Aidan Corcoran, my colleague based in Dublin, and I met in London and then traveled to Paris to meet with investors and macro folks at the 2014 SuperInvestor conference. Our key conclusions, which we detail below, are as follows:

• We do not foresee a triple dip in Europe, but below-trend inflation and tensions with Russia are denting CEO confidence and growth. Our research leads us to pencil in European gross domestic product at just 1 percent in 2015 and earnings per share around 5 to 7 percent, versus a consensus of 12 percent.

• We believe deflation risk, though not Japanese-style deflation, will be the key central bank policy issue for 2015.

• Significantly, we left with the sense that the bar for true sovereign quantitative easing (QE) may be higher than the market thinks. Ultimately, in our view, the European Central Bank will have to engage in QE, given the lack of available credit instruments it can acquire in the open market under its current program.

• Regardless, the ECB is in motion, with the intent to (1) drive spreads tighter via a variety of new programs and (2) put renewed pressure on the euro.

• After the latest round of warnings from the International Monetary Fund, foreign investors have now sold out of European equities in epic proportions (that is, positioning is now as clean as it has ever been since 2008–’09). As chart 1 shows, 65 percent of European equities now have a dividend yield above their corporate bond yield, which is what we saw in the U.S. in 2010–’11.

• Our macro thesis in Europe remains focused on marginal change: Incremental capital will flow toward areas in which things are getting better in Europe. But France and Italy, which together make up 38 percent of euro zone GDP, will continue to make the overall macro data look punk.

A Record Number of Companies Now Have Dividend Yields Above Corporate Bond Yields

Data as of October 21. Source: Datastream, Goldman Sachs Global Investment Research, "Adventures in Wonderland."

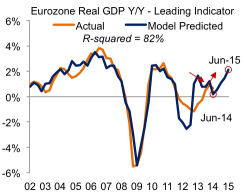

Although we do not foresee a triple dip in Europe, growth remains disappointing. Whereas our quantitative models have been pointing toward an improvement in Europe’s growth for several months — driven by lower rates, a lower euro and stabilization in housing — that has not happened. Why? We believe fears over Russia and Ukraine, the threat of deflation and slower global exports have trumped lower rates, a lower currency and a better housing outlook in Europe. We endured a similar experience with our quant work in the U.S. when Washington politics overwhelmed aggressive Federal Reserve action in 2010–’12.

We would also be remiss if we did not acknowledge that new leadership regimes in both France and Italy have underperformed expectations. French President François Hollande’s approval rating is a dismal 12 percent, essentially guaranteeing a quagmire until at least the next election. Our conversations in Paris were downright demoralizing about the overall direction of France’s economic policies. In Italy the economy is now in its third recession since 2008. We know from a prior trip to Milan that Prime Minister Matteo Renzi’s ability to implement reforms cannot compare with the achievements that occurred in Spain after the crisis there.

If you had told me when I joined KKR in 2011 that the German Bund would reach 80 basis points, the euro would fall to 125, oil would slip below $80, an ECB stress test on the banks would be successful, the Spanish five-year would trade inside its U.S. equivalent, and formal QE would be on the table, I would have said that European GDP, not to say European stocks, would be “up and to the right.” GDP and stocks are not up, however. Thus far, the ECB has largely just responded to crisis issues, not gotten ahead of them. Meanwhile, unlike the post-2008 U.S., which spent $800 billion on fiscal initiatives, there has been no coordinated stimulus.

Growth Has and Will Remain Disappointing

Data as of November 14. e=KKR Global Macro & Asset Allocation Estimates. Source: Eurostat, Global Macro & Asset Allocation analysis.

Macro and Geopolitical Forces Are Offsetting the Positive Impacts of a Lower Euro, Lower Oil, Lower Rates and Housing Stabilization

Data as of November 14. Source: Haver Analytics, Bloomberg, KKR Global Macro & Asset Allocation analysis.

So, where do we go from here? We now expect approximately 1 percent growth for 2015, slightly ahead of the consensus but well below our quantitative model, at a time when U.S. and U.K. growth could approach 2.8 percent and 2.6 percent, respectively. We also expect earnings to grow closer to 6 percent, versus a consensus of 12 percent. This 6-to-1 EPS-to-GDP ratio actually does not surprise us since the European corporate sector has neither the indebtedness nor the leadership issues that governments in the region face.

If the Ukraine situation does not spill over into 2015, the upside to lower commodity prices could be a nice tailwind by the second half of 2015. All told, we estimate that every $10 decline in the price per barrel of oil supports GDP to the tune of about 20 basis points over the following two years, and possibly more if consumers view the move as permanent. The fall in oil is not to be underestimated because it is occurring at a time of ongoing wage pressure as Europe seeks to become more competitive.

Henry McVey is the head of global macro and asset allocation at KKR in New York.

Get more on macro.