For Republicans, this appears to be a ‘do or die’ moment, politically speaking.

Regardless of what Wall Street dislikes about the proposed legislation, or finds impractical or sees as grandstanding, there’s an end game now in sight. For the GOP, sucking it up and conceding yet another Obama victory could be the better alternative than trying to kill the bill outright.

The latter strategy — killing the bill, not allowing Obama another victory — had in recent weeks been Plan A. Plan A required denying Chris Dodd even a single Republican vote in the Senate. It has been attempted. And it has backfired.

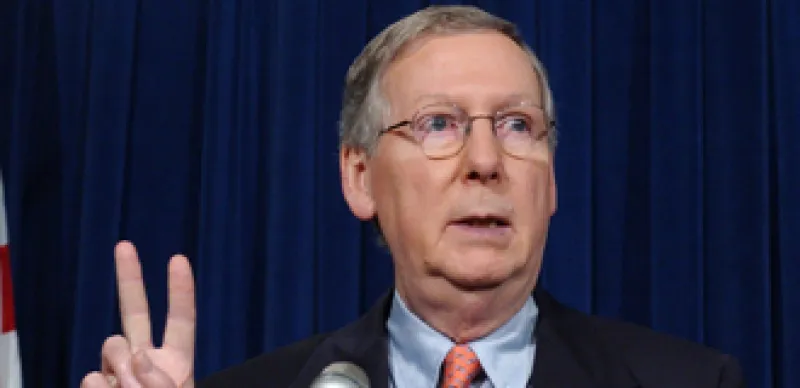

The trouble began with Senate Minority Leader Mitch McConnell and his over reliance on the Frank Luntz’s talking points memo (endlessly repeating the line about endless bailouts) not to mention McConnell’s unseemly fundraising meeting with hedge fund managers at the Peninsula Hotel earlier this month, a story that ironically was reported exclusively by Fox Business Network before being bandied about on Capitol Hill, finally even winnowing its way into President Obama’s radio address Saturday.

The news of the SEC fraud charges against Goldman Sachs also undermined the GOP’s push to kill reform.

While neither the White House nor the regulatory agency would ever admit to the Goldman fraud charge announcement being timed to coincide with the thick of financial reform debate, there’s clearly a leap of logic to be made here, and it would seem illogical not to make it.

CROWLEY: Okay, so what the president is saying is you met with Wall Street leaders, with [Sen. John Cornyn, R-Texas] the man who raises money for Republican Senate races, and talked about how to block this bill. Did the meeting take place? What was the conversation?

MCCONNELL: Well, we certainly didn’t talk about blocking the bill. I don’t know anybody who’s in favor of blocking this bill. I also met recently with the Kentucky bankers who are also opposed to this bill. The community banks, the little guys on Main street. We’re all meeting with a lot of people. This is the current subject.

On Tuesday, McConnell held a snap press conference.

MCCONNELL: Well, good afternoon, everyone. With regard to financial regulation, it’s pretty clear now ... and the majority leader has indicated to me that serious discussions have resumed. I think the [letter] last week indicating that Republicans wanted to see serious negotiation to occur rather than just political sparring has worked, at least for the short term. And we’re hopeful that Democrats and Republicans on the Banking Committee plus those involved on the Agriculture Committee on the derivatives piece can come together and give us a bipartisan, but truly bipartisan bill that we can move across the floor of the Senate. But at least the process to achieve that has now been reconstituted, if you will. And so we have an opportunity here to do something that was not done in the House of Representatives, where they produced a bill that had no Republican support whatsoever.

With those words, seemingly, Plan A, kill the bill, went by the wayside.

A Senate staffer close to the process, and who asked not to be named, helped explain how McConnell went from trying to kill the bill to a new stance, possibly working to help pass it:

“The Republicans, mainly Sen. [Richard] Shelby[, R-Ala.] and McConnell had two options. The first was to do everything they could to deny Obama another victory. The fallback was to have a bill that had one single Republican name on it, Shelby’s, so that it would be known for posterity as the Dodd-Shelby bill. To kill it they needed all 41 Republican Senators to oppose it. But there are at least a few Republicans [such as Olympia Snowe of Maine] who came forward and said they would be willing to vote for it. Even one single Republican vote in the Senate means it could go to debate.”

So while Plan A was to kill the bill and Plan B was to have Shelby be that one Republican, so he could get credit, there is now nothing set in stone that says the entire process could, suddenly, go to Plan C and gain bipartisan support. GOP Senators will be loathe to be painted in mid-term elections as having sided with Wall Street.

No wonder the Democrats are feeling emboldened.

When Sen. Blanche Lincoln, chairwoman of the Agriculture Committee, came out (on the same day the SEC announced its case against Goldman) with a bill proposing all OTC derivatives should be traded publicly on exchanges it seemed almost as over the top as allowing a short seller to secretly booby trap a CDO deal, but now even Lincoln’s aggressive measure appears firmly on the table.

The Democratic Senate staffer source:

“A month ago, the Wall Street lobbyists were dead set against the measure to have standardized derivatives contracts and centralized clearing. But just recently they have conceded that they are going to lose that fight. This is a big deal. There is perhaps no bigger issue right now then how to regulate derivatives.”

On Goldman’s conference call Tuesday morning, CFO David Viniar said that Goldman supports standardization of derivatives and centralized clearing.

“It makes the derivatives market safer, it makes us more competitive,” he said.

With that simple sentence, Wall Street — so protective of OTC derivatives, a market it owns and off which it makes mountains of money — appeared to signal the towel was being thrown in on an issue that even a month ago was worth waging a lobbying war that cost millions.

Will OTC derivatives end up on exchanges? Standardized contracts and centralized clearing is one thing, but total surrender of the market to the likes of the CME or ICE, is another. This is the fight now, one that will make the battle over where a consumer protection agency would be housed seem like late 90s verbal sparring between the two Corys, all due respect to the late Cory Haim.

Now there are reports that even the Volcker rule is back on the table.

The GOP can stand with Wall Street and fight, but standing with Wall Street could cost them in the mid-term elections. Plan A, killing financial reform at all costs, seems like it is being scrapped lest it kills the GOP. Time will tell what the new plan is, but Wall Street reform is taking shape.

Get ready for the home stretch.