Recent economic data and policy announcements in China suggest that the country is working to rebalance its economic growth model and to manage — though not reverse — the resulting slowdown in headline gross domestic product growth. In this second of a two-part series, we at Investec Asset Management take a closer look at the prospects for policy easing and credit-driven investment growth in a rebalancing China.

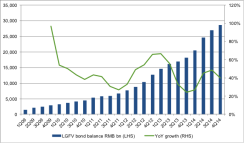

We expect policy easing to be gradual and targeted, as has been the case over the past nine to 12 months. We expect further policy rate cuts only insofar as necessary to keep real interest rates from rising. Rates have risen as headline consumer prices and producer prices have fallen to multiyear lows (see chart 1). Policymakers have also stated their intention to remove the cap on deposit rates in 2015, a key step toward more efficient pricing of capital. In addition, during the years of strong capital inflows leading up to 2014, Beijing repeatedly raised the banks’ reserve ratio requirements to absorb excess liquidity. The authorities began to reverse that trend in February, cutting reserve requirement ratios by 50 basis points, to 19.5 percent. Further reductions are likely in order to ensure domestic liquidity remains stable. This does not represent broad-based policy easing, however.

Chart 1: Real interest rates had risen as inflation fell

Source: Haver, IAM

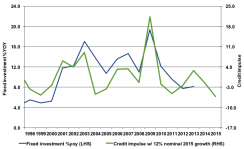

Overall credit expansion has stabilized since December 2014, but we believe that the pace of year-over-year expansion will slow. In terms of credit-led investment growth, this deceleration is consistent with Beijing’s rebalancing goals. Some market participants have become concerned about the risk of a significant devaluation of the yuan as an alternative policy lever. It is important to note, however, that Chinese exports have outperformed global peers over the past five years despite a 40 percent rise in the real exchange rate. We credit this to Chinese exporters’ exceptional scale and productivity. A devaluation of the yuan does not appear necessary to support external growth, with the trade surplus at a record high in U.S. dollar terms, and would risk capital outflows that could in fact hurt domestic growth. Importantly, recent data suggests capital flows have turned positive again.

Chart 2: China's credit impulse will support rebalancing from investment

Source: Haver, IAM

In our opinion, two more significant, positive long-term trends are emerging with regard to China’s currency and capital accounts. Following the successful start of the Shanghai-Hong Kong Stock Connect late last year and the expansion of renminbi qualified foreign institutional investors quotas for external investors and institutions, China has clearly stated its intentions to continue gradually opening its capital markets over the long term while avoiding destabilizing hot money flows. This includes the promotion of activity in offshore renminbi markets as part of a broader strategy to cement the yuan as a major global settlement currency, and move gradually toward something closer to reserve currency status.

To encourage the use of and increase the availability of Chinese currency outside the country while still running a material current account surplus, China is adopting a strategy somewhat akin to that of the U.K. in the late 19th century, recycling its external surpluses into outward foreign direct investment, rather than the accumulation of developed market government debt as in the past. This is taking place via President Xi Jinping’s “one belt, one road” pan-Eurasian road and maritime investment plan, as well as institutionally via the China-led Asian Infrastructure Investment Bank, which several nations across the world have committed to join. This will help to foster investment opportunities and bolster long-term potential growth across Asia.

Mark Evans, based in London, is an emerging-markets investment analyst and Wilfred Wee, based in Singapore, is a portfolio manager of the Asia local-currency bond fund, both at Investec Asset Management.

Get more on emerging markets and on macro.