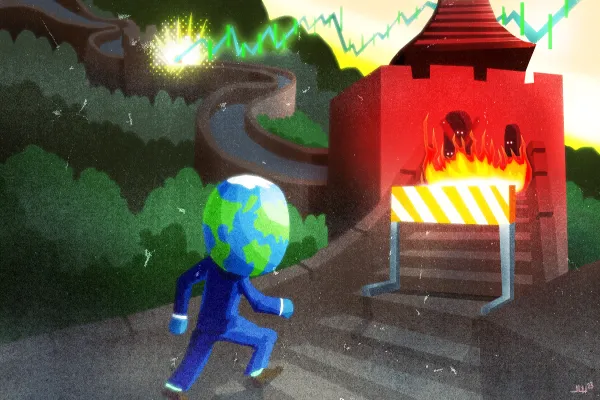

China’s equity and futures exchanges will not participate in the global mergers and acquisition game, but that doesn’t mean the exchanges aren’t going global.

Bo Que, the executive vice president of the Shanghai bourse, said the upcoming launch of Shanghai–Hong Kong Stock Connect — a mutual access program between the cities’ two exchanges that he will oversee — could be the first of several such ventures.

“M&A among exchanges is much easier in the U.S. and Europe, but a joint venture may be the most possible option in Asia,” Bo said last week at the annual meeting of the World Federation of Exchanges, in Seoul, South Korea.

The Stock Connect program will allow Chinese investors to buy Hong Kong–listed equities directly for the first time through brokerages in the special administrative region and allow international investors to buy mainland-listed A shares of Chinese companies through Shanghai-based brokerages. Bo declined to say when the program will be launched but made it clear he had high hopes for it. “Hong Kong will be the first, but in the future we may see similar linkages with other markets, perhaps in the U.S. or Europe,” he said.

Bo’s comments alleviated concerns among some market observers that an apparent delay in the introduction of the Shanghai–Hong Kong link indicated Chinese authorities had had a change of heart.

Premier Li Keqiang announced plans to forge a connection between the two markets in April but didn’t give a time frame for its launch. At the time, market participants estimated a launch in October. Now executives say they expect Stock Connect to begin later this year or in early 2015.

Hopes for an opening of two-way trading between Hong Kong and Shanghai have been dashed before. Beijing first floated the idea of mutual access, dubbed the through train, in 2007 but shelved the project.

Garry Jones, chief executive of the London Metal Exchange and co-head of global markets at its parent company, Hong Kong Exchanges and Clearing, said the program will launch soon, pending clarification of tax issues on both sides of the border. “Whether it goes through now or a month from now or later isn’t important,” Jones said at a panel discussion at the WFE meeting. “What is important is it goes well.”

China’s equity markets remain largely closed to overseas investors, who can only access Shanghai- and Shenzhen-listed A shares through a quota system that allows foreign investors to bring funds in from offshore to buy mainland equities and bonds. Although the current regulations allow for a total of $216 billion of investment through these quotas, authorities in Beijing have granted just $82 billion worth of quotas so far, an amount that represents less than 2 percent of the Shanghai market’s capitalization.

The new links would enable overseas investors to bypass those quota systems, making trading far quicker and easier. Chinese regulators have indicated that the program will begin with a limit of 300 billion yuan ($49 billion) a year for inbound investment into Shanghai and 250 billion yuan for Chinese investment into Hong Kong. Mainland institutional investors and individuals with more than 500,000 yuan ($81,000) in securities and cash accounts will be eligible for the scheme.

The Shanghai–Hong Kong program was one of many topics discussed at the World Federation of Exchanges meeting, which brought together top executives of 64 major equity and future exchanges. The gathering underscored the importance of emerging markets when members elected Juan Pablo Córdoba Garcés, president of Bogotá-based Colombian Securities Exchange, as chairman of the federation. Córdoba Garcés becomes the first leader of the group to come from an emerging-markets country. He succeeds Andreas Preuss, deputy CEO of Deutsche Börse and CEO of the German exchange’s electronic derivatives exchange, Eurex.

Delegates also elected Ravi Narain, vice chairman of the National Stock Exchange of India, as WFE vice chairman.

Córdoba Garcés vowed to make the federation more active as an industry lobbying force. “We helped the world to understand that exchanges were a stabilizing force during the global financial crisis,” he told the meeting in a closing speech. “Regulators are more open to listening to us than they were four or five years ago. We need to become more vocal than ever. We need to bring the message out there. We as exchanges have a real connection to the real economy.”

The federation has numbers on its side. In the year ended June 2014, the volume of equities traded hit $69 trillion, up 38 percent from two years earlier, according to the WFE’s data.