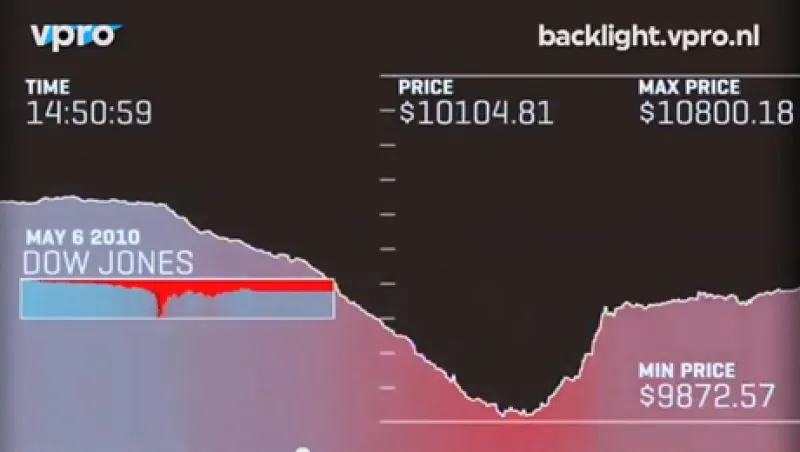

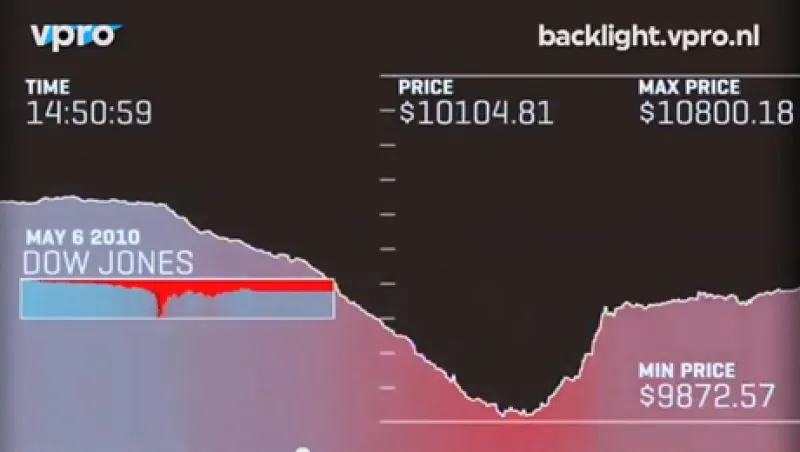

'Money & Speed' and the May 2010 Flash Crash

A Dutch documentary points out that many questions about the flash crash of 2010 remain unanswered.

Katherine Heires

February 21, 2013