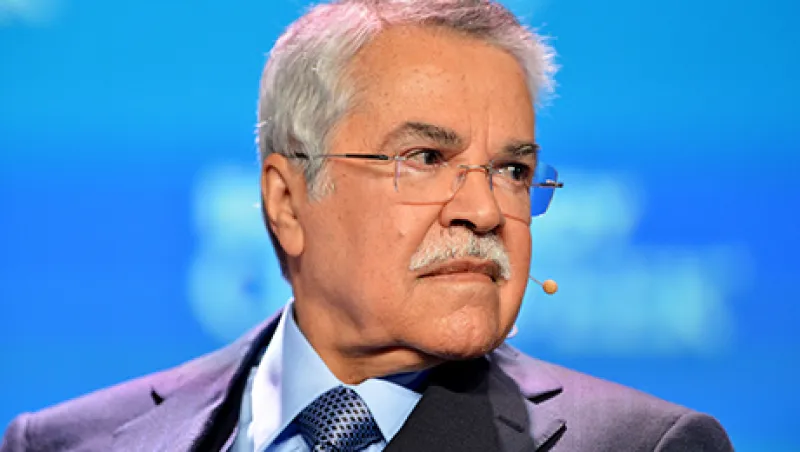

Crude oil futures declined in early trading on Wednesday as a brief rally in reaction to an announcement that production would be capped by Saudi Arabia, Russia and Venezuela last week dissipated. Front-month contracts traded in New York for West Texas Intermediate Crude fell below $31 dollars a barrel. The slip comes after comments by the Iranian Oil Minister that indicated no desire by the newly sanction-free nation to curb production and a public statement by Saudi oil minister Ali al-Naimi that his nation had no plans to lower the previously announced cap. With no accord among the major global producers to take action that might support prices, the potential downside for oil as greater capacity comes online in Iran and Iraq remains a primary concern for energy investors.

Chesapeake sells assets. On Wednesday Oklahoma City-based Chesapeake Energy Corp. announced that it has entered into agreements to sell $700 million in assets prior to a $500 million principal debt payment due in March. The news came amid earnings figures for the fourth quarter of 2015 with the natural-gas producer reporting a net loss of $3.36 per share.

Battle over Supreme Court appointment intensifies. On Tuesday, Republicans on the Senate Judiciary Committee pledged to block hearings or votes for any nominee presented by President Barack Obama to fill the vacancy on the Supreme Court left after the death of Justice Antonin Scalia. If successful, the unprecedented move could leave the highest U.S. court deadlocked.

Kuroda says he is willing to do more. Bank of Japan Governor Haruhiko Kuroda spoke before Japan’s parliament Wednesday pledging to take even more drastic easing measures if deflation persists. The head of Japan’s central bank specifically mentioned financial market volatility as a concern for policymakers.

JPMorgan’s investment banking unit faces grim reality. In a speech before investors at the bank’s annual conference in New York Tuesday, JPMorgan Chase’s investment bank head Daniel Pinto estimated that sales and trading revenues for the firm have dropped by 20 percent so far this year versus comparable pior periods. While some business units, notably mergers-and-acquisitions advisory, have thrived, trading groups have suffered during the global market rout.

Centerview Partners snags top M&A banker. On Tuesday, boutique investment bank Centerview Partners announced that former Goldman Sachs partner Jack Levy has joined the firm. Levy was formerly the co-chairman of Goldman’s global M&A practice.

Portfolio Perspective: PBOC and EIA Likely to Drive Sentiment

Two of the keys for Wednesday’s trading are likely to involve the People’s Bank of China yuan fixing and the release of the Energy Information Agency’s weekly U.S. petroleum inventories. The PBoC surprised the market with an unexpectedly weak yuan fixing Tuesday. But with the G-20 meeting in Shanghai at the end of the week, it seems unlikely the central bank will start a broader risk-off trade via yuan weakness ahead of it. The PBoC has certainly been unpredictable, so anything is possible, but starting a bigger depreciation now would be shocking.

As for U.S. petroleum inventories, EIA will release its weekly figures at 10:30 Wednesday morning New York time. An increase of 3.25 million barrels represents the consensus forecast. While the markets generally focus on non-U.S. production developments and U.S. inventories, the outlook is for steadily declining U.S. output throughout the year. A big issue though is that current inventories are at record levels and most of the drop in U.S. production is not expected until the second half of the year.

At some point the markets will start to place greater emphasis on the outlook for U.S. output cuts but at the moment there are so many other questions marks surrounding global demand that it is now only a secondary focus.

Early indicators on China’s economic activity in February have been weak, and this is obviously not encouraging. The Minxin manufacturing index fell to 37.5 in February from 41.8 in January, while the non-manufacturing component fell to 37.5 from 43. Market News International’s business confidence indicator Monday fell to 49.9 in February from 52.3 in January. And a measure of business activity of small and medium-sized companies online compiled by Baidu dropped to 98.9 in February, signaling “slightly depressed” conditions.

These reports are second-tier in nature but with them in alignment and the better-known official statistics lacking strong credibility, they are certainly not comforting to investors who are already on edge about the global outlook.

Karl Haeling is a vice president at Landesbank Baden-Württemberg in New York.