Nathan Lin, managing director and portfolio manager at E Fund Management (HK) Co., is all smiles these days — a rarity among executives in China’s asset management industry, which is suffering through a third year of an equity bear market.

Earlier this year Lin and his team sold 1.1 billion yuan ($175 million) worth of E Fund’s RQFII Fixed Income fund to Hong Kong investors. The fund is part of the renminbi qualified foreign institutional investor program, a major liberalization initiative that Beijing launched last December to enable Chinese asset managers to sell renminbi-denominated instruments in Hong Kong. The fund invests 80 percent of its assets in Chinese bonds and 20 percent in equities.

Only three of the 21 Chinese asset managers and brokers with operations in Hong Kong were able to sell out their RQFII quotas, and Guangzhou-based E Fund Management Co. is among them. The firm specializes in exchange-traded funds, which have attracted investors in spite of the poor performance of China’s stock market indexes. Now the firm is gearing up to sell even more funds in Hong Kong.

“We applied and just received quota for another 3 billion yuan worth of funds,” says Lin. The firm intends to fill its expanded quota by marketing a new fund indexed to China’s CSI 100 index, the mainland index that’s composed of 100 leading stocks listed in Shanghai and Shenzhen, he explains. “We’re confident we can sell this too.”

E Fund’s strong offshore performance was one of the factors that helped it to buck the industry’s ebbing tide last year. The firm had $24 billion in assets under management at the end of March, about $2 billion more than in the previous year. The total places E Fund in fourth place on the China 20, Institutional Investor’s exclusive ranking of China’s 20 largest fund managers. Of the 19 returning funds on the list, ten saw their assets decline over the past year.

There is no change at the top of the ranking, although the gap between firms narrowed a bit. China Asset Management Co. retains its No. 1 spot even though its assets declined to $40.7 billion from $43.5 billion in 2011. Harvest Fund Management Co. remains in the No. 2 slot with $36.3 billion in assets, down from $38.6 billion, while Bosera Asset Management Co. returns in third place with $29.7 billion, up slightly from $28.3 billion. “The past four to five years, not only the past two years, were very tough for Chinese asset managers,” says Lin. “The assets under management of the industry shrank by 30 percent since 2007, when it topped 3.2 trillion yuan, but last year it had fallen to 2.18 trillion yuan. The Chinese economy is still growing, but the equity markets are not doing well. The economy is still in deceleration. I believe it will be another two or three months before we see the economy turn around.”

China’s CSI 300 index is down 6.25 percent year-to-date through September 20 and down 17.65 percent over the past 12 months, making it difficult for many portfolio managers that in the past made money purely by chasing short-term gains in equities.

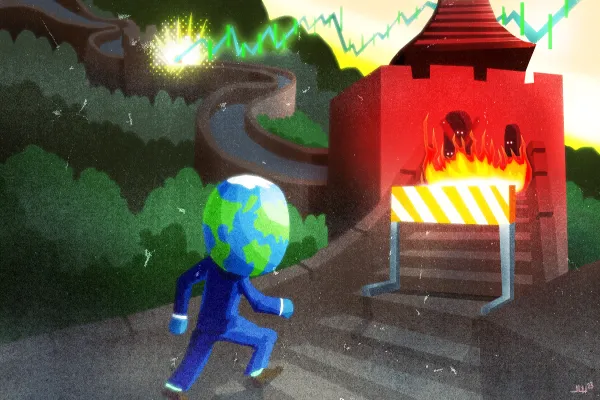

China’s equity markets are down in part because of investor concerns about the global economy and worries about the sustainability of earnings among companies in China’s export-dependent economy, says Huang Haizhou, chief strategist and head of research at China International Capital Corp.

Still, the asset management industry has been more “tenacious than thought,” says Howhow Zhang, director of research at Shanghai-based research firm Z-Ben Advisors. “Assets have been quite flat in the past year, rather than down. Managers continue to launch new products and expand. Competition will be stiff, as more entrants join the battle. Current stagnancy may continue for a while, but probably not for the next two years.”

Indeed, some firms have managed to make important gains despite the broader market weakness. ICBC Credit Suisse Asset Management Co., a joint venture between Industrial and Commercial Bank of China and the second-largest Swiss bank, jumps six places in the China 20, to No. 8, thanks to a 17 percent increase in assets, to $15.1 billion. The firm benefited from the huge retail distribution power of ICBC, China’s largest bank.

For most managers, however, the market environment is trying. Given the fact that Chinese regulators still restrict public mutual fund managers from the use of margin trading and shorting techniques, most managers have found themselves hard-pressed to deliver investment gains over the past two years. Chinese equity-centric funds delivered returns of 4.4 percent on average during the first six months of 2012 after a dreadful 2011 that saw the average fund decline by 23 percent, says Zhang of Z-Ben Advisors. Most listed companies pay little or nothing in the way of dividends, effectively eliminating one potential prop for the market.

China’s long-only portfolio managers have traditionally focused on stock picking and short-term investment strategies, says Liu Zhong, the deputy general manager of Shanghai-based China Securities Index Co., which designed the CSI 300 index and other indexes. This short-term focus on stock picking simply hasn’t worked for most asset managers in the bear market, however, says Liu, who adds that many firms are looking for alternative ways of investing.

Managers increasingly are turning to investing in index-linked funds to help diversify their risks, says Olivier d’Assier, Singapore-based managing director, Asia, at portfolio management research firm Axioma. The firm is working with China Securities Index to come up with various forms of index-linked instruments that can help managers hedge risk in a regulatory environment that bans mutual funds from short-selling.

“Active management has not brought about superior returns in a bear market,” says d’Assier. “Theory says active portfolio management should be able to make better returns, but data shows active management underperforms in bear markets. Data shows globally and in China too that in 2011, 77 percent of managers underperformed the benchmark, and 20 percent underperformed by more than 10 percent. So skills is not the issue.”

One idea D’Assier is pursuing with CSI is to construct indexes using so-called optimization methodology, a portfolio selection technique that uses weightings to eliminate a wide range of risks, such as those caused by price range momentum. “Most returns can come with the right exposure to select types of equities,” says d’Assier. “Even without the ability to short an equity, managers can achieve value, drive growth and minimize downside.”

The China Securities Regulatory Commission last year allowed domestic asset managers to begin selling hedge fund products to high-net-worth individuals and corporate clients, and this year announced that it would allow foreign hedge funds to begin distributing to wealthy individuals and corporate clients in Shanghai. Still, the ban on shorting for conventional mutual fund managers will not be lifted for quite some time, industry sources say.

That is why index-linked products are becoming more popular in China, says E Fund’s Lin. The firm was a pioneer in setting up China’s first hedge fund catering to high-net-worth investors, in 2010, and has launched dozens of ETFs tailored for mass retail investors.

According to CSI, China’s asset management industry has introduced more than 156 index-linked products since 2006, with total assets already exceeding 15 percent of China’s $3.3 trillion market capitalization.

“I see alternative investments as a growth area,” says Lin. “Chinese investors like the concept of absolute returns. Though Chinese retail investors don’t have access to hedge funds, they are allowed to invest in ETFs. The market potential for ETFs in China is huge.”

The same holds true for international investors. “There are only three offshore RMB ETFs in the world now,” says Eugene Lee, global head of sales at E Fund’s Hong Kong subsidiary. “Most global asset managers offer only long funds, and they need exposure to ETF products. Our message is clear: E Fund is the largest index product provider in China. We can help you get a diversified China exposure.” • •