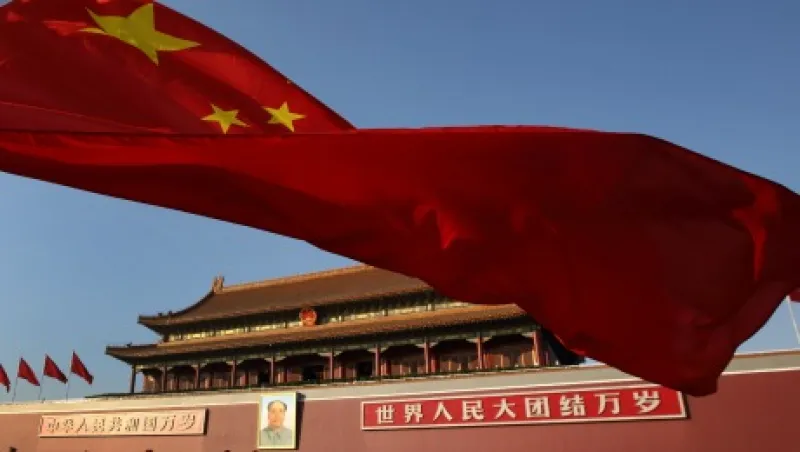

The focus of market narratives this week is on China. With consumer price index data due out tomorrow and private lending, retail sales, production and investment data coming out Thursday and Friday, the hard-or-soft landing debate has largely been replaced by concerns about what waning Chinese demand means for the rest of the globe. Unlike expectations for Europe, where the European Central Bank has thus far proven to be more bark than bite, investors focusing on China are largely anticipating swift reactions from the People’s Bank of China to any softness in activity measures. After disappointing trade data released last Friday, Jennifer Lee, senior economist with BMO Financial Group in Toronto, commented in a report for clients that softer exports and import figures were distorted by a crackdown on fake invoicing to circumvent capital flow restrictions and cheaper oil. “It is difficult to determine if this is a clean reading on global demand or not,” she noted. For investors in Chinese equity markets, operating under the assumption that the central bank will act on weaker numbers the next few days will be critical.

Trade data from Europe shows slight uptick. Germany registered an expansion in its trade surplus for October as both imports and exports declined for the month on a seasonally adjusted basis, driven by in part by softer oil prices. France reported a marginal increase in outbound shipments for the month with a modest decrease in deficit resulting. For now, neither economy is demonstrating sufficient strength in activity to reduce the pressure on ECB president Mario Draghi to make good on his pledge to stimulate the economy in the new year through asset purchases.

U.K. manufacturing sector disappoints. Manufacturing output levels in the U.K. contracted in October versus the prior month according to figures released by the Office for National Statistics today. Manufacturing specific output levels fell by 0.7 percent for the period versus consensus forecasts for a modest expansion, while aggregate industrial production contracted by 0.1 percent. This marks the first slowdown in activity in the overall U.K. industrial sector in five months, even as mining and energy extraction facilities continued to expand.

Greece announces election next week. Greek Prime Minister Antonis Samaras today announced a parliamentary vote for a new president to be held on December 17, creating the possibility of a new government. A swift sell-off in Greek equities and sovereign debt markets followed the news as investors raised concerns that the ruling coalition would fail to maintain a majority opening the door for antibailout parties to make gains.

Snapchat poaches banker. Messaging app Snapchat announced the hiring of Imran Khan, a Credit Suisse investment banker who oversaw the bank’s involvement in Alibaba’s initial public offering. Khan will become the firm’s chief strategy officer, reporting directly to 24-year-old CEO Evan Spiegel.

Portfolio Perspective: Market Momentum Still on the Move — Atul Lele, Deltec International Group

Following sharply negative momentum in mid-October, markets have rebounded strongly. Such a recovery so soon after a major bout of uncertainty — across both the global growth and the policy outlooks — is bound to cause concern, particularly when the midterm outlook for selected assets remains negative.

Yet across asset classes, risky assets such as equities, are not overshooting the current, or expected, level of growth momentum. Within asset classes, there are similarly no major signs of asset prices being stretched or investor complacency being elevated.

Against this backdrop, both the global growth and policy outlooks have improved. Growth momentum is now tentatively rising, selected developed market growth is definitively on a firmer footing and the policy outlook has gained some much needed clarity — and for certain regions — some much-needed stimulus.

As we move towards the close of 2014, following the announcement of major monetary stimulus, growth momentum will peak in early 2015 and tighter U.S. dollar liquidity conditions are coming. Soon.

Atul Lele is the chief investment officer of Nassau, Bahamas–based Deltec International Group.