The Securities and Exchange Commission has charged the co-owners of New York-based private equity firm Southport Lane Management with defrauding clients in a scheme involving insurers they controlled.

Alexander Burns — the majority owner of now-defunct Southport Lane — used fraudulent transactions to covertly steal money from insurance companies he bought in 2014, according to an SEC litigation statement released Tuesday. Co-owner Andrew Scherr assisted Burns in the scheme, which left at least five insurers with insufficient assets to pay policyholder claims, the regulator alleged.

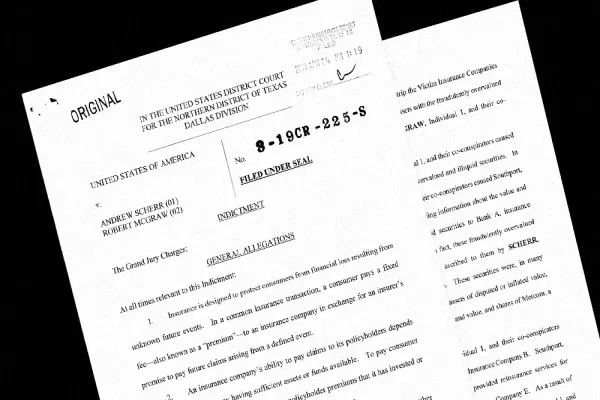

“Burns, with the assistance of Scherr, raided those insurance companies of their funds through a variety of fraudulent transactions and misrepresentations and omissions of material fact,” the SEC said in its complaint filed October 16 in the federal district court in Manhattan.

They fraudulently led the insurers and related reinsurance trusts to transfer more than $300 million in cash to companies they controlled in exchange for “essentially worthless or grossly overvalued” securities that they created, according to the complaint. They diverted millions of dollars for themselves and the use of their companies, the SEC alleged.

There were three phases of the scheme perpetrated by Burns and Scherr, according to the complaint.

First, their private equity firm bought majority stakes in five insurance companies and control of the funds in related reinsurance trusts. Southport Lane Management acquired the controlling interests in some of the insurers by selling them asset-backed securities of “questionable, if any, value” or by surreptitiously using the funds controlled by one insurance company to buy another.

Next, Burns and Southport Lane Management directed the insurers and trusts to enter into investment management agreements with its advisory firm, Southport Lane Advisors, so that it could make decisions for their capital reserve assets.

The third step was to take money from the insurers, the SEC claimed. Burns also sold the overvalued, illiquid securities to these Southport Lane’s advisory clients, according to the complaint.

As part of the alleged fraud, the co-owners enriched themselves by diverting more than $300 million of their clients’ funds and collected more than $8 million in management and advisory fees based on inflated assets, according to the complaint.

They profited in part by paying themselves annual salaries ranging from $460,000 to $600,000, the regulator claimed. In another example, Burns allegedly moved more than $35 million of advisory clients’ funds through his personal bank accounts, retaining about $915,000 — including his salary — and transferring the remainder to Southport Lane Management.

[II Deep Dive: SEC Sues Elon Musk Over Misleading Tweets About Tesla]

Burns, 31, resided in New York at the time of the scheme and now lives in Charleston, South Carolina, according to the complaint earlier this month. Scherr, 50, is a resident of Livingston, New Jersey, the SEC said.

Burns consented to a judgment on October 19 without admitting or denying the allegations, according to the regulator’s statement Monday. Any fines will be determined at a later date.

The SEC’s upcoming litigation against Scherr will be led by senior counsels Kevin McGrath and John Lehmann, according to the statement.