Illustration by James Heimer

Adapted from Better Than Alpha: Three Steps to Capturing Excess Returns in a Changing World

There’s a saying in real estate that the three things that matter most when buying property are location, location, location. Well, the three things that matter most to the success of an institutional investor are governance, governance, governance.

What does governance mean? If you ask ten people, you might well get ten different answers. It means authority to some, policy to others, leadership to yet others. I think the best definition is that governance is a body of rules, practices, and processes by which an organization is directed and controlled.

It is simply a matter of deciding who decides.

If behavioral alpha is the value we can add to investment returns by improving our individual decision making and eliminating behavioral biases, then organizational alpha is the institutional equivalent. It’s the improvement in investment performance that comes from better organizational decision making.

However, it’s impossible to eliminate decision biases individually without optimizing governance collectively. Good governance means having the right people in the right positions to make the best decisions. And this requires intentional effort, not merely a passive adherence to tradition.

There are some institutions that get this very right, with governance structures that empower the appropriate people, effectively balancing the competing needs for oversight and efficiency. In these organizations, everyone is pulling in the same direction and individual and collective performance are harmonized.

Unfortunately, there are many institutions that do not get this trade-off right, creating internal challenges, bureaucratic morasses, perverse incentives, and adverse selection bias. In such a case, the greatest enemy to returns is the organization itself. Although eliminating these challenges can indeed lead to better organizational outcomes — such as higher investment returns and increased funding ratios — improving investment governance is no trivial matter.

But before we can discuss good investment governance in practice, we need to know how effective governance works in general. To examine this, let’s turn to a framework created by German sociologist, philosopher, and political economist Max Weber. Born in 1864, Weber was a prolific author who wrote extensively about rationalism, capitalism, and legitimate sources of authority. In an essay titled “Politics as a Vocation,” based on a series of his lectures, he separates authority into distinct types dependent on the source of power behind it.

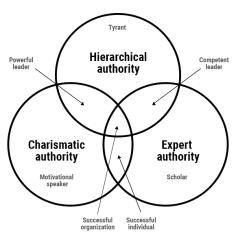

Weber proposes three sources of authority: traditional authority, or authority derived from long-established customs, traditions, and social norms; charismatic authority, the power that flows from a person with strong inherent leadership characteristics; and rational/legal authority, which stems from a set of complex rules and policies for selecting who gets to make the decisions in a society.

Taking a little liberty with Weber’s framework, we can adapt it to modern investment organizations. The hereditary rule that Weber cites as an example of traditional authority is now virtually nonexistent among modern societies, but we do have many positions of institutionalized hierarchal power. For instance, the CEO of a company has authority via the power of the seat. Though not hereditary per se, this authority is vested and transitioned solely through a shared collective belief. Essentially, CEOs have authority because it is adjudicated by rule that they have authority; they are the named leaders.

When it comes to rational/legal authority, Weber basically believed that technocrats running bureaucracies would make superior decisions in their areas of expertise. Hire experts, and have them decide. Or at least that was the idea.

Today bureaucracy is nearly synonymous with inefficiency and waste. Rather than relying on the hierarchical authority of the named leader of an inefficient bureaucracy, I propose another type of authority that would capture a meaningful distinction in the source of power while remaining true to the intent of Weber’s concept: expert authority. Expert authority is the rational authority willingly granted to an individual with recognized experience and expertise in a certain area of knowledge.

Though both expert and charismatic authority are inherent to the individual, expertise is knowledge-based whereas charisma is character-based. For example, think of the doctor you consult for a second opinion, the executive whose mentorship you seek when considering important career decisions, or even the outside expert witness brought in to testify in a court case. People willingly seek out these individuals, not necessarily because they are magnetically drawn to follow them, but because they explicitly acknowledge the domain expertise such individuals have.

To summarize:

- Hierarchical authority is coercive. People follow these leaders because they have to.

- Charismatic authority is emotive. People follow these leaders because they want to.

- Expert authority is rational. People follow these leaders because they ought to.

Using this framework, effective governance means ensuring that an organization has charismatic experts in positions of hierarchical authority. Effective organizations are those with as much overlap as possible in the sources of authority in the figure below.

Clearly, then, good investment governance must mean the intentional convergence of the circles in the Venn diagram: empowering those most qualified to make the relevant decisions and leading others to execute on those decisions with the hierarchical authority of the institution behind them.

This is easier said than done, however.

Although investing — especially investing a complex, globally diversified, alternatives-heavy portfolio — is a knowledge-based profession, determining objectively who has the relevant expertise to make specific decisions can often be difficult. This starts with breaking down the investment function into constituent parts. With most institutional investors, the investment process has four major components:

- Policy and objective setting

- Strategic asset allocation

- Manager and/or security selection

- Portfolio management

Institutions generally have the following layers to the hierarchy where these decisions take place:

- Board of trustees or board subcommittee (e.g., investment committee)

- Executive director, CEO, or president

- Chief investment officer

- Investment staff

Over the course of his career, Ambachtsheer has conducted research on the effectiveness of various governance and decision-making structures in public pension plans. His studies, among others, have shown that better governance strongly correlates with objective measures of better long-term strategic investment decisions.

For instance, some of the research from Rotman shows that pensions with a lower percentage of ex officio trustees — considered to be less accountable and aligned board members — exhibited significantly higher excess manager returns across asset classes compared with plans with a higher number of political trustees. The more-political plans also had lower funding ratios, on average.

Among the most important governance recommendations made by Ambachtsheer to combat these effects are:

- Creating a board skills/experience matrix to design roles and ensure a match with needs

- Separating and ensuring clarity between board oversight and management responsibilities

- Creating board evaluation protocols and establishing performance orientation throughout a firm

- Establishing formal board education and improvement requirements

Let’s take a look at a thought exercise where we can implement these concepts in a few theoretical scenarios.

First, imagine a large public pension, say $35 billion, with a portfolio globally diversified across all asset classes, including alternatives. Let’s assume this system has a seven-person volunteer board composed solely of participants in the pension fund. Additionally, the plan has an executive director who oversees administration, a chief investment officer who reports to the board, and a deep professional investment team of 30 dedicated individuals who work directly for the CIO.The members of the volunteer board do not have investment experience, so they should focus their efforts within the investment context on clearly defining investment objectives, creating organizational agreement around time horizons and risk thresholds, establishing an investment policy statement, setting up performance metrics and compensation structures for staff that incentivize desired behavior, and monitoring and reviewing performance relative to these metrics. They should be involved in the asset allocation discussion and should set permissible ranges for asset classes. Board members need to have an understanding of how the strategic allocation is selected even if they are not explicitly involved in approving the decision. However, the board’s most important responsibility is to monitor the performance of the asset allocation and the CIO and decide if changes are needed.

The chief investment officer in such a system should be responsible for implementing the strategic asset allocation, overseeing any tactical allocation or rebalancing strategy, setting all procedures for portfolio and risk management, and monitoring the performance of each asset class and asset class director. Manager selection in this context becomes part of the day-to-day management responsibilities of the investment staff and can be overseen by the CIO or by a professional internal investment committee, or even delegated to asset class directors as portfolio managers.

Now let’s imagine a fairly small nonprofit foundation, a charity with $50 million of endowed tax-exempt assets. This organization has no investment staff, just an executive director with some limited financial experience. However, this particular foundation has a 20-person board, as well as a six-member investment committee made up solely of volunteer investment professionals from the community. In this setting, the board might set objectives and policies, or it may defer such decisions to the expertise of the committee members.

The investment committee can then select a strategic allocation — perhaps a simple 65 percent equity and 35 percent bond portfolio — determine allowable ranges for each asset class, establish management responsibilities, and select managers. However, with only an executive director to oversee the day-to-day management functions (rebalancing, contracting with managers, funding investments, etc.), it may not be feasible to retain those functions internally. If the investment committee and executive director believe they should retain manager selection discretion, then having a simpler, more concentrated balanced portfolio of fewer managers versus a more complex and broadly diversified one is prudent.

On the other hand, good governance for a more diversified or alternatives-heavy portfolio at the same institution would require outsourcing at least some of the investment responsibilities to a third-party provider, such as a fund of funds or outsourced chief investment officer, with professional competencies in selecting hedge funds or private equity managers.

This entity could implement the portfolio within the guidelines determined by the investment committee by selecting managers and tactical ranges; a slightly different arrangement might even include delegation of the strategic asset allocation range to an OCIO vendor. In either case, the most critical element of the responsibility of the investment committee would certainly be performance monitoring and oversight of the portfolio. Selection of lots of managers across lots of asset classes, particularly complex ones, should not be a part-time job.

Though who should own what decision in all the examples above is certainly open to debate, a frank conversation around governance using this framework can best address those disagreements by bringing objectivity to the discussion. Remember that the primary objective of good governance should be aligning roles and responsibilities with skill sets and abilities, measuring performance, and ensuring accountability across an organization.

When this doesn’t happen, plans typically find themselves with poorer investment returns and ultimately lower funded ratios. This misalignment of governance principles is negative organizational alpha.

If, on the other hand, an organization effectively empowers the appropriate people at each level, vastly superior outcomes can be observed.

The State of Wisconsin Investment Board is one institutional investor that has successfully implemented many of these organizational strategies. First, the investment board is itself a separate agency, independent from the administration of the overall retirement system and tasked only with the investment management of the assets. This allows best investment practices, as opposed to more political considerations, to dictate governance and process. As a result, there is a clear separation of duties between board members, who set policy and provide oversight, and investment staff, who execute and implement. A highly experienced chief investment officer leads the organization, serving as chair of the investment committee.

Reporting to the CIO is a well-resourced team of 215 investment professionals who manage more than $144 billion in assets. The CIO and the staff have been delegated responsibility for asset class implementation and execution, managing approximately 57 percent of assets in-house for public securities — far cheaper than using expensive external managers in a vain search for benchmark-linked alpha. And for asset classes for which external managers are still required, like private equity, the staff applies disciplined and robust processes to select and terminate these investment firms as necessary, based solely on the expected contribution to excess returns.

Further aligning incentives, the investment team is compensated based on the plan’s five-year investment performance, which also serves as a retention tool. As a result, SWIB has outperformed both its policy benchmark and its required rate of return over long periods of time. SWIB’s policy benchmark has returned 8.1 percent over the ten years ended 2020, which exceeds the assumed actuarial rate of return of 7.0 percent, about 100 basis points of alpha from intelligent policy setting. However, the portfolio itself achieved 8.5 percent over the same time, nearly another 50 basis points of alpha on top of the policy from solid investment processes and decision making, including superior manager selection and tactical decisions.

Most important, all these behavioral, process, and organizational alphas add up to a funded ratio of about 102 percent for SWIB, the best in the country. The State of Wisconsin is in a better position to meet its obligations — to make beneficiary payments — than most other public pensions because every decision it has made has tilted the odds in its favor.

This is how institutional investors should think about alpha — not simply beating a benchmark, but improving the odds of investment success. In this paradigm, there is not a fixed pool of collective odds, where market participants must take from the probability distribution of others to improve their own outcomes. Rather, by improving all the little decisions along the way where costs leak out, biases creep in, and underperformance results, investors can access organizational alpha and increase the probability that they will meet their long-term financial obligations.

Christopher M. Schelling is the director of alternative investments for Venturi Private Wealth. As an institutional investor, he has allocated roughly $5 billion and met with more than 3,500 managers across hedge funds, real assets, private credit, and private equity.