Hong Kong is on its way up to become a global hedge fund center.

So says Kenneth Stemme, head of research at New York–based Larch Lane Advisors, which has seeded 26 hedge funds that collectively manage $3.7 billion.

“My first trip to Asia was in 1997, and my CEO first came in 1990,” Stemme says. “Over the past 20 years, Tokyo was the first stop. Now it is not. Increasingly, Hong Kong is the first stop. For a while there was a push and pull between Hong Kong and Singapore on where the talent is. There is talent in both places, but right now we see Hong Kong in the ascendance and Singapore losing some ground.”

Stemme says he will be coming to Asia, particularly Hong Kong, more often in the coming months to look for hedge funds to seed because of the talent pool and potential opportunities the city offers. Larch Lane, which hasn’t yet seeded an Asian fund, is in talks with several Hong Kong–based startups and may seed as much as $100 million in founding capital per fund if those talks succeed, he says.

“Hong Kong has strengths as a global financial center with a strong regulatory environment, and it has proximity to China,” says Philip Tye, managing director of Hong Kong–based DragonBack Capital, which incubates hedge funds and offers them a whole range of services from risk management to fund administration. “That makes it very, very appealing to fund managers and those in the alternative space.”

More than 70 percent of the 1,000 plus companies listed on the Hong Kong Exchanges and Clearing Limited are either based in China or do substantial business in China. Most of the equities can be shorted, offering fund managers an opportunity to both long and short China-based equities.

China’s renminbi (RMB) internationalization will be a major driver of growth for Hong Kong’s asset management industry, according to Christophe Lee, chairman of the Alternative Investment Management Association (AIMA) in the city, adding that the experiment will also eventually stimulate the growth of the local hedge fund industry.

The global crisis hit Asian hedge funds’ assets under management hard, falling to 23 percent from the 2007 high of $192 billion to $145 billion mid last year, according to industry tracker AsiaHedge, but there is increasing optimism within Hong Kong’s hedge fund circles.

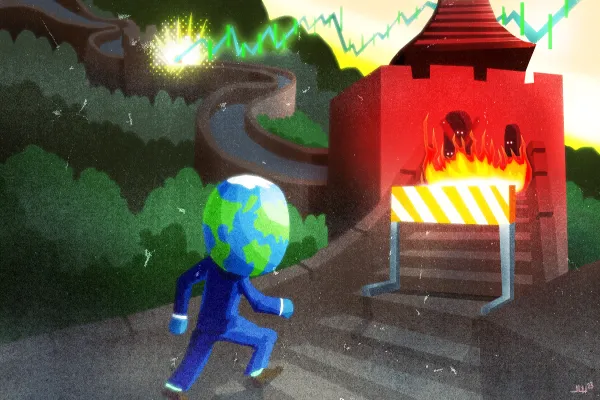

“We continue to see hedge funds coming to Hong Kong that weren’t here before,” says Lee. “On top of that, some people already here are growing. Why? My personal view is one word: China. There is a very clear trend of internationalization of the RMB and it is very clear that Hong Kong will play a major role in this process. You constantly see positive news related to this trend of China slowly opening up its markets. When you talk about the asset management industry, you have to look at development and growth of capital markets. A more near term driver of growth of new funds are spins-off from both bank proprietary trading desks and brand-name funds, and we expect to see a few big launches of this nature this year.”

Since becoming chairman of AIMA in Hong Kong in 2004, Lee has seen corporate membership grow from 21 to over 170 today, which is more than twice the number of AIMA members in Singapore, the rival hedge fund hub in Asia.

Larch Lane, which has seeded only U.S. and EU–based hedge funds so far, sees half of its seedlings funds coming from Asia in the coming years, particularly from Hong Kong.

“China is definitely a factor,” says Larch Lane’s Stemme. “We may be finding more hedge funds in Hong Kong today because there is more debate on China. Years ago you would have only managers that were heavily into longing China. Now there is debate on how strong China is. So that gives opportunity to long and short China. When you get a less clear picture, that creates an opportunity for hedge funds.”