Growth has generally improved in the developed world; fiscal deficits have narrowed; and, most critically for bond investors, the U.S. Federal Reserve has begun tapering its asset repurchase program. Some investors, perhaps not surprisingly, have allocated away from core bonds toward the extreme ends of the risk spectrum: cash, which is insulated from the negative impacts of yield increases; and equities, which would likely benefit from accelerating economic growth.

Yet we at Pimco believe cutting core bonds could only be justified as a market-timing strategy. Not only must the investor be right about rising yields, but also yields must rise within a narrowly predicted window of time. Those who flee to cash, which has a near-zero yield, may experience a long, slow decline if yields don’t rise as soon as expected. Those who increase equity concentrations may be overexposed to negative economic surprises. Capital gains from bonds have tended to kick in just when equities are selling off, helping to stabilize overall portfolio performance. So whereas it may seem intuitive to reduce core bond holdings in anticipation of yield normalization, many if not most investors may end up worse off by trying to time the market.

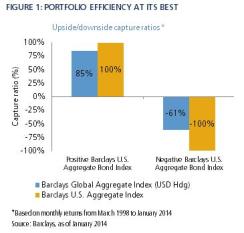

A more thoughtful response would be to retain core bonds and diversify the specific risk factor of concern — in this case, duration, or sensitivity to interest rates. In the past global bonds have captured most of the upside but avoided a significant amount of the downside relative to domestic-only bonds. Indeed, we believe the threat from yield normalization is a somewhat nonsensical concept for investors who have a global perspective (see chart 1). This diversification of duration risk is portfolio efficiency at its best.

In our view, investors can do more. The market offers the opportunity for compensation against rising rates through rolldown in an upward-sloping yield curve market, with the price of a bond increasing as the maturity shortens because bond prices move in the inverse direction to their yield; the amount of compensation fluctuates dramatically over time and across countries. Active investors can potentially enhance the average level of this type of return in their portfolios. If market expectations are not fully realized, then those investors may generate capital gains — in addition to coupon returns — even in a rising yield environment.

So what exactly does yield normalization mean?

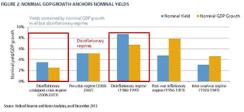

Nominal growth in gross domestic product anchors nominal yields (see chart 2). This makes sense. Lenders’ expectations for respectable returns on capital, as well as borrowers’ expectations for a reasonable cost of capital, are both conditioned by economic growth.

Most commonly, nominal yields are bounded from the top by nominal GDP growth. (The disinflationary regime of 1980–’99 and the past few years following the 2008–’09 financial crisis are exceptions.) The reverse has occurred during postwar reflationary regimes when policy yields were set below equilibrium, which in turn propelled nominal GDP growth higher while yields adjusted with a lag.

We are more likely to see reflationary, rather than disinflationary, efforts by central banks in the coming years. We do not think nominal yields will be as far below nominal GDP growth as they were during past reflationary regimes. Central banks have far more credibility and operate in a more liberalized financial system. Still, nominal GDP growth should serve as an upper bound for nominal yields.

The key factor, then, is outlook for nominal GDP. The International Monetary Fund (IMF) projects that nominal GDP growth over the coming three to five years will average 5.2 percent in the U.S., 4.25 percent in the U.K. and 4 percent in the euro zone. Beyond the next few years, however, trend growth is projected to decline because of demographic shifts and a slower pace of capital accumulation. St. Louis–based macroeconomic research firm Macroeconomic Advisers, for example, projects that U.S. nominal GDP growth will decline to 4.4 percent by 2020, consistent with the U.S. Congressional Budget Office’s own forecasts. Although imperfect, these figures serve as a solid upper-bound estimate for yields during the next few years.

Real yields in the U.S. averaged between 1.5 and 2.5 percent during the postwar era, depending on the maturity of the instrument. But there are persuasive reasons to believe that real yields could be far lower going forward.

The supply of loanable funds, for instance, should be higher, and the demand for loanable funds lower, in an environment without balance-sheet leveraging. Both of these would weigh on the market-clearing, or equilibrium, level of real yields. It is not just domestic households in the U.S., the U.K. and the euro zone that are striving to save more, adding to the supply of loanable funds. Emerging-markets lenders will likely continue to supply loanable funds to globalized capital markets.

Taking the argument a step farther, there has been quite a bit of academic research, summarized by Harvard University economist Larry Summers’ “Secular Stagnation” speech at the IMF Economic Forum in November, showing how equilibrium real yields could be infinitesimal — perhaps even negative — in an economy without balance-sheet leveraging. If true, this would explain disinflation in countries where policy rates have been set far below inflation for more than five consecutive years. It would also suggest that nominal yields may peak at a much lower level than they did in 2007, when they briefly touched 5.25 percent in the U.S. According to secular stagnation theory, these levels were reached only because of a historic borrowing binge and a housing bubble. Assuming borrowing-binge conditions are not repeated, nominal yields could peak at a much lower level the next time.

Putting it all together, we think that the ten-year government yield — at least in the U.S. and U.K. — during the next three to five years isn’t likely to go above 4.5 percent, with real yields slightly below average and inflation premiums slightly above average.

Forward yields repriced far more than spot yields during the 2013 bond market sell-off. Bond investors are enjoying not only higher yields but also greater cushion against further yield increases, depending on the maturity of the yield and the geography of the market. But at least according to our framework, longer-dated yields are already helping protect investors against a full normalization over the next three to five years. If yields peak at a lower level or take longer to get there, bond investors would theoretically realize capital gains on top of their coupon returns, even as yields increase. Specifically, forward markets anticipate that ten-year U.S. yields will rise to 3.6 percent in the next three years and to 3.8 percent in the next five years (see chart 3).

Theoretically, if the U.S. ten-year yield normalizes at 3.75 percent over the next five years, core bond investors would realize a capital gain to augment their coupon return. At the moment, the normalization priced into French forward markets is greater; in Canadian markets, it’s worse. By shifting exposure to those forward markets — when they offer a compelling cushion against rising rates — we at Pimco believe that investors can harvest quite a bit of potential for excess return.

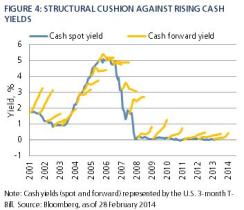

Markets historically have offered a structural cushion against rising short-dated yields, a premium that active investors potentially can tap as excess returns if spot yields do not increase to validate their forwards (see chart 4). This phenomenon is quite common during phases when central banks are on hold.

This uncertainty premium varies over time and across countries. For example, last May, when the Fed first hinted that it would begin to taper quantitative easing, this premium increased more in Europe than in the U.S. This didn’t make sense. Why would forward yields increase to fortify investors against European Central Bank policy rate hikes in Europe when it was the Fed that had changed its stance on U.S. monetary policy? This opportunity began to disappear nearly as soon as it had surfaced, and it was fully snuffed out when the ECB invalidated forward pricing by cutting its policy rate in November. Many instruments sensitive to these dynamics — short-dated bonds, for one, but especially money market futures contracts — went up in price.

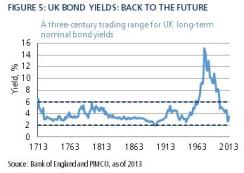

Many investors subscribe to the notion of symmetry: the idea that there must be an equal and offsetting bear run in bonds as the natural counterpart to the bull run experienced during the past 30 years. But in fact this has already played out: The bull run from 1980 to the present was the counterpart to the bear run from 1950 to 1979, during what was an abnormal and temporary aberration from a centuries-old trading range (see chart 5).

Rather than selling bonds in preparation for the return of such an abnormal environment, then, we at Pimco believe investors should focus instead on what is likely in the present macroeconomic environment: a rise in yields, perhaps, but one that is gradual and ultimately limited in scope. And because market prices adjust to anticipate future yield trajectories, one could even claim that yield normalization already occurred last May, when forward markets repriced to reflect the expectation of rising yields.

Scott Mather is a deputy chief investment officer and head of global portfolio management at Pacific Investment Management Co.’s headquarters in Newport Beach, California.

Michael Story is a vice president and product manager at Pimco’s London office.

See Pimco’s disclaimer.

Get more on fixed income.