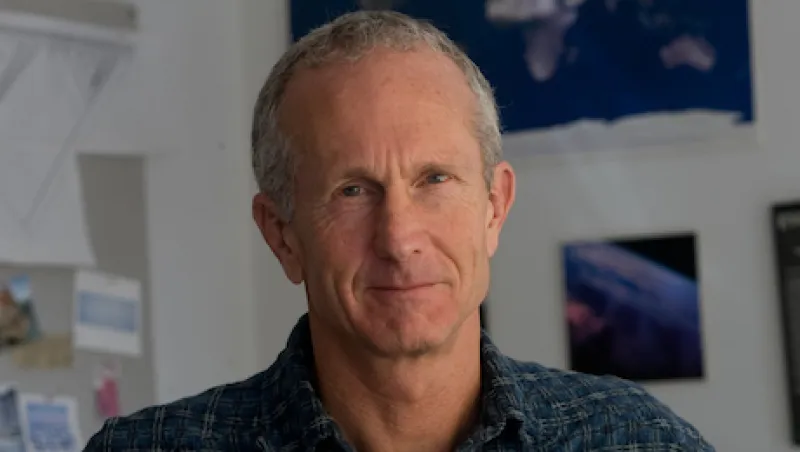

J. Doyne Farmer is making his mark by thinking outside the box as well. Farmer is a professor of mathematics at the University of Oxford and a director of the program on complexity economics at the Institute for New Economic Thinking. Additionally, he is an external professor at the Santa Fe Institute, a private, nonprofit research organization. But Farmer was originally trained as a physicist. In the 1980s he worked at the Los Alamos National Laboratory, home of the Manhattan Project, where scientific luminaries like J. Robert Oppenheimer and Richard Feynman once plied their trade. At Los Alamos Farmer founded the Complex Systems Group in the theoretical division.

In 1991, he co-founded the Prediction Company, a quantitative trading firm about which University of Chicago professor and architect of the Efficient Market Hypothesis Eugene Fama said: “Prediction Company’s chance of success is not zero, but close to it.” The firm would prove Fama wrong, however, and was purchased by Swiss banking giant UBS in 2005.

At the Santa Fe Institute, Farmer is looking for laws in financial markets that can help explain what drives the stability and performance of the banking system.

Over his career Farmer has collaborated with prominent academics such as MIT Sloan School of Management finance professor Andrew Lo — whose Adaptive Markets Hypothesis attempts to reconcile Fama’s hypothesis with the realities of human behavior through the application of evolutionary biology — and Yale University economics professor John Geanakoplos, a noted contributor to the general equilibrium branch of economics.

Currently, Farmer is working on a different method of understanding market behavior: agent-based modeling — simulations of financial market participation by investors.

This work requires gathering and coding an enormous amount of data and creating a library of information of sorts from which to simulate interactions of agents in financial markets. Farmer’s background in dynamical systems theory, time-series prediction and chaos theory coupled with his newer work with complex systems and financial economics has aided him in his effort to simulate and analyze the individual actions of and interactions between agents on a marketwide basis.

Farmer is also the scientific coordinator of CRISIS, a large-scale European Union project to build an agent-based model of the banking system and the real economy.

Institutional Investor Reporter Ben Baris spoke with Farmer about his work and agent-based modeling.

Institutional Investor: You were trained as a physicist. How did you come to study financial markets?

Farmer: The basic principles of how you make a good model are not that different in economics or biology. Time-series forecasting gave me a lot of exposure to real-world problems in a lot of different domains, so it means I know a little about a lot.

What is the problem with the way most economists approach finance?

They are still very closed to any way of thinking about theories for the economy that don’t satisfy the straitjacket of the neoclassical approach. A lot of things need to be brought in from outside economics — ironically, a lot of things from physics. Physics is a very empirical field, where any crazy idea can be proposed, and if it works, it will get respect; whereas in economics, there’s a view that all theories have to come from a certain set of basic postulates. If your theory isn’t about individuals selfishly maximizing their preferences, then its not even considered a theory in economics. I think an awful lot of what happens in the economy doesn’t have anything to do with individuals selfishly maximizing their preferences.

Assuming this is where complex systems come into play, can you explain what they are and how they work?

What we call complex systems — the brain, society, immune system, ecosystems — are composed of many small parts that interact with each other. The key thing that makes a complex system is that it displays emergent behaviors that aren’t obvious from the behaviors of the components themselves. A neuron is maybe in some sense a complex system all by itself, but to really understand how a brain works you have to really understand what happens when you have billions of interacting neurons and have to understand the emergent properties of those interacting neurons.

So similarly, complex systems are relevant in thinking about what the economy does, as an emergent property of the interaction of all the actors.

The second thing about complex systems is that as a discipline, it’s the belief that there are common properties to complex systems that exhibit themselves in very different arenas. So maybe an economist can learn something from listening to a neuroscientist, and I’m not just talking about people who are trying to understand how traders get nervous, but from thinking about the way the brain is self-organized. Maybe that tells us something about the way the economy is self-organized.

But what is there to learn if markets are efficient?

I think “efficient markets” is a subtle question that’s misunderstood by both sides. The way I would put it is that markets are efficient at first order and have to be inefficient at second order, and the idea behind that goes all the way back to [noted University of Chicago economist] Milton Friedman.

Maybe put differently, if there were just slam-dunk investment strategies, everyone would just pile in and they would disappear. And so what happens is there are none. There are strategies that involve thought and processing, skill, intuition, hard work, data gathering, computer processing. It’s not free money beating the market.

The mistake that finance has made is only looking at that first order and almost neglecting the question about who are those investors that are taking advantage of these inefficiencies and how does the nature of that game affect the way markets behave, because a lot of things that markets do have to do with deviations from efficiency.

What then would make a market efficient?

In finance you have to differentiate between informational efficiency — making profits and arbitrage — and allocative efficiency; that is, is the market fair, is it creating as much public welfare as it could? It’s pretty darn inefficient in that regard but fairly efficient in the other. Under general equilibrium theory those two are the same, but that’s under a whole bunch of totally unrealistic assumptions.

Successes are out there, and I think they illustrate this paradox because while firms make a lot of money, they do so typically in a situation where the statistical fluctuations are still significant, or they, in modern times, do something like high frequency trading where they have to put a really big investment and a lot of serious effort into computer infrastructure.

What do you think about the work done by the behavioral finance field?

I completely agree with everything they’ve done in pointing out what’s wrong, but I think they’re stuck in trying to understand how to fix it. The problem is the theories they set out to make are too close to theories that people doing rational expectations make.

A lot of economics is driven by structure rather than strategy. If you want to think about a limit-order book it’s important to think about how the limit-order book is set up and not imagine that you have a rational being that’s interacting with it. The problem is rationality is hard — it’s hard to understand what a rational person would do. On the other hand, if you go look at what people really do, you can make simulation models that simulate the real world. That’s one of the main thrusts of agent-based models — we think agent-based models are the natural partner of behavioralism, and that to make [behavioralism] into a positive theory, the behaviorists need to completely change their approach to building models and take advantage of the freedom that you have once you can encapsulate behavior as a computer algorithm and take a bunch of agents who have different behaviors and just simulate their interaction.