The Clean Power Plan, President Barack Obama’s proposal for carbon emission reductions that was unveiled June 2, will have implications for investors in coal and clean energy, say energy-focused analysts and asset managers, though most of those ramifications will be region-specific and unlikely to emerge for a few years. Many of those observers add that on the broadest scale the rules probably won’t dramatically hasten the change that the U.S. power generation industry is already confronting.

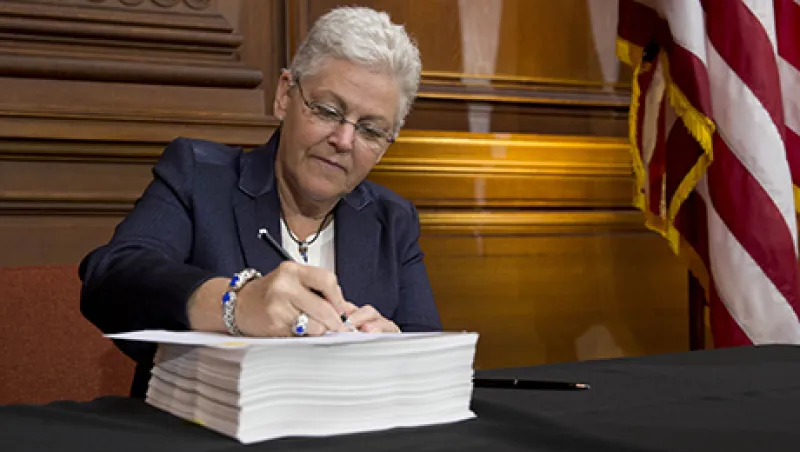

The president’s outline for clean energy aims to slash the U.S. power sector’s carbon emissions to 30 percent below 2005 levels by 2030. A 645-page document released by the Environmental Protection Agency last week lays out a state-by-state approach to achieving this goal, wherein each state has been given its own carbon-reduction target along with the flexibility to determine how it will tackle its cleaner-energy objective. The EPA’s proposal anticipates an economic burden on affected industries of up to $8.8 billion per year by 2030, whereas a report released by the U.S. Chamber of Commerce puts the number at $51 billion a year on average — though that report was released before the EPA analysis and assumed a reduction target of 42 percent by 2030. One reason the numbers vary so widely is because states’ implementation of the rules can and will take many forms. The EPA has modeled a few ways in which they can comply, however: States can make coal plants more efficient or shut them down; increase the proportion of natural gas — which produces half as much carbon per unit of electricity as coal — in power generation; keep nuclear power plants open; pursue renewables as a power source; or possibly push for energy efficiency retrofits of commercial and residential buildings to lower the demand for electricity.

“We do think there could be credit implications of this [proposal],” says Michael Ferguson, a credit analyst at Standard & Poor’s in New York who covers merchant energy producers. “But we think they’re probably going to be a few years out, and we really don’t know yet how each of the individual states is going to go about achieving these goals.”

He says that coal power plants — especially those in the Midwest and Southeast — are at most risk for future credit downgrades. States in those regions haven’t been as quick to adopt their own environmental standards, and their power industries will have farther to go in meeting their targets. States like California and the nine states in the Northeast that take part in the Regional Greenhouse Gas Initiative (with eastern Canada) have already set their own carbon reduction goals and won’t have to alter as much to comply with the EPA-imposed targets.

Steven Fleishman, electric utilities analyst at Wolfe Research in New York, points out that coal generation plants in states that also have a solid presence of natural-gas power are more vulnerable than those in states with no gas. Fleishman wrote in a research note last week that “11 states would all but eliminate coal from the portfolio mix as EPA assumes natural gas fully displaces it.” He adds that Texas is expected to see a 50 percent reduction in coal output — bad news for coal-heavy power generation companies with significant market share there. West Virginia and Kentucky, by contrast, have no natural-gas industry presence, he says, so those states will have to meet their goals without getting rid of coal.

Fleishman adds that the EPA’s proposal is positive for nuclear generation companies, since the rules give states credit toward their reduction goals for keeping open nuclear plants that they were considering shuttering.

Renewable energy sources, like wind and solar, could also be poised to benefit, given the emissions savings these power sources could represent. But just how much will be difficult to quantify until states start to make public their implementation plans, which they must file by June 2016.

“This should help renewables, because in order to get to the state goals for reduced carbon, it may be optimal to remove or seasonally mothball the oldest and most inefficient units, and they would likely replace those megawatts with low- to no-carbon megawatts,” says Stephen Chin, an alternative energy analyst at UBS in San Francisco. “That said, states have the option to promote energy efficiency programs, and many will likely take this route as well. All in all, there will likely be a mix of approaches taken.”

But at least for the moment, it’s the added certainty and vote of confidence from the EPA’s proposal that matter most for the clean energy sector, says Sheeraz Haji, CEO of Cleantech Group, a San Francisco–based research and advisory firm. He believes the regulator’s move could signal a sentiment shift and offer reluctant would-be cleantech investors the policy assurance they’ve been missing. According to Cleantech Group, investment dollars to the cleantech industry fell by 15 percent in 2013 from the year before. Haji says the Clean Power Plan could help ensure that last year’s figure is the industry’s nadir.

“We could see a shift in terms of more dollars to the space much sooner than in five or ten years,” he says. “I think it can happen in a year or two.”

But other industry experts doubt that the market response will be that swift or dramatic. Rob Romero, founder of and portfolio manager at $110.5 million, Palo Alto, California–based hedge fund firm Connective Capital Management, which dedicates 30 percent of its portfolio to emerging energy investments, calls the emissions rules “somewhat lenient” and says he believes the EPA’s choice of 2005 as a benchmark year is “somewhat of a concession,” since that year represented a peak in greenhouse gas emissions. Carbon pollution has already fallen 12 percent since then.

Peter Fusaro, an adjunct professor of international and public affairs at Columbia University who researches renewable energy project development and finance and is an investment adviser to hedge fund firms and a former regulator with the U.S. Department of Energy, agrees, calling the EPA carbon plan “window dressing” that isn’t likely to have a discernible effect on speeding up current trends.

“Frankly, Energy Economics 101 is already moving the needle with retirement of inefficient coal plants, cheap natural gas and the renewable energy revolution, which is continuing to grow,” says Fusaro. “They should have gone for much more significant cuts by 2030.”

Get more on macro.