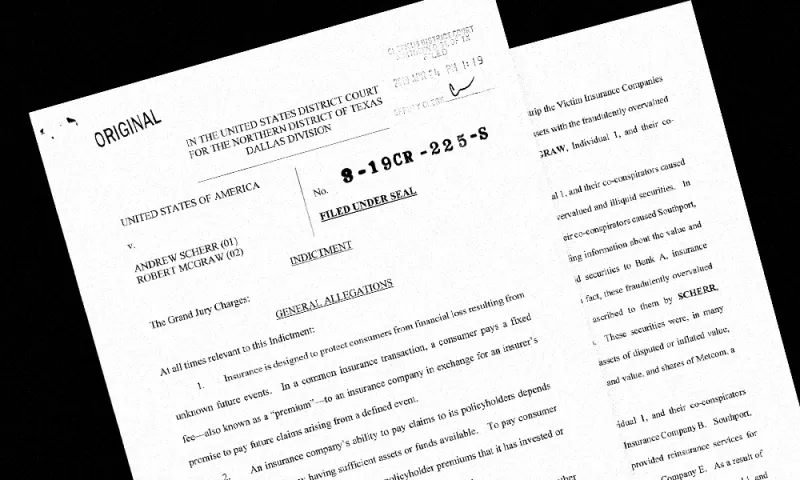

The Department of Justice has charged two former executives at private equity firm Southport Lane with a fraudulent investment scheme, unsealing the indictments six months after the Securities and Exchange Commission’s complaint about their activities.

Andrew Scherr and Robert McGraw allegedly defrauded insurance companies by moving them to exchange cash and other easily traded assets for illiquid, overvalued securities that they created, the DOJ said in a May 2 statement. Scherr was the chief financial officer of Southport and McGraw was executive director of the now-defunct firm.

[II Deep Dive: Private Equity Firm Owners Defrauded Clients, SEC Says]

Southport, which had an office in New York, marketed itself as a private equity specialist for insurance companies. Insurers victimized by the scheme collectively lost hundreds of millions of dollars as the former executives sought to enrich themselves, according to the DOJ.

“Scherr and McGraw diverted hundreds of millions of dollars from insurance companies’ investment portfolios, leaving several companies unable to pay their policyholder claims,” said Brian Benczkowski, the assistant attorney general for the criminal division of the DOJ, in the statement.

The SEC’s complaint in October alleged that they fraudulently led insurers and related reinsurance trusts to transfer more than $300 million in cash to companies they controlled in exchange for “essentially worthless or grossly overvalued” securities. One asset named in the complaint was a purported piece of work by Italian painter Michelangelo Caravaggio — which experts suspected was a fake.

Scherr, McGraw, and their co-conspirators used a portion of a Dallas-based insurer’s $30 million investment to buy shares of a company dealing in derivatives, a vineyard on Long Island, New York, and a limited interest in the so-called Caravaggio painting “David with the Head of Goliath,” according to the DOJ.

In 2012, the former Southport executives engaged a bank as trustee for $195 million worth of Destra Targeted Unit Investment Trusts they created, claiming they were secured by a $128 million interest in the Caravaggio work. “They knew the purported $128,000,000 interest in the Caravaggio painting, which made up the bulk of the $195,000,000 valuation for the Destra UITs, was fraudulently and grossly overvalued,” the indictment stated.

Scherr bought the painting stake from a Florida trust despite being provided conflicting reports on its authenticity, according to the DOJ. In exchange, the trust received a $610,000 payment and $15 million promissory note signed by Scherr and guaranteed by Southport, the indictment shows.

“The criminal division is committed to holding accountable those who defraud investors, especially those who target companies that rely on those investments to live up to the promises made to their policyholders,” Benczkowski said.