In 2003, when word got out around Vancouver that some local guy had started a free dating site called PlentyOfFish (POF) and was running it out of his apartment, many single Vancouverites rolled their eyes. Who would want to go out with someone too cheap to pay for a dating site membership?

Markus Frind knew better. Frind, the creator of PlentyOfFish, found there was no shortage of people willing to test-drive his online dating site for free — or use it for casual hookups. By early 2006 POF had begun to attract more than 2.2 billion page views per month. Frind was making upwards of $900,000 a month in revenue from Google AdSense. That was less than the $20 million per month paid sites collectively were bringing in, Frind wrote on his blog that year, but enough for him, the sole employee of his bootstrap company.

Fast-forward to 2015. POF serves 100 million users around the world, three million of whom poke around on the site every day, according to Frind. Last month Match Group, part of media exec Barry Diller’s IAC/InterActiveCorp, agreed to buy POF for $575 million in cash, the highest price it has ever paid for any of its various dating sites.

It’s safe to assume that the eye rolling has largely ceased.

To industry watchers, the high price that POF fetched was not all that surprising. IAC already dominates the online dating segment in the U.S. It owns such properties as paid site Match.com and free site OkCupid, which rely on questionnaires and algorithms to set up potential connections, as well as Tinder, the mobile app that allows users to scan hundreds of potential hookup partners within a geographic range designated by the user. IAC controlled 22 percent of the U.S. market before adding POF’s 4.9 percent share. (The second-biggest player in the industry is the decidedly long-term-relationship-focused eHarmony, with 13.5 percent of the online dating market, followed by Zoosk with 5 percent.) In fact, Match Group, the division that’s home to IAC’s matchmaking properties, is gearing up for its own initial public offering later this year. (Read more: “Why Online Dating Has a Hard Time Hooking Up with Venture Capital”)

Since its launch, PlentyOfFish has just barely pulled its hookup reputation out of the gutter. The site now offers a smart chemistry-matching option and attracts many users looking for a lasting connection. Still, many site members feel the need to reiterate that they are not out fishing for a kinky catch-and-release kind of matchup. Its design has even less sex appeal than that of online classifieds site Craigslist. The site’s acquisition also raised a number of questions: Why did IAC decide to add that particular site to its collection of algorithmic matchmakers, especially when a faction of IAC shareholders have been pushing for Diller to kick all his dating sites to the curb? Was Diller’s love for dating apps blind? Was this a sign of a dating app bubble?

No, no and no, according to Mark Brooks, Internet dating industry consultant and editor of Online Personals Watch, a web-based trade news publication on the industry. He says the POF deal was mostly about timing. IAC first hinted at its Match Group spin-off in June. That was a move analysts and shareholders who have been bullish on dating sites had been clamoring for, even though IAC plans to retain 80 percent of the common stock. Diller and his deputies would still have to face scrutiny, however, says Brooks: “Buying PlentyOfFish took one question off the table: What about the pressure from free sites, from POF? Now the answer is, ‘We bought it.’”

Analysts are eager for the spin-off. Bank of America Merrill Lynch analysts recently valued Tinder alone at as much as $3 billion. Chris Merwin, a senior U.S. Internet analyst at Barclays in New York, commented that IAC had been held back by the group’s search businesses like Ask.com. “Now that there will be a true value for the Match Group in the marketplace, we think IAC will be able to unlock tremendous value.” Brooks, too, feels shareholders are excited that Match Group will now be something “they can touch and feel.”

Skeptical IAC shareholders had been concerned that growth in the dating site category was about to flatten, and that IAC would have a hard time monetizing its existing subscribers. But Sam Yagan, Match Group CEO and co-founder of OkCupid, has begun to address the monetization concerns, most significantly by turning on fees for Tinder, a site with 50 million users globally after only three years in business. All of those users signed up for free.

The company introduced Tinder Plus, a premium service, earlier this year. It unlocks perks for paid users and allows subscribers to undo accidental left or right swipes — rejecting or selecting a potential match — as users are wont to do when rapidly scrolling through profile cards. The company priced the premium service in the U.S. at $19.99 a month for anyone age 30 and older, and $9.99 a month for those 29 and younger, which prompted some users on the older end of its 18–35 target demographic to bolt. This past spring, Tinder also began running interactive ad campaigns for the first time.

Industry experts say it makes sense for IAC to seek to grow its market share, because even if people get tired of Tindering, there’s a good chance that Match Group has another product to sell them. Besides, many people looking for love will maintain profiles in several places at once. “One thing we know is that if we can’t convert someone on one site, we can usually get them on a competing brand,” says Brooks. “There are people who won’t try Match.com, but they will try PlentyOfFish.”

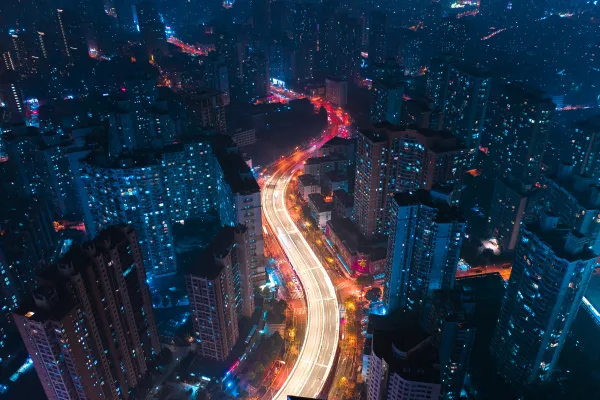

There’s still the problem of growth. Online dating is now a $2 billion industry in the U.S., according to Australian research company IBISWorld, and the market is expected to continue to grow at about 5 percent a year over the next five years, well short of double digits. In 2013 the Pew Research Center found that about 10 percent of adults in the U.S. have sampled a dating web site or app. Victor Anthony, Internet media analyst at Axiom Capital Management in New York, says he’s aware that naysayers don’t believe online dating businesses are sustainable because of the high churn rates, and that some see Tinder as a fleeting fad. Anthony disagrees, however, and argues that there’s still mid- to high-single-digit subscriber growth to be made, with most of that coming overseas, where he expects Match Group to continue its shopping spree.

“Listen, it’s not online search,” he says. “It’s not sexy like social. It’s not one of these top-line businesses, but it’s part of a certain subset that has some attractive traits.” Among its turn-ons: favorable demographic trends, the shift to mobile technology and the fact that it’s a business with a high cash flow and a low capital requirement. “My view is that it’s an attractive industry, and Match essentially owns it,” he says.

Brooks would agree on all counts. Specifically, he believes the real growth is in South America in the near term and Africa in the long term. He also maintains that the domestic industry could find more room to innovate by going deeper with insights into its users’ behaviors. Alternatively, he adds, dating companies could begin looking for new connections in barely related categories. eHarmony, for example, is about to launch a matching site for employers and job seekers.

IAC’s second-quarter earnings beat expectations as Match Group made up for losses in the company’s other divisions. It announced better-than-anticipated results from Tinder Plus and a higher number of users signing up for dating sites overall. The Match Group accounted for roughly one third of total IAC revenue of $771.1 million.

For now, though it’s impossible to know with certainty whether Tinder — and its legions of copycat sites — will turn out to be a midlife crisis kind of fling or a market disrupter with legs. But as we wait to find out, Diller and his wife, fashion designer Diane von Furstenberg, are looking to give New Yorkers a new romantic nexus. They have pledged $113 million toward a futuristic floating park on Manhattan’s Pier 55, located on the Hudson River within blocks of IAC’s gleaming, Frank Gehry–designed headquarters. The site of the proposed park was where survivors from the Titanic were brought ashore. It might soon be used for concerts, movies, exhibitions — and impressing first dates.

Get more on corporations.