The corporate reaction to the crisis and CEOs sharing responsibility

Whilst the present size of the pension deficit is typically clear to the company, there is increasing pressure for the corporate CEOs to understand and monitor the possible future movements in the pension deficit and implications upon the corporate key performance metrics and investor perception. Accordingly, Commerzbank has recently seen increased need for companies to create clear-cut frameworks for impact analysis and management of the future deficits in a way that concurs with the requirements of the major corporate stake holders.

Major future risk factors for pension liabilities

Central bank policy and political uncertainties come top of the risk check list currently. If United States continues to raise interest rates, for example, long dated corporate bond yields might rise leading to lower valuations in assets as well as in the value of the pension deficit. More questions would be raised: How quickly would the impact be felt in Europe? How would the pension deficit be affected globally? How would equity markets react?

Another aspect of political uncertainty and central bank policies is the resulting currency volatility. Brexit and the Swiss Franc peg removal were good examples. The Swiss Franc denominated pension liabilities of a Pan-European company reporting in EUR are now valued higher, whilst those in the UK have decreased.

Managing potentially increasing future deficits – focus on what matters

In response to rising deficits combined with low or negative yields, much of the recent focus of pension managers has been on how to increase asset returns. However, irrespective of how good an asset portfolio one has and no matter how much yield the asset portfolio generates, if pension liability grows faster than pension assets, or if the valuation of the asset portfolio drops (for example as a result of an equity market decline), the risk of not being able to meet future pension obligations increases. In some countries (e.g. in UK) in this situation, pension managers may be forced to make enhanced contributions to the pension fund in order to meet regulatory funding requirements.

In other words, it is crucial for pension fund managers to appreciate the fact that matching assets with liabilities is a much safer way to manage pensions than going after high asset returns which may not correlate in any shape or form to the movements in the future pension liability. Focussing on asset return only can lead to unwarranted consequences, and the effects of this have indeed been painfully felt by many a managers and corporates over the past years.

As an example, even if a bond does not have a positive yield, the bond price will move in the opposite direction and match, to a certain extent, movements in the pension liability if the duration of the bond and the pension plan are matched.

However it may not be easy to find bonds which are as long dated as the pension liability or reflect the same characteristics as the actuarial valuations of the pension liability or the company’s own credit rating. In this situation alternative ways to securing the future of the pension plan can be considered, such as described below.

The pros and cons of hedging and transferring liabilities to an insurance company through a buyout

Interest rate, inflation swaps and FX contracts can be used to minimise the volatility of future pension deficit. Many companies use interest rate swaps to manage their financial debt and FX forwards and options to manage their cash flows. On average, between 50% and 90% of corporates already use derivatives and FX for hedging, and hedging pension liability with these instruments is hence an available and known option, worth considering. It should be noted however that under the current IFRS accounting rules it may not be easy to avoid P&L volatility when hedging pension deficit in the balance sheet. To avoid this it may be necessary to segregate the pension deficit into its own unit and then apply the hedge at this level.

Another viable solution to make sure there will be no volatility in the pension deficit in the future would be to transfer the liability of future pension payments to an external vendor, for example an insurance company, to take care of.

Removing a liability completely off balance sheet is quite expensive because the future monitoring, the future risks and the future pension payments, are effectively removed from the company.

In this case it is worthwhile to compare three cases: 1. how much, potentially, the pension deficit can grow in the future and how big a problem it can become if no management through pension asset matching or derivatives is done, and 2. If the pension deficit is effectively managed, and 3. the buy-out upfront cost, all discounted to the present under the same assumptions about future.

Hybrid issuance and asset securitisation as ways of managing the amount of current deficit in the balance sheet

In some cases it may be desirable for the company to consider reducing its pension liability by introducing some form of assets to the pension fund.

With hybrid bond issuance, pension liability is turned in effect to a form of equity – the liability can be as long as 100 years, often bearing a fixed interest rate. Over the past couple of years, a number of companies have issued hybrids to fund their pension deficits.

Another option to consider is to transfer some form of company’s own assets to the pension fund, either directly or indirectly. If the latter, income from either operational or non-operational buildings, for example, could be ring-fenced and turned into a pension asset that will offset a component of the pension liability.

In both of these cases a reduction in the pension deficit without a cash outlay can be affected.

It is worth noting that by transferring assets or by acquiring debt to pay down the current deficit, the future variability of the pension deficit remains a concern as described above.

*The European Insurance and Occupational Pensions Authority (Eiopa) conducted stress tests in 17 EU countries of 140 defined benefit and hybrid schemes with more than EUR 500 million in assets. Results were announced in January 2016.

Commerzbank advised on a recent acquisition case. The client was a UK corporate that acquired a German company with annual defined benefit pension payments of EUR3.6 million and future pension obligations amounting to a “pension deficit” of EUR50 million.

Commerzbank guided the CFO of the UK client (the acquiring company) through three fundamental considerations related to pensions in Germany:

1. The structure of the pension plan going forward: Establishing a Contractual Trust Arrangement (CTA) will enable the company to manage the pension plan in an efficient way, at the same time allowing for protecting of pension claims in the event of corporate insolvency. Through the CTA the company can fund the plan with assets and then apply hedges to minimise future volatility of the deficit and/or payments.

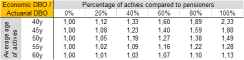

2. Comparing the economic payments to the actuarial ones provided by the pension actuaries. The economic basis will in most cases lead to a higher liability value than the actuarial basis. The difference between economic and actuarial deficit calculation is based on a different assessment base: the actuarial deficit only takes into account the past service of employees, whereas the economic deficit also incorporates the future service into the calculations. The two assessments merge at some stage when all active workers will have retired and so all future services will have converted into past service. The simplified table below demonstrates accordingly how the higher the percentage of active members with low average age (and long time to retirement), the bigger the expected economic deficit is likely to be, compared to the actuarial one.

3. How to manage the pension deficit in the future: The transfer of the deficit to an insurance company through a buyout as a final settlement solution is only possible under specific circumstances under German law. Therefore another option that the CFO of the UK corporate considered was to create a “synthetic” insurance solution by evaluating hedging ideas for longevity-, inflation-, discount rate risks. The hedges would help the company acquire protection against future increases in the pension payments which would continue to be the responsibility of the company. By using this “synthetic” solution the company can fund the deficit over time to the CTA or pension plan whilst in the buyout case a fee amounting to the current pension deficit plus additional premium depending on the pension plan, would have to be paid to the insurance company upfront. It is worth noting that there is no obligation for a company in Germany to fund the deficit but instead an annual contribution to a public insolvency protection plan has to be paid to protect the plan members. Many companies prefer to fund the plan regardless in the current environment where funding costs are low.

For more information, contact Corporate and Investor Solutions at Commerzbank.

Take control of market uncertainty — view Commerzbank's risk management solutions.

View our latest insights into capital markets.

Read Commerzbank's full disclaimer here.