a degree that does not look particularly striking by recent historical standards (see Chart 3). Meanwhile, the construction component of Mexican industrial output has struggled. Mexican construction posted sharply negative growth rates in both of the first two quarters of 2013 and by July was down 6.5 percent year-over-year (see Chart 4). While U.S. construction activity dipped in the first quarter of 2013, it came roaring back the following few months, posting a double-digit annualized increase. The differing construction cycles in the two countries, with U.S. construction rebounding from the housing bust of the past six years, account for the contrasting paths for overall growth.

Chart 3: U.S. and Mexico manufacturing production (percent three months over three months, seasonally adjusted annual rate)

Chart 4: Mexico construction activity (percent)

U.S. trade data shed light on the possible reasons for the Mexican economy’s sluggishness. These show imports from Mexico growing nearly apace with overall U.S. foreign purchases and, if anything, slightly eclipsing those of its neighbor so far this year (see Chart 5). U.S. imports from Mexico have barely grown recently, edging up an average of just 0.2 percent year-over-year in the three months leading to July. The problem is not any loss of Mexican market share but rather the overall sluggishness of U.S. imports. National accounts data tell a similar story, with real imports of goods rising a modest 1 percent year-over-year, versus 1.6 percent for overall GDP, an unusual lag at this stage of an expansion.

Chart 5: U.S. imports (percent year-over-year, three-month moving average)

Industrial and trade figures suggest a couple of reasons for Mexico’s underperformance in 2013. First, Mexico’s construction sector has suffered, most likely from interrupted government spending. As usually happens every six years in Mexico, spending falters when a new administration has to find its footing (Enrique Peña Nieto took presidential office this past December). Indeed, fiscal data show significantly slower spending during the first half of 2013. Second, recent U.S. growth has been benefiting domestic producers more than foreign ones, with imports weak relative to overall spending.

Neither of these trends suggests a structural change in the U.S.-Mexico relationship. Construction weakness should prove short-lived, as the Mexican government sets its priorities and approves its own projects. Although Mexico seems unlikely to duplicate the rapid growth that construction experienced in the U.S. in the past two years, U.S. building activity itself seems likely to cool off once interest rates rise.

The expected acceleration in U.S. growth in 2014 should eventually push up imports — that is, in the absence of any obvious underlying reason for imports to continue losing market share, such as weakness in the U.S. dollar. Mexico has kept pace with other exporters to the U.S. during the past several years. If anything, Mexico has been gaining share at the margin and should feel a tailwind as U.S. growth picks up. In the near term, however, the Mexican economy has faced obstacles like storm disruptions, which will probably hurt the economy during the third quarter. Renewed uncertainty about the U.S. as a result of the roughly two-week ?government shutdown is probably weighing a bit on growth during the present three-month period. But the historically close relationship between the two economies will likely reassert itself in 2014, paving the way for a stronger Mexican economy.

Michael Hood is a market strategist for J.P. Morgan Asset Management.

Get more from J.P. Morgan Asset Management.