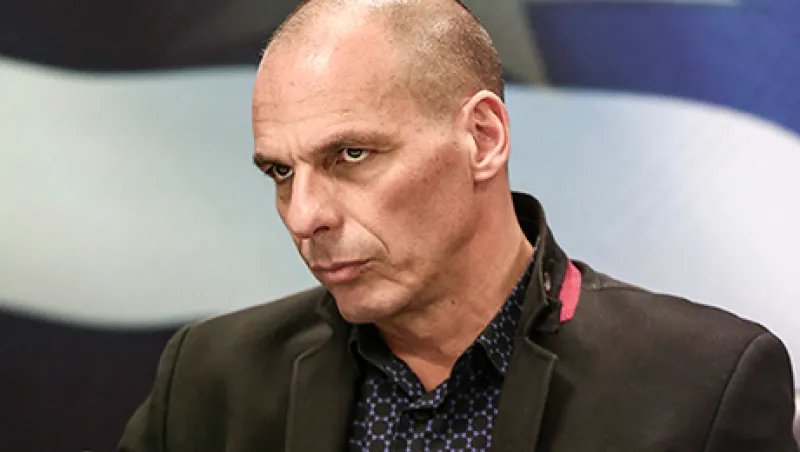

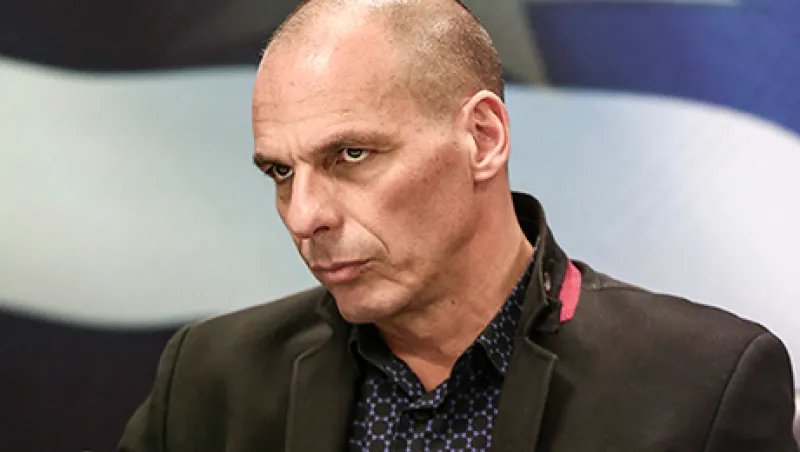

Yanis Varoufakis Provokes Greek Drama with Bailout Stance

The country’s charismatic new Finance minister has vowed to keep Greece in the euro area while scrapping most of its debt obligations.

Tom Buerkle

February 16, 2015