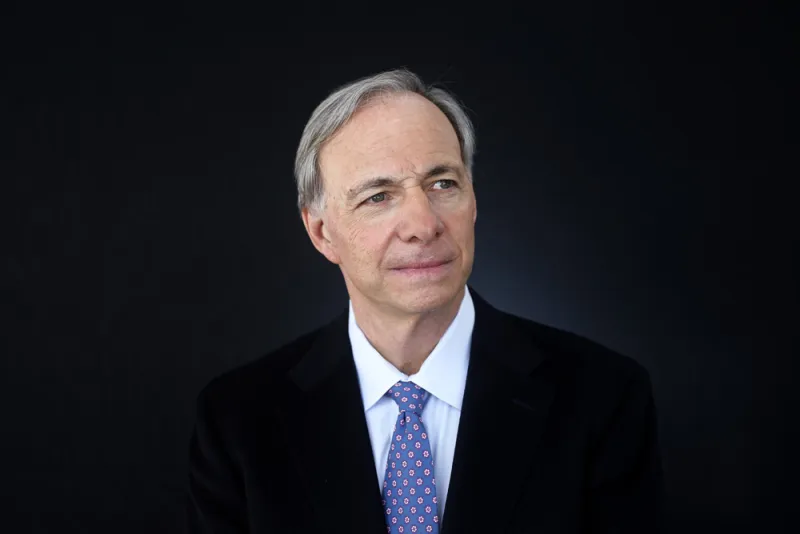

The market cycle is shifting — and so is the hedge fund industry, according to a trio of hedge fund industry power players including Bridgewater Associates’ Ray Dalio.

In a wide-ranging panel discussion at the inaugural Greenwich Economic Forum, held at the Delamar Hotel in Greenwich, Connecticut, Dalio cited a number of concerns that are looming over the economy, including geopolitical tensions, the rise of populism, and where he thinks we are in the economic cycle.

Dalio wouldn’t say whether a downturn is imminent — “nobody is ever sure of the exact moment” when cycles turn, he said — but he reiterated several themes that he has cited as concerns over the past few months.

“What concerns me is… we’re in the later stages of a longer-term debt cycle,” said Dalio. “Everyone is leveraged long. By lowering interest rates, you push asset prices up — so if you have a downturn, there’s not as much ability for that to be dealt with effectively with monetary policy. That also has made risks asymmetric.”

But there's one area he is positive about: China. Bridgewater was granted a license earlier this year to sell investment products there.

“China’s been tremendously successful and continues to be in many different ways,” said Dalio. “The new China has an energy to them. In terms of entrepreneurship and energy, it’s a very exciting place. I’m excited about China — I can’t understand how anybody couldn’t be excited about China.”

[II Deep Dive: Two Sigma Launches China-Focused Fund]

Afsaneh Beschloss, founder chief executive officer of hedge fund investment firm Rock Creek Group, said equity market sentiment is beginning to turn. She noted that one area of GDP growth that has been left behind is wages — and that will change.

“Over the next 12 months, interest rates are still going up, this year and next,” said Beschloss. “Wages also will be changing; we have had unprecedented wage stagnation. Those two things will potentially lead to a stagflation scenario later in the cycle.”

Dmitry Balyasny, founder of hedge fund firm Balyasny Asset Management, also observed the beginnings of a shift in the current market cycle. He noted that, as a firm that specializes in fundamental equity, Balyasny is privy to a lot of bottom-up market information from thousands of conversations with companies the firm covers.

“Over the last earnings period you can hear the tone kind of changing,” he said. “There is a lot more caution than there was before.”

Balyasny said part of that is down to several classic late-cycle traits in effect today: rising interest rates, more difficult comparisons for companies, and rising leverage on corporate balance sheets over the past ten years. Trade tariffs are adding a layer of confusion, he said, which is beginning to affect corporate confidence.

“It’s starting to bleed into less [capital expenditure], as opposed to a year ago, when we thought you were going to get a lot of capex,” said Balyasny. “That’s what markets are struggling with layered in with higher rates.”

The panelists had similarly cautious outlooks on the hedge fund industry. For his part Dalio — who cautioned against looking at hedge fund performance in aggregate— said the next downturn will identify which funds add value.

“I think alpha is zero sum,” said Dalio. “The real question will be how much diversification exists in other portfolios when you have a bear market. There’s a lot of long beta built into a lot of hedge funds, and the important thing is to differentiate one from the other. If you keep looking at the averages, and those funds continue to have beta, they are going to be not much use in a bear market.”

Balyasny added that a bullish environment and rising prices across various asset classes over the past ten years has masked “a lot of performance issues,” adding that “most investments have a bullish bias to them.”

He predicted that, as more entrants compete with one another to squeeze excess returns out of the market, the industry trend of consolidation will continue. But he expects that a more fruitful investment environment for hedge funds will result.

Beschloss pointed out that the hedge fund industry has evolved and grown with the onslaught of institutional assets — now managing some $3 trillion — but that, like everything else, it is cyclical in nature. She expects a return to its earlier days, with smaller funds in which the founders constitute a larger proportion of assets, and more long-standing funds converting to family offices.

Dalio took a dim view of the rise of algorithmic trading strategies, saying that, if poorly implemented, they pose a great deal of risk.

“I think algorithmic decision-making can be very negative if there’s not understanding,” he said. “If you don’t a have deep understanding that the future is different from the past, that’s a formula for disaster. Algorithmic decision-making and machine learning is a tremendously powerful tool if used well and I think it’s a very dangerous tool if you’re careless with it — and I think nowadays a lot of people are careless with it.”