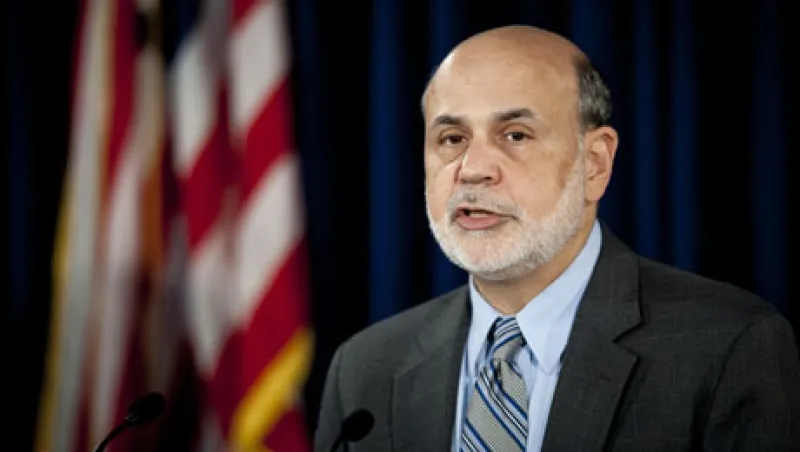

Ben S. Bernanke, chairman of the U.S. Federal Reserve, speaks during a news conference following the Federal Open Market Committee meeting in Washington, D.C., U.S., on Wednesday, Sept. 18, 2013. The Federal Reserve unexpectedly refrained from reducing the $85 billion pace of monthly bond buying, saying it needs to see more signs of lasting improvement in the economy. Photographer: Pete Marovich/Bloomberg *** Local Caption *** Ben Bernanke

Pete Marovich/Bloomberg