Institutional Investors’ ESG strategies balance investment priorities with the externalities of production and consumption, according to new research from Vontobel and II’s Custom Research Lab. As investors seek EM fixed income investments that are aligned with ESG mandates, they reveal a clear-eyed view of the transition from fossil fuels to the next generation of energy.

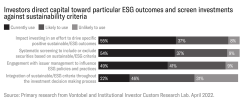

Institutional investors look to emerging markets as a source of higher returns, stability, and diversification by investing in EM fixed income. And ensuring alignment with ESG principles is among investors’ top priorities for their fixed income holdings, according to 45% of participants in this study among investment decision makers at asset owning institutions around the world. Survey respondents say they are most likely to use a combination of strategies to direct their capital toward investments that deliver positive social and environment outcomes and away from those that degrade the natural world, contribute to climate change, and harm employees, customers, and the public more broadly.

Impact investing and systematic screening are well established among investors participating in for this study, as shown below. The head of fixed income at a German insurer says his company “works with MSCI and uses some NGO data along with data from 14 different suppliers worldwide. If they have a negative sustainability rating, we don’t invest in the country or company.” His institution’s ambitious use of data seems to be a sound response to the uneven quality of information available on emerging market fixed income, as a majority of survey respondents cite data inconsistencies from third-party data providers as a top concern when investing in EM fixed income.

Investor thinking on engagement with issuers rather than divestment has matured in recent years, according to investors interviewed for this study. Rather than starve a bad economic actor through divestment, investors increasingly nourish such companies through active engagement with management on its ESG policies and practices. “We generally have a policy of engagement rather than divestments. We prefer to transition companies to a lower carbon path [rather] than just sell. If a company is just simply divested, then there are a couple things that can happen. One thing is, the company can’t afford to transition to better practices, which is not really positive. Or private equity comes in, buys the company, does whatever it wants with it, and all disclosure stops, and that doesn’t really help. And if you just sell, then the company still does whatever it was doing and the effect on the world is still the same. Your portfolio statistics may look better, but the world hasn’t changed a bit.”

Investing through an ESG lens may well be an especially daunting task for EM fixed income investors, according to sources interviewed for this study, largely, it seems, due to the nascent state of the transition away from fossil fuels, traditional but unsound management practices, and archaic treatment of the workforce. A fixed income analyst at a UK insurer asserts that ESG investing in emerging markets is notably more difficult than in developed markets. “Emerging markets are quite a lot more challenging for ESG than developed markets. You have to be a bit more realistic, because many things are in just the earliest stages of development. Some of the plans that, for example, India or South Africa put out last year about moving away from fossil fuels and toward wind and solar – they sound great, but they have not really started yet.”

The eagerness to transition to new sources of energy can at times conflict with near-term ESG aspirations. A carbon neutral economy in which machinery is powered by sustainably generated electricity requires massive investments in generation and transmission infrastructure, along with the next generation of vehicles and other machinery powered by electricity. Such investments of course require many of the same materials and intermediate goods as the old hydrocarbon economy. These materials need to be mined, refined, and manufactured – all of which contribute to, rather than remedy, many of our current environmental problems. But, as the German insurance portfolio manager points out, “Without commodities there is no energy transition. If you look at European parties and the political landscape, they think commodities are a very bad thing. And because of the pollution, if you mine them, or if you produce them, there are very negative external effects. But in the end, if you want to have an energy transition, you need copper, nickel, and also oil.”

This article is adapted from the research report, Institutions Look to Emerging Market Fixed Income for Yield, Diversification, and ESG Alignment, published by Vontobel Asset Management and II’s Custom Research Lab in May 2022. The study includes survey data from more than 300 asset-owning institutions worldwide and interviews with ten investment decision makers at such institutions. Click here to download the full report www.vontobel.com/fi2022.

More From Vontobel

Global Crises Lead to Opportunities in Emerging Market Fixed IncomeNew Markets, New Opportunities, and New Risks for EM Fixed Income Investors

In Emerging Markets, Active Fixed Income Investors Look for “Speedboats, Not Oil Tankers”