When Julian Robertson Jr.’s legendary hedge fund, Tiger Management, shut down in 2000, one of its analysts, Chase Coleman, got a slug of cash from his mentor to start his own firm, Tiger Global Management.

That turned out to be arguably one of the best investments Robertson ever made.

Last year Coleman’s firm’s long-short fund, Tiger Global Investments, posted a 13.6 percent net gain. Its long-only fund, Tiger Global Long Opportunities, rose 3.4 percent despite suffering a 12.7 percent loss in the fourth quarter, according to the firm’s fourth-quarter letter, which was obtained by Institutional Investor.

That performance, in a year when most global equity markets lost money, helped cement Tiger Global’s status as not only as one of the most successful of the firms run by the so-called Tiger Cubs — those managers who previously worked at Tiger Management — but as one of the premier hedge fund firms of its generation.

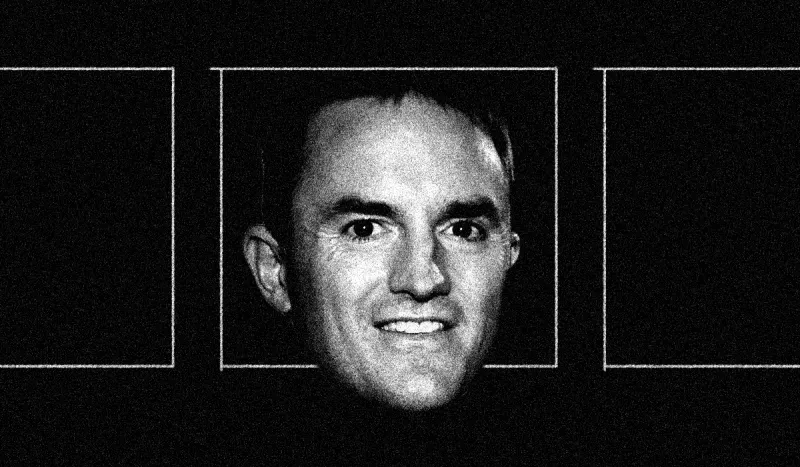

It also landed Coleman another appearance — his eighth — on Institutional Investor’s annual Rich List ranking of the highest-earning hedge fund managers. Coleman earned $465 million last year.

This is one of a series of sneak peeks at the 18th annual Rich List. The full list will be published at the end of April.

Coleman, a 43-year-old billionaire who grew up in the tony North Shore Long Island community of Locust Valley, where he was friends with Robertson’s son Spencer, has appeared on the Rich List in seven of the past eight years.

Scott Shleifer, who plays a prominent role running the public funds, earned $250 million last year, securing him a spot on this year’s Rich List as well. This is the second straight year the 41-year-old has qualified.

Tiger Global mostly lives and dies with internet, technology, telecommunications, and media stocks. And in recent years it has been taking a more concentrated bet on these sectors.

Last year the long-short fund made all of its money from short positions and private investments, according to the firm. The short book generated a 12 percent gross gain for the year, virtually all of it coming in the fourth quarter, when the equity markets crumbled, as the letter to clients points out.

On the short side, three sectors largely drove 2018 gains: offline retail, industrials, and technology companies, a group that included several component makers that the portfolio managers believed “were over-earning on a short-term basis,” the letter notes.

“We also generated good returns from short positions in frauds as well as certain secularly challenged businesses with declining earnings,” Tiger Global adds in the letter, noting that the firm delivered “strong performance” shorting retail stocks.

On the private side, the long-short and long-only funds were mostly driven by gains from Indian

e-commerce company Flipkart and e-cigarette maker JUUL, according to the letter.

The two funds invested in JUUL in July 2018. In December tobacco giant Altria bought 35 percent of JUUL at a $38 billion valuation, Tiger Global says. “We received our pro rata share of the transaction proceeds shortly thereafter,” according to the letter.

Tiger Global also says it benefited back in August when Walmart bought a majority stake in Flipkart at a $22 billion valuation.

Meanwhile, in March Tiger Global announced that private equity head Lee Fixel will leave the alternative-investment firm after 13 years. Shleifer will take over as the global head of private equity, and he and Coleman will serve as co–portfolio managers of the private equity business.

Tiger Global manages a total of $26 billion in capital, including its venture capital funds, hedge funds, and long-only fund, according to a person familiar with the firm. (The Rich List does not include earnings derived from the venture capital business.)

In October, Tiger Global’s venture capital operation raised $3.75 billion for Private Investment Partners (PIP) XI, its 11th venture capital fund. The hedge funds and long-only funds also allocate small portions of their equity to private companies as part of their strategies.

Coleman, a star lacrosse player in high school and college, joined Tiger Management as a technology analyst in 1997 after graduating from Williams College with a BA in economics and Spanish.

After Robertson shut down his hedge fund firm, he seeded a handful of individuals, including Coleman, who launched what was then called Tiger Technology Management; the name was changed to Tiger Global Management in 2005. Shleifer joined Tiger Global in 2002 after having worked in private equity at the Blackstone Group.

Already this year the Tiger Global duo are strong contenders to top next year’s Rich List. Their long-short fund posted a 2.7 percent gain in March and is now up nearly 20 percent for the year.

Two high-profile long positions are leading the gains: Amazon.com’s shares have gained more than 18 percent this year, and Microsoft’s have climbed more than 16 percent.

Apparently, Tiger Global was not hurt by its short positions despite the stock market’s double-digit surge in the first quarter. As it turns out, entering 2019 Tiger Global told clients its short exposure was “considerably lower,” in part thanks to the strong performance of its short positions last year as those stocks declined in value, and to reducing positions that became less attractive “as risks/rewards changed.”

“Absent a macroeconomic calamity, our models have been yielding superior prospective returns for many of our longs relative to our shorts,” Tiger Global tells clients in the letter.