Jim Iuorio, for CME Group

AT A GLANCE

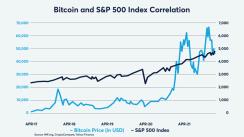

- Although historically uncorrelated to other assets, cryptocurrencies began to have a growing positive correlation with risk assets like stocks during 2021

- Inflation, government spending and the potential for regulation will be in focus for traders looking at the crypto markets in 2022

2021 was an interesting and volatile year for cryptocurrencies as bitcoin finished up 60% and ethereum finished an astonishing 350% higher. But those numbers only tell part of the story.

After putting in highs in November, both currencies have recently traded much lower, with bitcoin down 38% at its worst level and ethereum down 41%. Several catalysts emerged in 2021 that seemed to significantly affect crypto prices, from the IPO of Coinbase in April to the October launch of a bitcoin ETF comprised of CME Group futures contracts. One of the more unexpected developments in 2021, however, was the growing positive correlation between cryptocurrencies and risk assets like stocks.

Historically, one of the prized characteristics of crypto was that it was uncorrelated to other assets. This was viewed as valuable in keeping traders and investors somewhat diversified. Many traders believe that this recent increase in correlation is related to the Federal Reserve’s easy money policies that tended to push up a wide range of assets, including stocks, commodities, NFTs and crypto.

Josh Lim, head of derivatives at Genesis Global Trading, thinks that “as more sophisticated traders from macro trading firms and equity long/short firms continue to look at crypto as a complement to a tech portfolio and trade it like other risk assets, correlations should creep even higher in 2022.”

Tim McCourt, managing director of equity products and alternative investments at CME Group, believes that broader adoption in the crypto space has provided some validity. “The advent of Micro Bitcoin and Micro Ether contracts, alongside the regular size contracts, have helped both institutional and individual participation to continue to grow.” It’s a trend that accelerated into the end of 2021 at CME Group.

McCourt also believes that the launch of the futures-based ETF was a major factor in validating the space, noting that CME futures are at the center of price discovery and enable market participants to do what they do best. That means structuring products like ETFs using futures, validating the interrelatedness and the growth versus growth nature of the crypto ecosystem. “It’s great for the futures and it’s great for the market in general,” McCourt said.

The macroeconomic story of 2021 was a story of Fed easy money, coupled with talks of enormous government spending packages to counterbalance the negative effects of pandemic policy. The belief was that this was the perfect environment for cryptocurrencies if they truly were an inflation hedge.

This story appears to be changing dramatically in 2022. Talks of the Federal Reserve pivoting to a tighter monetary policy to combat inflation have pushed risk assets and cryptocurrencies lower over the last few weeks. Although Lim won’t go as far as to say that this would continue to force cryptocurrencies lower, he does admit that “2022 will see a lot more attention from crypto traders that hadn’t really thought about the Fed before on what their inflation policy is going to look like going forward.”

Of course, there are many unknowns ahead of us in 2022, ranging from pandemic headlines to potential for policy responses that could affect cryptocurrencies positively or negatively. As McCourt said, “We are excited to see what happens in 2022 as the question has evolved for investors and other participants from ‘should I be involved in crypto’ to ‘how much should I be involved in crypto.’”

Watch our full OpenMarkets Roundtable discussion on cryptocurrencies above. Watch other episodes here.