As assets in fixed-income exchange-traded funds have ballooned in recent years, critics have argued that a liquidity mismatch in these products could exacerbate the next downturn — particularly when it comes to ETFs that invest in bank loans.

But in a new paper to be released next week, asset manager Invesco lays out a counter argument, saying that bank loans aren’t as illiquid as many people think.

The fear over liquidity in credit-focused ETFs arises from the fact that investors can sell their ETFs, which trade on exchanges, at any time, but the underlying securities in the products change hands in over-the-counter markets that aren’t nearly as efficient. What’s more, credit markets have become increasingly illiquid since the financial crisis, as the big banks have stepped back from market making.

[II Deep Dive: The Big Risk Lurking in ETF Markets]

To be sure, Invesco has reason to argue that such loans aren’t problematic: It runs the $5 billion Invesco Senior Loan ETF. Invesco uses the senior loan ETF as its case study in the paper.

ETFs of bank loans, which are privately arranged, senior secured debt instruments typically made to below investment grade companies, have been the focus of much of the criticism. In part that’s because the securities trade over the counter, the deals are private, and trades aren’t reported to TRACE, a reporting system that provides some public information on corporate bonds.

“A common misconception in the bank loan space that arises as a result of the OTC nature of the market is that bank loans are illiquid,” wrote the report’s authors. Using information from the Loan Syndications & Trading Association (LTSA), the authors contend that these loans aren’t as illiquid as many argue.

For starters, the secondary market is active and growing. According to LSTA, the volume of bank loan trades hit a high last year of $720 billion. Trading volume has grown by more than 7 percent annually over the past three years.

Invesco also pointed out that bank loans trade more frequently — a measure of liquidity — than do corporate bonds. On average, 47 percent of bank loans changed hands 20 or more times each month of 2018 — or one per business day.

While liquidity issues with the bank loan markets in general are overblown, according to Invesco, the asset manager also has a number of additional protections in place. Its ETF product tracks only the 100 largest bank loans, with no single security representing more than 2 percent of the index. As a result, the ETF holds a subgroup of securities that are easier to trade than the broader market.

In addition the ETF’s index includes loans that trade at a narrower bid-ask spread, meaning they’re higher quality than the markets as a whole. In 2018, 91 percent of the loans in the index the ETF tracks traded at least once per day, compared with the 47 percent figure for the broader market.

To protect investors in the ETF, Invesco also holds some high-yield bonds and cash as an extra guard against liquidity problems. Since the product was started in March 2011, cash has ranged between 5 and 8 percent of its assets.

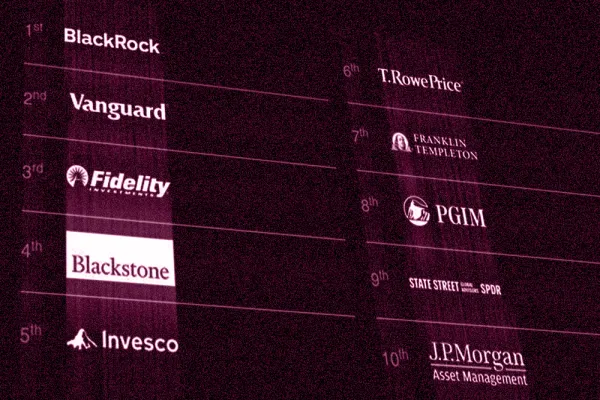

Asset managers, including BlackRock, have argued over the years that credit ETFs add liquidity to the market as investors can readily sell to available buyers before the asset manager has to sell in underlying markets.

“Even with significant upside or downside market moves, we still see a healthy mix of buyers and sellers matching off on exchange or in the secondary market,” the Invesco report stated. Eighty-one percent of the volume traded in Invesco’s bank loan ETF does not result in a creation or redemption of ETF shares.

The end of last year was a test case. From October to January, the ETF lost 30 percent of its assets. But, the authors wrote, “there was still an incremental layer of liquidity over the underlying bank loan market with 76 percent of the volume traded on exchange in [the ETF] being natural buyers and sellers matching off without a bank loan being sold in the underlying market.”

Still, there are plenty of concerns. Moody’s Investors Service recently issued a report on the risks of credit ETFs, focusing on the downside of funds investing in instruments that become hard to sell in times of market stress.

“Unexpected market liquidity shortfalls could be most pronounced within ETFs tracking inherently illiquid markets, such as high-yield credit,” stated the report, published last month. “These ETF-specific risks, when coupled with an exogenous systemwide shock, could in turn amplify systemic risk.”