The size of the outstanding BBB-rated corporate debt has exploded in recent years, nearly quadrupling since the 2000s (see below). The dramatic increase in BBB debt results from a few primary market drivers: low borrowing rates; cost of capital models guided companies to take advantage of relatively immaterial incremental punitive costs of BBB versus A-rated debt; growth in the overall size and scale of companies through M&A activity; and increased investor demand for yield.

Weakening credit fundamentals: While the investment grade credit market has been growing, aggregate credit fundamentals have been weakening (see below). According to Morgan Stanley, debt-to-EBITDA, a measure of corporate leverage, has been trending upwards since 2012 while the interest coverage ratio for investment grade companies has declined since 2014. “A noticeable increase in the leverage ratio and decrease in interest coverage implies that companies have not only regained comfort taking on debt, but are becoming increasingly aggressive,” says Gary Creed, Chief Credit Strategist at Aegon Asset Management. “Meanwhile, the cash-to-debt ratio has been deteriorating since 2012 as U.S. tax law changes have enabled companies with cash overseas to repatriate it in a more cost-efficient manner. This cash, which had previously been buoying net debt ratios, is in part being used for shareholder friendly activity as opposed to debt reduction.”

A booming BBB market has investors asking two key questions.

Question 1: Will these companies be able to maintain investment-grade status? Aegon’s baseline view is credit will continue to benefit from a steadily growing economy in the U.S. over the near-to-intermediate term. The current favorable economic backdrop continues to be supportive of growing revenue, cash flow and earnings for corporate issuers. While, companies have added leverage to fund growth through organic and M&A activity, rating agencies are giving companies the latitude to operate with weaker-than-normal credit profiles for their given ratings.

“Longer term, we believe we will see downgrades consistent with past economic cycles,” says Creed. “We are watching a number of catalysts that could spur the next downgrade wave. In our view, the most likely triggers include: a traditional business cycle slowdown materializing sooner than anticipated, a Fed policy mistake such as raising rates too far too fast, unintended consequences of tariff negotiations, or idiosyncratic credit stress in international markets spreading to developed markets.”

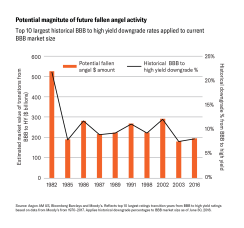

When the cycle turns, Aegon expects that downgrade activity from investment grade to high yield – commonly referred to as fallen angels – will likely be consistent with past downturns in percentage terms. However, given the size of the current BBB market, the dollar volume is likely to outpace prior cycles.

To assess the potential size of the next fallen angel wave, Aegon applied Moody’s historical rating migration percentages to the current BBB market value of $2.4 trillion as of Q2 2018. “Focusing on the years with the largest percentage of downgrades from BBB to high yield status, we can estimate transitions from BBB to high yield based on some of the worst downgrade years since 1970,” says Creed. “Assuming an average rate of 11% for the ten worst downgrade years, the next downgrade wave could exceed $250 billion if the severity mirrors prior years.”

Question 2: What will be the impact on the credit markets as BBB-rated companies transition to high yield? “A weakening credit environment is likely to increase the risk premium required by investors to hold investment grade bonds as they begin to price in the risk of downgrades,” Creed says. “And the transition from investment grade to high yield may cause dislocation in the high yield market. Given the current size and scale of BBB bonds, the high-yield market may have increased difficulty absorbing the rising number of fallen angels.”

Continuing with the earlier example, $250 billion of migration in a year is roughly equivalent to 20% of the aggregate high-yield market and approximately equal to the average annual gross high yield issuance over the past 10 years through August 2018. Contrary to most new high-yield issuance, downgrades typically aren’t price sensitive – they happen regardless of market conditions or investor demand and prices adjust to facilitate the needed transitions. Furthermore, fallen angels tend to rise when the high yield market is also facing fundamental pressures from weakening credit conditions. When considering this, and overlaying the scale of downgrades in the high-yield market example, it’s possible to see why it is likely that the rise in fallen angel activity could have a meaningful impact on high yield spreads.

Market liquidity and other concerns: Another potential concern relates to how changes in market liquidity could impact the transition from investment grade to high yield. Financial industry regulation following the 2008 crisis has decreased the capacity of dealers to hold proprietary positions resulting in smaller dealer inventories. “Much of the trading now involves a pass-through from buyer to seller without dealers taking positions into inventory. Such large dislocations could create greater price movement than observed in prior periods of stress as traders work to clear the market without dealer inventory serving as a buffer,” says Creed.

Additional challenges for high yield managers that can arise during periods of increased rating migration may include: managing issuer concentrations limits caused by the size of some investment grade issuers, increased interest rate risk given the longer duration of many BBB bonds, and reduced covenant packages relative to traditional high yield issuance. From an investment grade manager perspective, the urgency with which they want, or need, to address the downgrade is also a major contributor. The more discretion a manager has in addressing the downgrades can provide them an opportunity to avoid a forced sale of assets.

Despite concerns, Aegon remains constructive on credit fundamentals: In the near-to-intermediate term, Aegon believes the potential downgrade risks are manageable and unlikely to manifest into a broader credit issue without a risk-off market event. “We continue to closely monitor credit markets for signs of stress,” says Creed. “While we have become increasingly more cautious on credit throughout the year, this is primarily a result of valuation and concern over whether we are getting paid for increasing risks as the cycle matures. We continue to favor a modest overweight to corporate credit with an increasingly balanced view between investment grade and high-yield overweights. Barring a market shock, the BBB market growth and potential for an increase in fallen angels is a concern that bears watching, but in our view, it is not an imminent risk to credit investors.”

Creed acknowledges that there will eventually be a downturn in the credit markets as the business cycle turns. “The extreme growth in BBB corporate credit market, coupled with aggressive borrowing practices, is likely to give way to the next wave of fallen angels. While the timing of such an event is hard to predict there will ultimately be consequences for credit markets. Even so, a rise in fallen angel activity also provides opportunities for active investment managers that are able to effectively manage client portfolios and navigate the crossover credit market as assets transition between investment grade and high yield markets.”

To gain more insights, go here.

Past performance is not indicative of future results.

This material is to be used for institutional investors and not for any other purpose.

This communication is being provided for informational purposes in connection with the marketing and advertising of products and services. This material contains current opinions of the manager and such opinions are subject to change without notice. Aegon AM US is under no obligation, expressed or implied, to update the material contained herein. This material contains general information only on investment matters; it should not be considered a comprehensive statement on any matter and should not be relied upon as such. If there is any conflict between the enclosed information and Aegon AM US’ ADV, the Form ADV controls. The information contained does not take into account any investor's investment objectives, particular needs, or financial situation. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to you. The value of any investment may fluctuate. Investors should consult their investment professional prior to making an investment decision. Aegon AM is not undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

The information presented is for illustrative purposes only. Individual accounts may vary based on restrictions, substitutions, cash flows and other factors.

Specific sectors mentioned do not represent all sectors in which Aegon AM US seeks investments. It should not be assumed that investments of securities in these sectors were or will be pro table.

Aegon AM US may trade for its own proprietary accounts or other client accounts in a manner inconsistent with this report, depending upon the short-term trading strategy, guidelines for a particular client, and other variables.

Results for certain charts and graphs are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions.

There is no guarantee these investment or portfolio strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest over the long-term, especially during periods of increased market volatility.

This document contains "forward-looking statements" which are based on change to the firm's beliefs, as well as on a number of assumptions concerning future events based on information currently available. These statements involve certain risks, uncertainties and assumptions which are di cult to predict. Consequently, such statements cannot be guarantees of future performance and actual outcomes and returns may differ materially from statements set forth herein. In addition, this material contains information regarding market outlook, rates of return, market indicators and other statistical information that is not intended and should not be considered an indication of the results of any Aegon AM US-managed portfolio.

Aegon Asset Management US is a US-based SEC registered investment adviser and is also registered as a Commodity Trading Advisor (CTA) with the Commodity Futures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon Asset Management US is part of Aegon Asset Management, the global investment management brand of the Aegon Group.

Recipient shall not distribute, publish, sell, license or otherwise create derivative works using any of the content of this report without the prior written consent of Aegon Asset Management US, 4333 Edgewood Rd NE, Cedar Rapids, IA 52499.

©2018 Aegon Asset Management US