Nothing illustrated Chile’s conversion to the cause of free-market economic liberalism in the 1970s and ’80s like the country’s funded, privately managed pension system. Inspired by economist Milton Friedman’s landmark book, Capitalism and Freedom, José Piñera, Labor and Pension minister during the dictatorship of then-president Augusto Pinochet, introduced revolutionary reforms in 1981 that overhauled the country’s pay-as-you-go social security system. As a result of those changes, workers are required to contribute 10 percent of their salaries to 401(k)-style funds, known as administradoras de fondos de pensiones, or AFPs, which invest the money in a variety of fixed-income and equity securities at home and abroad (see also “Chile’s AFPs: A Lucrative Market for Foreign Fund Managers”). This system has allowed Chile to build up one of the world’s biggest pools of retirement capital — $162 billion, or 62 percent of gross domestic product — and has served as a model for more than 25 countries around the world, from Colombia to India to Russia. Piñera, whose brother Sebastián would later serve as president, from 2010 until this March, was celebrated as “the pension reform pied piper” by the Wall Street Journal.

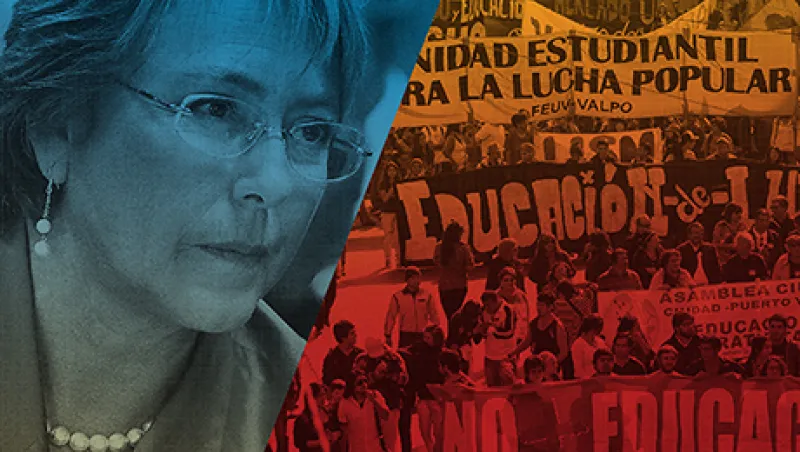

Today the private pension system is at the center of a new inflection point in Chilean politics. Michelle Bachelet, a Socialist Party politician who returned to the presidency in March, is preparing to embark on the biggest revamp of the country’s pension system in its 33-year history. Arguing that the system leaves too many Chileans without retirement security and carries excessive costs, Bachelet wants to introduce a new, state-run AFP to compete with the private pension funds. The recommendation has provoked a howl of protests from existing pension fund managers, which include some of the biggest names in global finance, and warnings from economists that Chile runs the risk of stifling its economic dynamism with an increasingly powerful state.

“I think a state-run AFP is a very bad idea,” says Arturo Cifuentes, academic director at the University of Chile’s Center of Regulation and Macrofinancial Stability and president of the committee that advises the government on the investment policy of the country’s two sovereign wealth funds, which hold a total of $22.5 billion. “What can the government offer that the private investment funds do not?”

Notwithstanding the critics, Bachelet seems determined to see her reform through. She campaigned on a promise to reduce rising inequality in Chile and won a strong mandate; her 62 percent of the vote in December’s presidential run-off election was the highest share of any presidential candidate since the country returned to democracy in 1989. After taking office on March 11, she gave her ministers 100 days to draw up legislation to overhaul the pension system. They did so in June, and Bachelet sent a bill to Congress that would establish a state-run AFP under the auspices of CORFO, the Chilean economic development agency.

“Our priority is to improve the system so that we are able to give people greater opportunities in life,” the president said. “The plan is to introduce greater competition and to cover those people like women, self-employed workers and others who live in remote parts of the country.”

Cifuentes acknowledges the political pressure for change. “The proposed reform reflects a cultural issue,” he says. “In the U.S. people do not expect the government to intervene. However, increasingly in Latin America, people want the state to do more and more things for them.”

Chile has been drifting leftward since the restoration of democracy a generation ago, but the new reform drive stands out because of the country’s recent history.

After leading a coup that overthrew Socialist president Salvador Allende in 1973, Pinochet cut back the state’s role in the economy and made Chile a virtual testing ground for liberal policies, many of them drafted or inspired by economists from the University of Chicago, such as Friedman. Over the ensuing decades prosperity blossomed: The country boasts the highest standard of living of any major Latin American nation, with per capita GDP of $15,458 in 2012, according to World Bank data. Growth has averaged 4 percent a year for the past five years, and inflation is projected to be 3.5 percent this year. Unemployment stands at 6 percent, one of the lowest rates in Latin America, and the government runs a modest structural budget deficit of 0.98 percent of GDP, according to the International Monetary Fund.

Yet the fruits of that prosperity have not been widely shared. According to the World Bank, Chile’s Gini index, which measures the distribution of income on a scale of zero to 100, with a higher number reflecting greater inequality, stood at 52.1 in 2009 (the latest figure available), compared with 46.1 in Argentina and 36.3 in Uruguay. Of the 34 members of the Organization for Economic Cooperation and Development, Chile has the biggest gap between rich and poor.

Social unrest grew during Sebastián Piñera’s presidency, with university students staging mass protests in 2011 over the cost of education. Bachelet rode that wave of discontent to victory in December and now seeks to deliver on her promises.

THE PROPOSAL FOR A STATE-RUN pension plan is part of a wider package of reforms. The president has promised that the state will pay tuition fees for the poorest 70 percent of university students by the end of her four-year term. Currently, students and their families have to shoulder the bulk of those costs. She also has promised to ramp up spending on health care and reduce income inequality. Overall, the government wants to boost spending by some $10 billion, or nearly 4 percent of GDP. It plans to finance the spending mainly by hiking corporate taxes to 25 percent from 20 percent over a four-year period and by abolishing a mechanism that allows companies to defer indefinitely the payment of taxes on reinvested profits.

Although Chile has a very light tax load — it stood at 18.6 percent of GDP in 2010, compared with 26.1 percent in Argentina and 34.4 percent in Brazil, according to the Heritage Foundation — some analysts warn that the government’s plan to boost spending could put a damper on the economy. “Although a fair trade-off from a structural standpoint, it is already negatively affecting business confidence,” says Gustavo Canonero, chief economist for emerging markets at Deutsche Bank. “This is expected to be a major impediment for a rapid recovery this year and next, although expansionary fiscal and monetary policy should be expected to come partly to the rescue.” In May and June students staged a new round of demonstrations that brought tens of thousands of people into the streets to protest that the government’s education reforms lacked ambition and urgency.

Under the current pension system, workers must contribute 10 percent of their salaries up to a ceiling of $3,152 a month, which makes the maximum required contribution $315 a month. People can voluntarily add to their pension savings, contributing as much as 30 percent of their salaries on a pretax basis. At retirement workers have a few options for accessing their funds, but all involve some form of an annuity, either directly from the AFP or through a life insurance company.

It’s easy to see why so many countries have been keen to adopt the Chilean model. Because the system is funded, it relieves the strain on public finances from social security expenses. It helps foster the growth of savings that are crucial for economic development. And the system is popular with many Chilean workers and retirees. The AFPs have allowed the middle class — people with secure, well-paying jobs who have been contributing to the system for decades — to build significant retirement savings.

According to figures from the Pensions Supervisor, the government agency that regulates the industry, the average monthly pension payment received in January 2013 by nearly 1 million Chileans in the AFP system was about 179,000 Chilean pesos, or $322.

“The current solution is not perfect, but most people with steady jobs receive a pretty good pension,” says Axel Christensen, chief investment strategist for Latin America and Iberia at BlackRock in Santiago. “It’s no surprise that if people have not contributed regularly, their pension is not adequate.”

For others, such as lower-paid employees, people in precarious occupations with spells of unemployment and those in the informal sector, or black economy, the private pension system provides much less, if any, retirement security. The informal sector accounts for as much as 25 percent of Chile’s economic output. Many workers in this sector reach retirement age with no retirement account or with a balance that’s too small to provide an adequate income. Currently, 4.96 million Chileans, or slightly more than 60 percent of the country’s labor force, are contributing to an AFP; an additional 4.62 million retirees in the system are drawing benefits.

The pension fund system has come in for growing criticism since the outbreak of the global financial crisis in 2008–’09, which dealt a blow to investor returns. AFPs are required to offer five funds with different risk profiles, ranging from the very conservative to the very risky; contributors can invest in as many as two of the five funds. Funds with intermediate risk generated average annual returns of 5.25 percent between September 2002 and May of this year, but annualized returns were only 2.62 percent between June 2011 and this May, according to the Pensions Supervisor. Overall, the system produced annualized returns of 8.7 percent between 1981 and 2013.

Consolidation has reduced the number of AFPs from 32 in 1997 to just six today:

• Provida, a subsidiary of New York–based MetLife, with $45 billion in assets as of November 2013, according to the Pensions Supervisor;

• Habitat, which has $42.3 billion in assets and is run by the Chilean Chamber of Construction;

• Capital, a $33.5 billion-in-assets arm of Colombian financial services company Grupo de Inversiones Suramericana;

• Cuprum, with $33.4 billion in assets, part of Principal Financial Group, a Des Moines, Iowa–based financial services group;

• Planvital, a $4.4 billion-in-assets unit of Assicurazioni Generali, Italy’s biggest insurer; and

• Modelo, a $1.9 billion fund run by Chilean investment firm Sociedad de Inversiones Atlántico.

FOR BACHELET, PENSION reform represents one of the biggest pieces of unfinished business from her first term in power, between 2006 and 2010. (Chile’s constitution prohibits presidents from serving consecutive terms.) Back then she managed to make some changes, introducing a minimum pension — currently, the equivalent of $160 a month — for all Chileans; making women eligible for a state-subsidized pension, known as el bono por hijo, depending on their number of children; and providing subsidies to match the pension contributions of low-income workers. But she failed in a 2008 bid to launch a state-run AFP through a government bank, Banco del Estado de Chile. As drafted, the proposal would have allowed all banks to set up pension funds. The AFP industry lobbied heavily against the measure, and the government shelved it.

The new proposal is unlikely to meet a similar fate. Bachelet’s Socialist Party and its center-left allies enjoy a solid majority in Congress. In addition, the government is sidestepping the banking issue by proposing to set up the new AFP through development agency CORFO. The new fund would use the nationwide branch network of the Institute of Social Security, the public pension service for people who do not belong to AFPs, to serve its members.

The government contends that existing AFPs charge high management fees and that greater competition would help to bring them down. The funds charge an average management fee of 1.48 percent, but actual rates vary widely. In May, for example, Modelo charged the lowest fee to existing clients (0.77 percent), while AFP Planvital charged the highest (2.36 percent), according to the Pensions Supervisor. All of the pension fund managers also charge contributors 1 percent of their monthly pretax earnings to buy disability insurance and insurance for surviving dependents.

The AFPs rebut the cost argument, pointing to another reform that Bachelet pushed through in 2008. Under this measure the government puts out to tender the exclusive right to sign up new entrants to the labor force over the following two years. The tender is based solely on price, with the winner being the AFP that bids the lowest management fee. Workers enrolled under this measure are obliged to stay with the fund for at least two years.

The pension fund companies assert that this procedure increases competition and puts downward pressure on fees, eliminating the need for a state-run rival. Modelo won the first two tenders, in 2010 and 2012, with its 0.77 percent management fee. Planvital won the latest tender, in January, by bidding a management fee of only 0.47 percent for new contributors; it gains the right to sign up new entrants to the workforce beginning in July. In addition, the firm announced it would extend the same low management fee to existing contributors starting in July — a drastic cut from the previous level of 2.36 percent.

“Only announcing that a draft law to set up the AFP is being sent to Congress has led to strong reductions in commissions,” says Eugenio Rivera, economics program director at Fundación Chile 21, a left-leaning think tank that is close to the government.

Planvital CEO Alex Poblete says the tender system is more effective than a state pension provider would be. “A state-run AFP could not have lower fees,” he says. “Under the tender system we automatically receive new members. The state-run AFP would not have that advantage and would need a sales team.”

Yet even with the tender system, competition appears to be sorely lacking in the pension market. The biggest problem is inertia: By law, the AFPs must publish their fees each quarter, and the Pensions Supervisor’s website provides tools for comparing costs and simulating their impact on pensions, but few Chileans take advantage of this to switch AFPs.

“Most people do not even know the commissions they pay,” says BlackRock’s Christensen. “The big problem with the government’s reform is that people’s expectations are high. It takes a long time to see the results, and you cannot change someone’s pension pot in four years.”

Will a new AFP increase the willingness of contributors to change providers? Some experts estimate that as many as 1 million participants in the current system, out of a total of 9.58 million, could switch to a state-run AFP. But many industry executives dismiss such forecasts as wild guesses.

“I can’t see the state-run AFP’s foundation as a real economic event — it’s more political,” says Pedro Dañobeitia, head of the global client group for Latin America at Deutsche Asset Management. “The government says it wants to increase competition. I have hardly ever seen improved competition come from the state — at least, that has not happened in Europe.” Planvital’s Poblete echoes that view. “It’s hard to believe that many people will just switch to the state AFP,” he says. “It will be starting from zero. It will have no track record.”

A new, state-run AFP may be only the first of a number of changes to the Chilean pension system. The government has appointed a commission — led by David Bravo, an economics professor at the University of Chile, and including some of the world’s leading economists and pension experts — to consider an array of other reforms, such as extending the retirement age, increasing the contribution rate and improving the system’s coverage. The commission is due to deliver a report to the government by January.

Launching a state AFP will “make it easier to have a debate about other reforms, such as improving the contribution rate,” says Rivera. “It will help to create a better climate to discuss general reform of the pension system.”

The Chilean system already ranks as one of the better pension programs on the planet. It won a B grade in last year’s Melbourne Mercer Global Pension Index, meaning it has a sound structure with many good features but still has some room for improvement. Other countries whose retirement systems earned a B grade included Canada, Sweden, Switzerland and the U.K. Only Australia, Denmark and the Netherlands received an A rating (see “Top Danish Pension Fund ATP Is Making Headway in the UK Market”).

Melbourne Mercer says Chile could improve its rating by raising the level of mandatory contributions to increase retiree benefits, requiring employers to make contributions, raising retirement ages and continuing to review the minimum pension for the poorest pensioners.

Critics of the government’s proposal for a state-run AFP say it would do nothing to address those fundamental issues. “There is no technical or logical reason why the state-run AFP should be set up,” says Poblete.

One of the reasons for discontent with the current system is a perception that it has failed to deliver the level of benefits its founders promised. When the system was launched in the early 1980s, officials predicted that AFP plans would provide retirees with income equal to 70 percent of their working salaries — a ratio known as the replacement rate. The actual rate for workers on average earnings in 2013 was 41.9 percent, according to the OECD. Though higher than the U.K. and U.S. replacement rates of 32.6 percent and 38.3 percent, respectively, that was below the OECD average of 54.4 percent.

One of the main reasons Chile has a lower replacement rate is because employees contribute only 10 percent of their salaries to their AFPs. By comparison, the average contribution rate for private pension systems in OECD countries is almost 20 percent.

“The Chilean system does offer pretty good value for money overall,” says Rafael Rofman, a social protection specialist at the World Bank who is based in Buenos Aires. “The benefits may be lower, but that is mostly because contributions are significantly lower. In many ways this is a political decision.”

Rofman adds, “The Brazilian pension system has very good coverage, but public pensions in that country amount to around 10 percent of GDP. In Chile the government spends very little on pensions, up to 2 percent of GDP.”

The graying of Chile’s population is increasing the urgency around the issue of contribution rates. According to the country’s census, there were 2.4 million Chileans aged 60 or older, or 14 percent of the population, in 2012, up from 11 percent in 2002. Life expectancy is 30 percent higher than it was 30 years ago. The individual account balances that Chileans have built up must now be spread over many more years, resulting in lower retirement incomes.

Pension and actuarial experts say contributions would have to rise to 15 to 16 percent of salaries to give a meaningful boost to retirement income, but such a shift would either eat into workers’ current income or cause a significant rise in labor costs.

Fundación Chile 21’s Rivera says employers should be forced to contribute an additional 3 to 6 percent, but other experts argue that this would only encourage employers to hire people on an informal basis.

“It might be politically challenging, but the surest way of improving pensions is by extending the retirement age and increasing the contribution rate,” says Jaime de la Barra, a partner at Compass Group, a Latin American investment adviser with offices throughout the region.

As with most countries, there is no single, simple solution to Chile’s pension dilemma. Bachelet never promised that a state-run AFP would be a panacea. Instead, the country will need a menu of options. Increasing contributions and raising the retirement age would enhance retirement security and help ease complaints from private pension fund managers about the new competition. That could bolster Chile’s vaunted pension model for a new generation. • •