| |

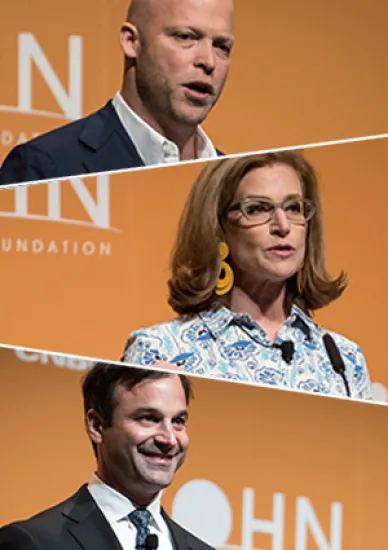

| The 22nd Annual Sohn Investment Conference. Left to right: Keith Meister; Debra Fine; Josh Resnick (Photo Credit: Kholood Eid/Bloomberg). |

So, after sitting through the Sohn Investment Conference this year, I am a little concerned. Investors seemed mostly upbeat and were eager to trot out their favorite bullish ideas. Of course, that’s what this conference is all about — with the noble goal of raising money to fight pediatric cancer and other childhood diseases.

Except last year most of the presenters were bearish or cautionary. And what happened? The markets finished the year strongly.

This time we are now in the ninth year of the bull market — although just four months for the new presidential administration. And just one person expressed some sort of macro fear, and it wasn’t a hedge fund manager. Kevin Warsh, who served on the board of governors of the Federal Reserve System during both the Bush and Obama administrations and is now a lecturer at the Sanford Graduate School of Business, wondered whether the central bank is prepared and has any bullets left to fight the next economic slowdown.

Otherwise, hedge fund luminaries — none of whom incidentally will have qualified for the Rich List this year when it is published shortly — mostly trotted out their favorite long positions. Yes, several hedgies talked up short bets, while one offered a hedge. Jeffrey Gundlach of DoubleLine Capital thinks the Standard & Poor’s 500 stock index’s outperformance of emerging markets is over and recommended going long the iShares MSCI Emerging Markets, an exchange-traded fund that bets on emerging markets stocks, and simultaneously shorting SPY, the most popular S&P 500 ETF.

Davide Serra, founder of London-based Algebris Investments, recommended shorting British government paper, while two other investors recommended shorts of specific equities. Otherwise, we mostly heard longs on a day that was filled with interesting ideas.

Here is a sample of a few.

___

The most shocking short recommendation came late in the day after the market had already closed, when Josh Resnick, the founder of Jericho Capital Asset Management, recommended shorting Frontier Communications, noting the telecom company’s stock is down 50 percent but has “100 percent more to go from here.” Translation: It is going bankrupt.

He has been short the stock for five years, the longest-standing short in his career. Resnick expects the company, which recently slashed its dividend by 62 percent, to eliminate it altogether. He also thinks that later in the year it will be in breach of the covenants of some loans. He also pointed out that the company gets 32 percent of revenue from traditional phone lines, a dying business. After marshaling additional negative facts and playing videos of unhappy customers, he had many of us convinced.

___

Resnick’s presentation was the mirror image of the presentation of Corvex Management’s Keith Meister. Earlier in the day the activist talked up the shares of another telecom company, CenturyLink. The over-riding reason: It is in the process of acquiring Level 3 Communications for about $34 billion. He asserts consolidation is very profitable in the telecom business, because the bigger company benefits from more traffic and greater scale.

CenturyLink also has a 9.2 percent yield, the highest in the S&P 500, which he felt was not safe before the deal but is now. “The Level 3 merger was game changing,” Meister said. “It secures the dividend,” he added, among other factors. Meister did reference Frontier’s dividend cut, but otherwise didn’t seem to have a play on it.

___

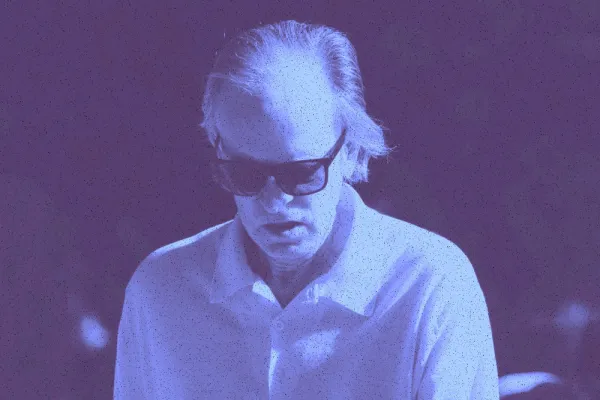

David Einhorn, the sometime-activist whose Greenlight Capital has been suffering this year, in part from short bets against stocks in its famous “bubble basket” — such as Amazon.com and Tesla Motors — as well as his recent disclosed short in Caterpillar, went public with his short on Core Laboratories. He called the stock “way overvalued” and made the case for the stock to drop to $62. It had closed on Friday at $113.43, before dropping 2.4 percent Monday on Einhorn’s presentation.

Einhorn asserts investors and Wall Street’s sell-side analysts mistakenly think it is a secular growth company rather than a cyclical oil services company. “It was in the right place at the right time in the last cycle, but not this time,” the hedge fund manager insists. He says the company does not heavily benefit from a boom in the shale business. Einhorn also mocked the company for asserting it is in the middle of a V-shaped recovery.

___

The most interesting, niche long play was presented by Debra Fine of Fine Capital Partners, conspicuously the only woman to present at the main program, which led to her opening line that she didn’t want to be seen as the “token Jew” at the event. Her comic timing was pretty good.

In any case, she talked up DHX Media, a little-known Canadian company traded on the Toronto Exchange. The stock was selling for C$5.50, and she thinks it is worth closer to $20 or more. The company owns some old children’s television programming and toy names, like Teletubbies, Degrassi, and Inspector Gadget, to name a few.

The company basically arbitrages the assets, buying them at what they used to be worth and then monetizing the assets with much better merchandising and video deals. Fine stresses that unlike adults, children can watch the same show over and over and over. “The value of children’s content does not devalue after first showing,” she adds. It is also cheaper to produce and more globally transferable. Meanwhile, new buyers like Netflix and Amazon are driving demand. Who knew?