“You get what you pay for” has for years been uttered in support of the rich compensation of alternative-investment managers. One is as likely to hear it from an asset allocator as from a hedge fund partner or private equity consultant. But evidence is mixed, at best, that higher fees correlate with higher net returns.

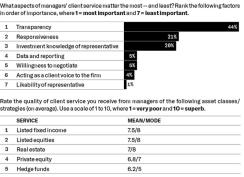

Worse yet, in another key area of manager performance — client service — data back the reverse: The more you pay, the less you get. Traditional fixed income and equities tied for first among five broad asset classes in a survey by Institutional Investor Network, an allocator-only network known as IIN. Worldwide, 250 IIN members opened up about the non-investment side of their manager relationships. They rated long-only stock and bond firms a 7.5 out of 10 on average, citing Pacific Investment Management Co., Wellington Management Co., and BlackRock as top servicers, while handing lower grades to alternative-asset managers.

For hedge funds, the last-place results weren’t pretty. The category earned an average 6.2 out of 10 for quality of client service, and the most frequent score allocators gave was a 5. Institutional investors answered the poll in fall 2016, well into hedge funds’ years-long weak streak relative to U.S. equities markets. Active long-only managers have likewise underperformed, but their top marks for client service suggest returns do not color all other aspects of the investor experience. Private equity offered further evidence of this point. The asset class came second-to-last for service, scoring 6.8 on average, even as it’s been a standout investment for most portfolios in recent years.

Transparency (or lack thereof) helps explain alternative managers’ poor showing, according to investors’ reporting of what matters to them. Nearly half, or 44 percent, of respondents called transparency the most important service factor, ahead of responsiveness at 21 percent, representatives’ investment knowledge at 20 percent, and willingness to negotiate at 5 percent. Yet willingness to open up the black box for investors is only step one, says consultant Eugene Podkaminer, a senior vice president and risk-factor specialist at Callan Associates. For, say, a quantitative hedge fund, the struggle of explaining what’s in that box can be acute.

“As strategies get more technical and geeky, the client service person still has to be able to go a couple of layers deep with the client before calling in a portfolio manager,” Podkaminer says. “On the other hand, knowing what you don’t know is really important. The very good client service professionals know when to say they don’t have the answers, and bring in somebody who does.”

As quant firms proliferate and mature, there aren’t enough of these left-right balanced brains to go around, according to Podkaminer, who says, “It’s rare to find both technical and emotional intelligence in the same person.” Only two hedge fund firms got more than one vote for best-in-class client service — Bridgewater Associates and AQR Capital Management — and both run highly technical strategies. (“None” was also a popular response.) Investors often mention these firms in the same breath as PIMCO as managers positively differentiated by their client service. That sends a message to underperforming hedge funds: It can be done. It’s a wide-open opportunity to gain an edge over your competitors.

The first step, though, is recognizing the problem, something it seems many fund managers haven’t done. While scant research is available on the topic, in a 2014 SEI survey more than half of senior asset managers said they were satisfied with industry client servicing, whereas only 10 percent of consultants and 6 percent of investors felt the same way.