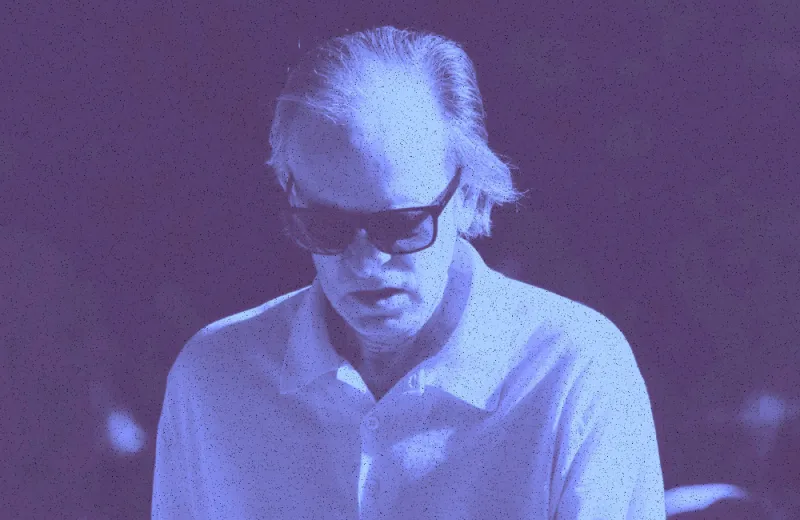

Bing Guan/Bloomberg

In April 2013, an investing legend looked in the proverbial mirror and asked himself “Am I a great investor?” In one of his regular and highly anticipated public notes to clients, competitors, and the world, he offered a preliminary answer: “No, not yet.”

He felt he, and his peers, were untested. Since the early 1980s, when he and a handful of other well-known managers got their start, market conditions had been so favorable for bonds that the bond investors couldn’t actually claim to be great — at least not yet. Interest rates were still on a decades-long, relatively steady march lower, which is fuel for higher bond prices. (One of the simpler finance equations: The price of a bond rises as interest rates decline.)

I wish Bill Gross had been kinder to himself, because in 2013 he had arguably reached his peak. In the weeks that followed, the Federal Reserve would hint at ending its support of financial markets (basically what it broadcasts it’s doing now, but for real this time), and those markets would be upended. Gross would never entirely regain his footing.

I’ve spent the past eight years reporting and researching a book about Gross, Pimco, and the bond market. I’ve read old articles, interviewed hundreds of sources, studied Gross’s old “Investment Outlooks” notes — some hilarious, some reflective like the one in 2013, and all ending with commentaries on the direction of fixed-income markets. That book, The Bond King, details Gross’s multidecade rise, from helping to create active bond trading to many years running the world’s biggest bond fund — to a quick exit in 2014, when Gross left the firm he had cofounded for a much smaller rival, Janus Capital.

Over those eight years, whenever I told someone in the industry about the project, the most common response was something like: Sure, he did well, but it was just luck. Indeed, a commenter on The Wall Street Journal review of my book says the same: “No mention of luck and timing. . . . He was fortunate to ride a gigantic bull market for bonds.”

People would assert that once the Total Return fund got to some threshold size, Gross was delivering more beta — the return of the market overall — than alpha — the returns above that, which active portfolio managers like to say are a product of their unique skills. His performance, the thinking goes, was just the market’s performance, and Gross was incapable of generating anything on top of the benchmark, or what investors could get with a cheap index fund.

My years of research showed that, actually, Gross was indeed a great investor. Sources told me they’d never seen a better trader, for one thing. But I found most compelling Gross’s own case for the strategies. He identified market inefficiencies around which he was able to structure trades that, over decades, wrung out extra basis points. He helpfully described these strategies himself in a 2005 paper and in his keynote speech at the 2014 Morningstar conference.

“Structural alpha,” he called it, in the jargoniest jargon. And more directly: “the keys to the kingdom.” The tenets included selling volatility — for example, betting that other investors were so anxious about the future that he could profitably sell them insurance to help assuage that fear. Gross also invested more than competitors did in mortgage securities, which have inherent options. He used complex derivatives more often and with more vigor. And within that framework, he squeezed every basis point out of every dollar, eking out a little bit more, for example, by holding cash equivalents instead of just cash.

One source told me that when he joined Pimco, someone pulled him aside and said, “There are only four things you need to know. Going long duration,

People might think determining if a legendary investor produced returns beyond what the market gave everybody is a routine exercise. After all, this is the investment industry’s product. But the facts are not so clearly laid out. A quick look at Pimco’s website shows that if you had put $10,000 into the institutional share class of Total Return in May 1987, the date of the fund’s start, you’d have had $79,357 by the end of September 2014. If you had put that same $10,000 into the Bloomberg Barclays Agg (a benchmark whose very name tells a story of finance), you’d have only $61,059.

To my delight, my sources’ stories have largely been corroborated by a pair of researchers. Here’s that nuanced look: In 2019, Aaron Brown and Richard Dewey analyzed the Pimco co-founder’s track record to see if he had generated alpha, using the framework from a well-respected 2012 paper by Andrea Frazzini, David Kabiller, and Lasse Heje Pedersen about Warren Buffett’s investment track record. Using Gross’s public statements about the strategies, they teased out three different factors and compared the returns of those factors with Gross’s actual returns from 1987 to 2014.

The factors were a yield curve steepener, which favored 5-year bonds over 30-year bonds; selling volatility, by selling options or owning mortgage-backed securities, which have an implicit short option position; and owning more credit risk — the risk that a company may default — than peer funds.

The researchers found that these three factors, along with the path of interest rates (the four decades of falling rates), account for 89 percent of Gross’s monthly returns. But Gross did manage to find a little extra above and beyond those factors: A passive portfolio tracking the factors over the same period would have lost to Gross by 0.84 percent per year. In the world of bonds, which move in increments of 0.01 and which investors often buy to protect their portfolios from wild swings, that’s substantial. Gross’s benchmark outperformance was an annual 1.08%, so the researchers found that most of his outperformance was indeed alpha.

Still, he sees that as proof that the overall approach was sound, as it underscores that Gross had a system and the system worked. “He wasn’t waking up saying, ‘Today’s a great time to have a curve steepener on,’” Dewey explains. “It was more holding these factors more or less constant.”

To many people, the researchers’ conclusion must be reassuring. At least we didn’t listen to this guy for decades for no reason.

That much of Gross’s performance is attributable to identifiable factors doesn’t mean achieving it was easy or unimpressive, Dewey points out. Buffett and Gross “weren’t doing it with the benefit of hindsight, and that’s the real magic,” he says. Like the joke when you’re looking at a Mark Rothko or a Jackson Pollock and saying that your five-year-old could have painted this — right, sure, but they didn’t. The genius is in knowing you’re onto something, Dewey says, and sticking with it over time.

According to Dewey, Gross’s legacy is that Gross managed to identify these threads before anyone else, and stick with them — and build an entire firm around them. Without a business, a good trader is just a day trader. Communicating the strategy and attracting and keeping clients are also enormously important in building a successful track record and firm.

Gross’s investors did get a sort of early warning that the bond manager’s long winning streak — in the market and atop his firm — was about to turn. Pimco Total Return’s underperformance in 2011 and 2013 preceded a deluge of headlines about the firm’s “turmoil at the top” and Gross’s “erratic” behavior. Arguably, the underperformance helped to catalyze that turmoil by undermining Gross’s internal credibility, loosening his grasp on power.

Unfortunately, and famously, Gross was unable to replicate his success in his second act, at Janus Henderson. For this I see a few potential explanations. For one, Gross was managing a different product — an “unconstrained” fund, not the Total Return type he’d invented and dominated for decades. Maybe he had one of those random bad streaks that any game of odds delivers now and again and didn’t have time to wait for the “true odds” to play out. Maybe those “structural” trades worked less well. The direction of interest rates certainly didn’t help: From the day he started at Janus to the day he announced his retirement, the yield on the 10-year Treasury climbed from 2.43 percent to 2.73 percent.

Most of all, though, I think his departure from Pimco destabilized Gross and threw off his trading. He started gunning harder.

I learned in my reporting that during his early years, while card-counting in Las Vegas, Gross observed his fellow gamblers getting too emotional, and he knew not to be like them. During most of his years at Pimco, he seems to have kept his emotions sufficiently in check. But I think at Janus, his motivation changed from competing with an index, a passive benchmark that had never wronged him, to competing with people he basically saw as enemies. He said as much, too. He told me in 2014 that he checked the daily performance of his former funds at Pimco against his funds at Janus. “I have a happy night if I’m doing better, and a not-so-happy night if I’m not doing better,” he said. I believe he allowed emotion into his investing, and it had a deleterious effect.

Now that the book is out in the world, the most common questions I’m getting are: Who is the bond king now? Is there one? I think the answer is complicated.

Seeking a “star manager” is human nature. Clients are of course looking for a good track record, in the somewhat irrational hope that it might indicate good future results. But we are still oriented around stories and people. What really sticks with us is the great minds who see the world more clearly, and the stories they tell us about their trades. People want a special genius, and to root for or against that person. This is true not just in finance, although it may make the least sense in finance. Our collective desire for a star created a machine that Gross was happy to feed himself into. All he had to do was deliver results, play up an interesting or bombastic persona to generate headlines, and rake in client money and more headlines. The flip side of that: The second he stopped delivering, people started calling him “erratic.” His investors and peers began to view those quirks that had been taken as a sign of brilliance instead as a source of risk.

In the many years since Gross’s coronation as the bond king, it almost seems we have learned some lessons. Maybe we’ve moved away from star managers and turned more to index funds and roboadvisers. Maybe we’ve noticed how risky it is to embed so much value and confidence in one “key man,” to hope that the good times will continue and the key man won’t start acting irrationally.

A world without stars has drawbacks: It’s less exciting, less fun, and devoid of the hope of an enormous upside generated by some precious genius.

To some extent, they’re still out there (plenty of people point to DoubleLine Capital’s Jeffrey Gundlach as the current sovereign). But maybe our waning enthusiasm for them was a function of a bull market. With the yield curve inverted, inflation appearing settled in to stay, and interest rates marching up, suddenly a nimble mind again seems appealing.

It’s a compelling use case for Bill Gross’s legendary innovation: actively trading bonds.