The climate is brightening for cannabis entrepreneurs around the U.S. After more than a year and a half of legal cannabis in Colorado, the results appear to be mostly positive. Though some unexpected health effects have been reported in association with higher rates of marijuana intoxication, studies show that use of pot among youth did not increase in Colorado after legalization as many critics had feared, and the Colorado Department of Transportation recently reported that highway fatalities reached a near-historic low in 2014, dispelling fears of drugged driving. Meanwhile, tourism, housing prices and tax receipts for the state have increased substantially. Now that the perception of cannabis has started to change, business owners — many of whom deliver their tax payments in bags full of cash — say it’s time to address the real danger of marijuana legalization: operating outside the banking system.

Because of federal laws such as the Bank Secrecy Act of 1970 and anti-money-laundering statutes enforced by the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN), banks are blocked from even distantly connecting themselves with activity prohibited by federal law, even in states where the activity is legal. FinCEN issued guidance last year to help the burgeoning marijuana industry, banks and credit card companies start to reconcile their practices and expectations, but experts say the federal government’s approach has only made things more confusing.

“All of this is prosecutorial guidance, so it can change,” says Richard Morris, a corporate and regulatory attorney with law firm Herrick Feinstein in New York. “It’s sort of like dealing with a permission that could be revoked at any time. What’s proper today may not be proper tomorrow, so I can’t tell [a prospective banker] they won’t be a target.”

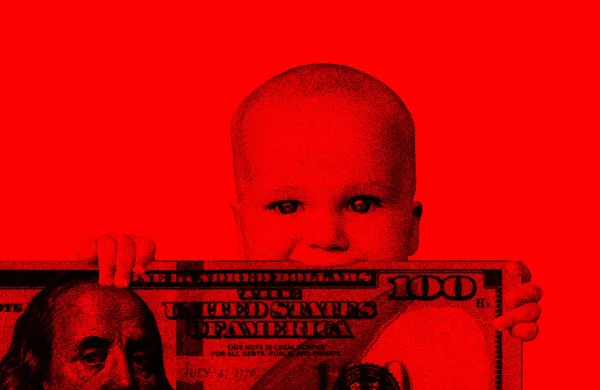

This fear of prosecution has led to a nearly 100 percent cash-based dispensary industry, with business owners handling, transporting and storing large amounts of currency and raising the risk of theft from both employees and violent criminals.

Jessica McElfresh, a criminal defense attorney based in San Diego who works with medical marijuana businesses as part of her practice, says when a legal cannabis business approaches a bank, one of three things usually happens: A client is honest with the bank about its business plan, and the bank declines to issue an account; a client is not completely honest with the bank about the purpose of its business because it anticipates the previous scenario, leaving the bank unable to properly fill out forms and the client omitting vital information; a client obtains a bank account, but the bank closes it in short order because of the large number of cash deposits, which put up a red flag for many banks. Each of these scenarios leads to a less transparent and safe cannabis industry, says McElfresh. “It’s extremely difficult to track activity and adhere to the federal government’s strict regulations without bank accounts,” she adds.

Several efforts to include cannabis accounts in existing banks or create new cannabis-focused banks and credit unions have been thwarted. Oregon-based MBank was the only bank in the state offering checking accounts to cannabis businesses until it backed away from the industry this spring after just a few months, citing limited resources to handle the 75 clients’ compliance needs. In Colorado, the Fourth Corner Credit Union recently sued the federal government over the Federal Reserve’s decision not to approve an application for a master account at its Kansas City branch.

This difficulty has led some cannabis businesses to make creative — and in some cases dangerous — workarounds. In addition to being unable to find a bank, cannabis dispensaries are also largely blocked from accepting credit cards because of Visa and MasterCard regulations and laws governing their sponsor banks. One consumer, who asked not to be named because of the uncertain legality of the situation, tells Institutional Investor that after a trip to one dispensary in Boulder, Colorado, the name of what she thought was a credit union showed up on her bank statement. A quick search shows that the name actually belongs to a small property management company. Jeff Foster, founder of Jane, a Denver-based cash management and compliance firm for the cannabis industry, says the property management company is likely being used as a front for this particular dispensary in order to get around banking rules.

“The dispensary probably doesn’t even know that’s happening,” says Foster. Independent sellers of credit card processing equipment have been known to bend the truth with credit card companies in order to get business from the rapidly growing cannabis industry, according to Foster, who says the most common cover businesses are flower shops and hair salons.

Jane, which grew out of Foster’s experience with payment management systems and kiosks, aims to separate the business of handling money from the actual hands-on operation of a cannabis dispensary. The long-term goal is to make banks more comfortable working with sellers and growers, but until then the focus is cash management through the use of in-store kiosks and armored trucks that transport cash to vaults for safekeeping. Jane also assists business owners with compliance, to the extent that the procedures are clear. Foster believes that all it will take is one bank to create a successful cannabis financing practice, and “the competitive spirit of the rest of the banking industry will take care of it from there.”

There is some legislation in the works that could potentially make it easier to bank these people — presidential hopeful Senator Rand Paul of Kentucky has sponsored such a bill and recently held the first-ever marijuana industry–focused presidential fundraiser, in Denver — but experts aren’t optimistic.

“Much of what we’ve seen is neither encouraging nor likely to succeed,” says attorney McElfresh. “There are a variety of bills pending in the U.S. Congress, but I’m skeptical that they will make it out of committee and be passed.”

The climate is frustrating for investors as well. Patrick Rea, founder of business accelerator CanopyBoulder, says he’s come across many high-net-worth individuals and a few venture capitalists interested in the sector, but many are turned off from dispensaries and grow operations by the confusing regulations and risks associated with all-cash businesses. The Boulder-based firm matches highly qualified entrepreneurs pitching investor-friendly cannabis-adjacent business ideas, such as software, with wealthy individuals looking to cash in on the nascent industry. The incubator graduated its first class of companies in June after a 13-week program focused on management, financing and pitching.

The program has so far been a success, with graduates presenting their ideas for ancillary cannabis businesses from software to consumer products at this summer’s Cannabis Business Summit in Denver, the same event where Paul held his fundraiser. The CanopyBoulder second class entered the incubator this week. But while the accelerator is lending legitimacy to a specific sector of the growing class of cannabis entrepreneurs, those involved in actual handling of legal marijuana — grow operations and dispensaries — are getting left behind.

At some point, experts agree, something will have to give at the federal level. Until then, those in the cannabis industry will continue to find ways to do business, even if it means sometimes still behaving like outlaws. It’s not unheard of for cash-heavy cannabis business owners to pay for protection, according to attorney Morris. “Every day that we have this multibillion-dollar underground economy, we are feeding a monster,” he says.

Follow Kaitlin Ugolik on Twitter at @kaitlinugolik.