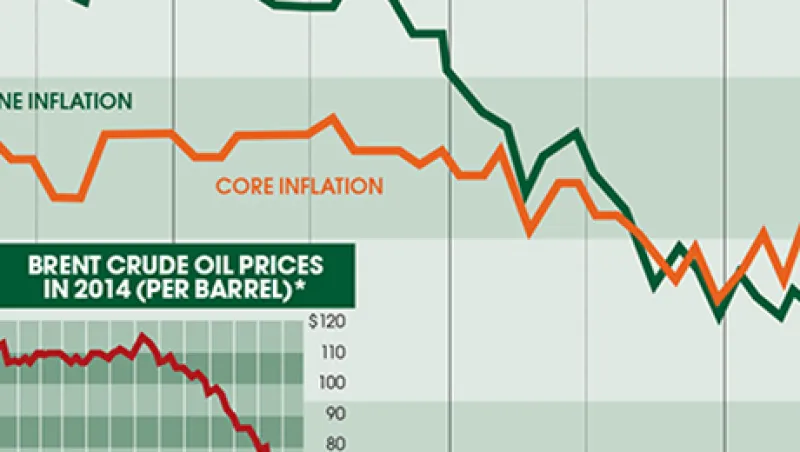

Among their hundreds of worries during the depths of the credit crunch, investors found the specter of deflation particularly horrifying. This year, though, many seem unfazed by falling prices in the euro zone, which has returned to deflation for the first time since 2009. In December consumer prices were 0.2 percent lower than a year earlier. The crucial factor is the sharp decline in the value of oil: Brent crude fell as low as $45 a barrel in mid-January, less than half its 2014 peak.

Some investors are even upbeat about this striking deflation statistic. “In the next six to nine months, we are expecting consumer prices to be in negative territory for sure, with deflation rates similar to December’s or higher,” says Jérôme Broustra, head of fixed-income global rates at €607 billion ($705 billion) AXA Investment Managers in Paris. “The good news about deflation is that it means higher real income for European households.”

Oil-driven deflation could benefit many parts of the stock market, investors argue. “The increase in the wallet is significant,” says Rupert Welchman, a London-based fund manager for European equities at Union Bancaire Privée, the SFr95 billion ($110 billion) Swiss private bank and asset manager. “So I would expect retail and other consumer stocks to continue to look quite good.”

Deflation is a complex beast. One reason economists fear it so much is that it can encourage consumers to spend less at the shops. Why buy something now when you can get it for a discount later? According to some experts, Japan’s long-term deflation hit consumer spending in the 1990s and 2000s.

But for people to stop spending, the prices of thousands of common consumer goods must start falling. In most euro zone countries, this isn’t happening, and investors don’t believe it’s likely. In contrast to the headline inflation rate of –?0.2 percent, “core inflation is even increasing a bit,” says Broustra of AXA IM.

“The fear of deflation has increased, but the risk is quite limited because several forces are supporting inflation,” Broustra says. These include the demand for other goods and services unleashed by sinking energy prices and the euro zone’s economic recovery, he adds.

Even if outright deflation is unlikely to take root, the low rate of core inflation suggests that even when oil prices stop falling, headline inflation is likely to remain far below the European Central Bank’s target of 2 percent or just below. The arrival of headline deflation convinced investors that the ECB would engage in quantitative easing by purchasing bonds. On January 15 that certainty prompted the Swiss National Bank to abandon its ceiling of 1.20 Swiss francs to the euro, whose probable weakness following QE would make it even harder for the central bank to maintain that ceiling through heavy euro buying.

On January 22, when the ECB announced that it would start QE in March, fears among some investors that it would be a disappointment proved unjustified. Charles Diebel, head of rates strategy at £240 billion ($363 billion) Aviva Investors in London, had estimated that the market was pricing in an overall program of between €500 billion and €700 billion. For bond yields in general to continue falling after the announcement, the ECB would need to pledge “at least €1 trillion of purchases,” he forecast. Diebel had a hunch that Draghi would exceed market expectations — and so he did, announcing €1.14 trillion in bond buying through September 2016, at a rate of €60 billion a month.

In response to Draghi’s onslaught against low inflation at the very least — and deflation at worst — which bonds should investors buy? Diebel sees strong potential in peripheral euro zone sovereigns because their yields have further to fall. He predicts that Spanish spreads above German Bunds could drop from just over 1 percentage point on the eve of the QE announcement to as low as 30 basis points this year. On January 22, Spanish spreads for ten-year paper tipped below the 1 percentage point mark, finishing the European trading day at 96 basis points.

If peripheral bond spreads fall to the levels that Diebel expects, investors will feel compelled to pump money into European companies by allocating to riskier corporate credit and equities — exactly what Draghi wants them to do.