After a summer of trendless markets and exceptionally low volatility, the autumn has started with one very clear and strong theme: a stronger U.S. dollar (USD). Historically, such trends in the dollar have tended to create significant headwinds across emerging-market economies and assets.

However, in this post-global-financial-crisis world, we believe that care must be taken in drawing lessons from historical periods of dollar strength. The rate-hiking cycle in the U.S. may look quite different this time. Other large developed economies such as Europe and Japan may be easing as the U.S. tightens, providing some offsetting effects. And, most important, many emerging markets have transformed themselves in a number of important ways over the 15 years since the U.S. dollar last rallied, making themselves significantly less vulnerable this time around.

Why is the dollar strong again?

Markets expectations at the start of the year were for a further rise in the long end of the U.S. yield curve, with the yield on ten-year Treasuries expected to push well above 3 percent. Instead, a pothole in U.S. GDP growth in the first quarter, combined with strong technical demand and risk aversion stemming from the Russia-Ukraine crisis, pushed the U.S. yield curve lower. The dollar was quite weak, in particular versus emerging-market currencies, and trading volumes across many assets fell as volatility diminished. The markets became complacent.

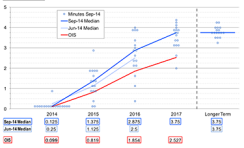

A strong rebound in U.S. growth in the second quarter and continued improvement in the labor market meant that by late August, attention turned to the fact that market participants were anticipating slower hikes in U.S. interest rates than the Federal Reserve was projecting. As participants adjusted their expectations, short-term U.S. interest rates started to move up. This trend accelerated when the Fed revised its own estimates up quite sharply at its mid-September meeting (see chart 1). The changing differential between short-term U.S. interest rates and those elsewhere is a key driver of developed- and emerging-market currency movements, as well as dollar-denominated commodities.

Chart 1: Market pricing vs. Fed expected pace of rate hikes on day of September 2014 FOMC

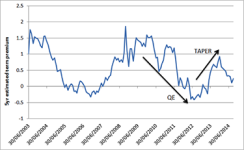

We believe it is important to differentiate between the current period of dollar strength and the events of mid-2013. At that time, long-term U.S. interest rates had moved to very low levels, and the “term premium” (the excess yield on long-term versus short-term bonds) that investors usually demand for the risk of holding longer-term bonds had turned negative (see chart 2). The subsequent rebound in the term premium caused the so-called taper tantrum, which hurt emerging markets because they are more sensitive to longer-term U.S. rates. Today the term premium is at more reasonable levels, suggesting less risk for emerging markets.

Chart 2: U.S. term premium (percent)- measure of long-term interest rate uncertainty

This is broad dollar strength, not just against EM currencies

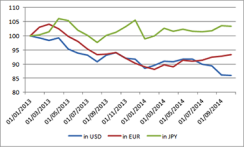

Developed-market currencies and commodities tend to be more sensitive to short-term U.S. interest rate moves. The dollar index against G-10 currencies (DXY) rose 8.6 percent in the third quarter, whereas Brent crude has fallen 22 percent in dollar terms over the same period. Chart 3 shows the performance of the J.P. Morgan emerging-market FX index in euro and yen terms, in which emerging markets have posted gains over the past few months. Consequently, the risk of material outflows appears lower as many investors have not suffered losses. Further aggressive monetary policy easing from both the European Central Bank and the Bank of Japan appear quite possible in the first half of 2015. Such easing will not only ensure that outflow pressures remain limited from investors based in these currencies, but, more fundamentally, it also means that liquidity from these central banks may partially replace the gradual withdrawal of U.S. dollar funding, which has been ample for emerging markets over the past decade.

Chart 3: J.P. Morgan EMFX index vs. major developed-market FX

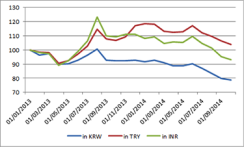

Significantly, the decline in many commodity prices has outstripped the fall in EM currencies. Chart 4 shows Brent crude oil priced in selected emerging-market currencies — the prices faced by domestic consumers. Unlike in 2013, the price is falling across all emerging markets, helping to lower inflation and deliver relative stability in local currency bonds. In countries like Turkey in which further currency depreciation is needed to adjust still large current-account deficits, the central bank can allow this without risking spiraling domestic prices. Of course, declining commodity prices are not good news for all emerging markets, and may weigh on some markets, such as Nigeria and Chile, which are major commodity producers.

Chart 4: Brent crude denominated in selected emerging-markets currencies

Big picture: This is different from the USD cycles in the 1980s and 1990s

Some commentators have drawn parallels between the events of recent weeks and the start of the multiyear dollar bull markets of the early 1980s and late 1990s, when the U.S. was largely the world’s only growth engine. There are reasons to be believe that coming quarters may not see such a strong dollar cycle, and certainly not with the same broad negative implications for emerging markets:

1. Many economists now estimate the long-term potential U.S. growth rate at less than 2 percent a year, an assessment we share. In the early 1980s and late 1990s, structural reforms and the technology revolution pushed potential U.S. growth above 3 percent. This meant that the Fed had to raise policy rates much higher than it will this time around.

2. The basic U.S. balance of payments (current account plus long-term foreign direct investment) was in a small surplus at the start of the historical dollar rallies. Although the balance has improved in recent years, thanks to domestic energy production, it remains in a modest deficit, creating some further headwinds.

3. Since the 1997 Asian financial crisis, most emerging markets have decreased the proportion of debt issuance denominated in the dollar, leading to a drastic improvement in the net USD debt position of all but a few countries. The exposures to a stronger dollar that triggered the string of EM crises in the 1980s and 1990s have been reduced to levels that are well covered by forex reserves in all but a handful of emerging markets. Although sovereign debt is covered by such reserves, we acknowledge that there has been a significant increase in dollar-denominated corporate debt in the past three years.

4. Many emerging markets have made huge strides in reducing inflation to very manageable levels and creating policies that anchor inflation expectations. This means currencies can move more freely to adjust the domestic economy, without requiring drastic monetary policy interventions.

More differentiation within emerging markets

We feel that the current environment of modest dollar strength, combined with slower Chinese growth and resulting lower commodity prices, creates opportunities for investing in strong relative themes across emerging markets.

Terms of trade may continue to diverge, with those selling to U.S. final demand and importing now-cheaper energy seeing positive relative trends that can support their currencies.

Although economies with greater external funding requirements should still feel depreciation pressures from further adjustments in short-term U.S. interest rates, we will have to be alert to any increased probability of monetary stimulus from Europe or Japan, which could drive renewed performance in current-account-deficit countries.

Credible inflation anchors provide a further source of differentiation. Many emerging markets have seen stable bond markets and continued easing biases from central banks despite rising U.S. interest rates. Those countries with more credible inflation anchors can continue to deliver positive local bond returns in spite of the global environment.

Most significantly, an environment of modest dollar strength places an additional premium on countries delivering productivity growth and structural reforms. Countries that can deliver higher productivity will enhance their inflation anchors through improved supply-side dynamics, along with better fiscal fundamentals, further differentiating local bond and credit returns. Their real effective exchange rates will also continue to appreciate on a long-term basis. Most interestingly, several emerging markets — including India, Vietnam and the Philippines — are moving further in this direction. The upcoming election results in Brazil may add another important name to the reform list.

Mike Hugman is a strategist on the emerging-markets fixed-income team at Investec Asset Management in London.