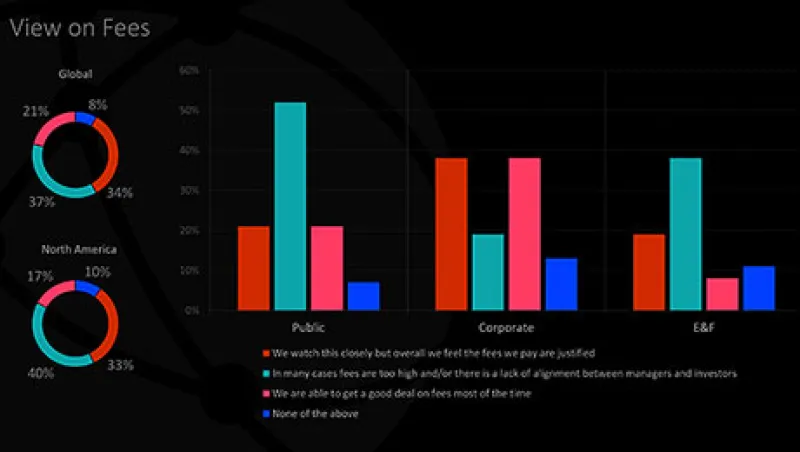

Does the amount investors pay asset managers reflect the value they deliver? More than a third (37 percent) of global investors would say no, based on data from the 2016 global survey by the Investor Intelligence Network (IIN), II’s allocator-only network. North Americans have a more negative view — 40 percent think fees are too high.

Alternative asset classes are driving the discontent. More than two-thirds of global investors confessed in 2013 to paying at least some of their managers close to the standard 2-and-20 fee structure, in which investors pay a 2 percent management fee and 20 percent of performance gains, a trend confirmed in 2014. Almost 70 percent of North Americans, led by corporate pensions, participated in this trend, according to data from IIN’s 2014 Annual Global Survey. European investors did not lag far behind. Subsequent data show that the 2-and-20 structure has diminished in popularity, but hedge fund performance has dipped alongside it.

“The views on fees hasn’t changed overall” from annual survey to survey, says analyst Kristina Zucchi, who has worked on several editions. “Investors are always looking to cut fees. But if they see value, they are willing to pay. And I don’t think that’s changed.”

The attitudes toward hedge funds have, Zucchi continues. “It’s gone hand in hand with performance. From a willingness to pay 2-and-20, to respondents becoming less enamored.” But, she notes, “they’re still willing to pay for private equity, and exposures they can’t access any other way.”

Much of the fee dissatisfaction stems from the belief by almost three-quarters of investors surveyed that performance fees are prone to “gaming” by managers. Moreover, North Americans, in particular, strongly feel that the characteristics that hedge funds offer can be accessed more cheaply elsewhere.

Smaller investors feel the sting more strongly. An investor with a sub-$2 billion North American public pension plan commented, “Because of our limited assets we are generally forced to be fee-takers.” But, the investor continued, “we do negotiate where possible.”

The CIO of a similarly sized foundation was more accepting of this position. “We are mindful of fees but are willing to pay higher fees if we believe the manager’s returns will justify it.” Agreeing, a mid-sized North American corporate pension staff member remarked that the team is “willing to pay for superior performance.”

Not all felt that they lack the ability to dictate fees. Twenty-one percent of global investors reporting being “able to get a good deal on fees most of the time.” And the dissatisfied allocators might consider the advice of one mid-sized Japanese government fund investor: “Just fire those whose fee structure does not justify the performance.”

Leanna Orr is Global Content Director of Investor Intelligence Network, Institutional Investor’s private community for asset owners.